Two titans, two strategies: Solana's explosive ecosystem growth vs Ripple's specialized payment dominance. Here's the institutional investor breakdown:

🏎️ Performance Showdown: Solana: Thousands TPS with Proof-of-History + PoS consensus Ripple: 1,000 TPS with ultra-efficient Federated Byzantine Agreement Both deliver near-instant finality and negligible fees

💼 Institutional Appeal: Solana's Broad Strategy:

-

Partnerships: Visa stablecoin pilots, Stripe fiat onramp

Ecosystem: DeFi, NFTs, RWA tokenization, gaming

ETF potential bringing billions in institutional capital

General-purpose blockchain for diverse applications

Ripple's Focused Approach:

-

RippleNet: Established banking partnerships worldwide

Specialized cross-border payment rails

Compliance-friendly tools (account freezing, etc.)

New RLUSD stablecoin launch

⚠️ Risk Assessment: Solana Risks: Past network outages (largely resolved), regulatory uncertainty Ripple Risks: SEC legal battles (partial victory achieved), centralization concerns

🎯 Bottom Line:

-

Choose Solana if you want exposure to explosive ecosystem growth, RWA tokenization, and diverse DeFi applications

Choose Ripple if you prioritize specialized payments utility, regulatory clarity, and established institutional relationships

The verdict depends on your investment thesis: diversified blockchain platform vs focused payment infrastructure.

💡 Pro Tip: Solana suits investors betting on the broader crypto economy expansion, while Ripple appeals to those focused on traditional finance transformation.

Read the complete institutional analysis: 👇 https://blog.jucoin.com/sol-and-ripple-which-is-better-for-investors/?utm_source=blog

#SOL #XRP #Solana #Ripple #Institutional #Crypto #Blockchain #DeFi #Payments #Investment #JuCoin #ETF #RWA #CrossBorder #FinTech #Web3

JU Blog

2025-08-07 10:32

⚡ SOL vs XRP: Which Blockchain Wins for Institutional Investors in 2025?

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

How Solana (SOL) Is Addressing Network Congestion and Downtime

Solana (SOL) has rapidly gained recognition as a high-performance blockchain platform capable of supporting decentralized applications (dApps) with fast transaction speeds. Its innovative architecture, based on proof-of-stake (PoS), allows for quick processing times that surpass many traditional blockchains. However, this speed has come with notable challenges, particularly network congestion and occasional downtime events. Understanding how Solana is tackling these issues is essential for users, developers, and investors who rely on its stability and scalability.

Causes of Network Congestion on Solana

Network congestion occurs when the volume of transactions exceeds the network’s capacity to process them efficiently. On Solana, this problem often arises during periods of high demand—such as popular NFT drops or DeFi activity—leading to slower transaction confirmation times and increased fees. The core issue stems from the blockchain’s design: while it can handle thousands of transactions per second under optimal conditions, sudden surges in activity can overwhelm nodes.

High transaction volumes strain validator nodes—the backbone of the network—which must verify each transaction before adding it to the blockchain. When too many transactions flood in simultaneously, validators may become overwhelmed or delayed, causing bottlenecks that impact all users relying on timely processing.

Technical Challenges Leading to Downtime Events

Downtime events are disruptions where parts or all of the network temporarily become unavailable or unresponsive. For Solana, these outages are often linked to technical glitches such as node failures or software bugs within its infrastructure. Sometimes they result from network partitions—situations where different parts of the network cannot communicate effectively—or from overloads caused by malicious attacks like spam transactions.

These downtimes not only hinder user experience but also threaten trust in the platform's reliability—a critical factor for developers building mission-critical dApps and enterprises considering blockchain adoption.

Recent Strategies Implemented by Solana

To combat these issues head-on, Solana’s development team has introduced multiple technical improvements aimed at boosting scalability and resilience:

Exploration of Optimistic Rollups:

One promising approach involves integrating Optimistic Rollup technology into their ecosystem. This method allows complex computations to be processed off-chain while maintaining security guarantees through fraud proofs submitted periodically on-chain. By offloading some computational work outside the main chain, Solana aims to reduce congestion during peak periods without sacrificing decentralization or security.Validator Upgrades:

Regular updates have been rolled out for validator nodes—including bug fixes and performance enhancements—to improve overall stability. These upgrades help ensure that validators operate more efficiently under load conditions while reducing vulnerabilities that could lead to outages.Load Balancing Techniques:

Implementing load balancing across validator clusters distributes traffic more evenly across nodes rather than concentrating it on a few points—thus minimizing single points of failure which could cause downtime during traffic spikes.

Community-Led Initiatives & Ecosystem Support

Beyond core technical solutions, community engagement plays a vital role in addressing operational challenges:

Developer Efforts:

Developers within the ecosystem are actively working toward creating more efficient smart contracts optimized for lower resource consumption—a move that reduces unnecessary strain during high-demand periods.User Education Campaigns:

Educating users about best practices—for example avoiding peak hours for large transactions—helps spread out demand naturally over time rather than overwhelming networks at specific moments.Third-party Solutions:

Several third-party tools have emerged offering services like batching multiple transactions into one submission or utilizing off-chain data storage solutions which alleviate pressure directly on mainnet operations.

Impact on Users and Market Position

Persistent congestion problems can significantly affect user experience by increasing delays and costs associated with transacting on Solana’s platform—a concern especially relevant when competing against other scalable chains like Avalanche or Binance Smart Chain which aim for similar use cases but claim better uptime records.

Economic implications include higher gas fees during busy times; this can discourage frequent trading activities among retail investors or small-scale developers who seek cost-effective solutions within decentralized finance ecosystems.

Furthermore—and perhaps most critically—the reputation damage caused by frequent downtimes might lead some projects away from Solana toward alternative platforms perceived as more reliable; thus making continuous improvement efforts crucial not just technically but strategically too.

By adopting innovative solutions such as optimistic rollups combined with ongoing validator upgrades and community-driven initiatives focused on efficiency improvements—and maintaining transparency about progress—Solana strives toward becoming a resilient high-throughput blockchain capable of supporting mainstream adoption without compromising decentralization principles.

For stakeholders interested in long-term growth within Web3 environments built atop scalable infrastructure like Solana's ecosystem remains promising—but only if ongoing efforts successfully mitigate current limitations related to congestion and downtime events effectively address user concerns around reliability and cost-efficiency over time

JCUSER-WVMdslBw

2025-05-14 21:16

What measures address network congestion and downtime events on Solana (SOL)?

How Solana (SOL) Is Addressing Network Congestion and Downtime

Solana (SOL) has rapidly gained recognition as a high-performance blockchain platform capable of supporting decentralized applications (dApps) with fast transaction speeds. Its innovative architecture, based on proof-of-stake (PoS), allows for quick processing times that surpass many traditional blockchains. However, this speed has come with notable challenges, particularly network congestion and occasional downtime events. Understanding how Solana is tackling these issues is essential for users, developers, and investors who rely on its stability and scalability.

Causes of Network Congestion on Solana

Network congestion occurs when the volume of transactions exceeds the network’s capacity to process them efficiently. On Solana, this problem often arises during periods of high demand—such as popular NFT drops or DeFi activity—leading to slower transaction confirmation times and increased fees. The core issue stems from the blockchain’s design: while it can handle thousands of transactions per second under optimal conditions, sudden surges in activity can overwhelm nodes.

High transaction volumes strain validator nodes—the backbone of the network—which must verify each transaction before adding it to the blockchain. When too many transactions flood in simultaneously, validators may become overwhelmed or delayed, causing bottlenecks that impact all users relying on timely processing.

Technical Challenges Leading to Downtime Events

Downtime events are disruptions where parts or all of the network temporarily become unavailable or unresponsive. For Solana, these outages are often linked to technical glitches such as node failures or software bugs within its infrastructure. Sometimes they result from network partitions—situations where different parts of the network cannot communicate effectively—or from overloads caused by malicious attacks like spam transactions.

These downtimes not only hinder user experience but also threaten trust in the platform's reliability—a critical factor for developers building mission-critical dApps and enterprises considering blockchain adoption.

Recent Strategies Implemented by Solana

To combat these issues head-on, Solana’s development team has introduced multiple technical improvements aimed at boosting scalability and resilience:

Exploration of Optimistic Rollups:

One promising approach involves integrating Optimistic Rollup technology into their ecosystem. This method allows complex computations to be processed off-chain while maintaining security guarantees through fraud proofs submitted periodically on-chain. By offloading some computational work outside the main chain, Solana aims to reduce congestion during peak periods without sacrificing decentralization or security.Validator Upgrades:

Regular updates have been rolled out for validator nodes—including bug fixes and performance enhancements—to improve overall stability. These upgrades help ensure that validators operate more efficiently under load conditions while reducing vulnerabilities that could lead to outages.Load Balancing Techniques:

Implementing load balancing across validator clusters distributes traffic more evenly across nodes rather than concentrating it on a few points—thus minimizing single points of failure which could cause downtime during traffic spikes.

Community-Led Initiatives & Ecosystem Support

Beyond core technical solutions, community engagement plays a vital role in addressing operational challenges:

Developer Efforts:

Developers within the ecosystem are actively working toward creating more efficient smart contracts optimized for lower resource consumption—a move that reduces unnecessary strain during high-demand periods.User Education Campaigns:

Educating users about best practices—for example avoiding peak hours for large transactions—helps spread out demand naturally over time rather than overwhelming networks at specific moments.Third-party Solutions:

Several third-party tools have emerged offering services like batching multiple transactions into one submission or utilizing off-chain data storage solutions which alleviate pressure directly on mainnet operations.

Impact on Users and Market Position

Persistent congestion problems can significantly affect user experience by increasing delays and costs associated with transacting on Solana’s platform—a concern especially relevant when competing against other scalable chains like Avalanche or Binance Smart Chain which aim for similar use cases but claim better uptime records.

Economic implications include higher gas fees during busy times; this can discourage frequent trading activities among retail investors or small-scale developers who seek cost-effective solutions within decentralized finance ecosystems.

Furthermore—and perhaps most critically—the reputation damage caused by frequent downtimes might lead some projects away from Solana toward alternative platforms perceived as more reliable; thus making continuous improvement efforts crucial not just technically but strategically too.

By adopting innovative solutions such as optimistic rollups combined with ongoing validator upgrades and community-driven initiatives focused on efficiency improvements—and maintaining transparency about progress—Solana strives toward becoming a resilient high-throughput blockchain capable of supporting mainstream adoption without compromising decentralization principles.

For stakeholders interested in long-term growth within Web3 environments built atop scalable infrastructure like Solana's ecosystem remains promising—but only if ongoing efforts successfully mitigate current limitations related to congestion and downtime events effectively address user concerns around reliability and cost-efficiency over time

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Solana Ecosystem Grants and Incentive Programs: Supporting Growth and Innovation

Overview of Solana’s Ecosystem Development Initiatives

Solana, a high-performance blockchain platform launched in 2017, has rapidly gained recognition for its ability to process transactions at lightning-fast speeds with minimal fees. To sustain this momentum and foster a vibrant developer community, the Solana Foundation has implemented various grants and incentive programs. These initiatives are designed to support innovative projects, encourage ecosystem participation, and ensure the long-term sustainability of the network.

By providing financial backing and strategic support through these programs, Solana aims to attract talented developers, researchers, entrepreneurs, and community members who can contribute to its decentralized infrastructure. This comprehensive approach not only accelerates technological advancements but also helps build a diverse ecosystem that spans DeFi applications, NFTs, gaming platforms, and more.

Types of Community Grants Offered by Solana

The primary mechanism for funding development within the Solana ecosystem is through community grants managed by the Solana Foundation. These grants serve as catalysts for innovation across different areas:

Developer Grants: Focused on supporting individual developers or teams working on projects that enhance the functionality or usability of the Solana network. These grants often cover expenses related to coding efforts, marketing campaigns for new dApps (decentralized applications), or operational costs necessary during development phases.

Research Grants: Aimed at advancing blockchain technology itself—improving scalability solutions like sharding or layer-two integrations; enhancing security protocols; or optimizing consensus algorithms such as proof-of-stake (PoS). Such research ensures that Solana remains competitive in terms of performance while maintaining robust security standards.

Community Engagement Grants: Designed to promote active participation among users and developers through events like hackathons, meetups, workshops—and even online campaigns—aimed at increasing awareness about solan-based projects. These initiatives foster collaboration within local communities worldwide.

Each grant type aligns with specific strategic goals: fostering innovation (developer grants), improving core infrastructure (research grants), or expanding user engagement (community grants). The foundation’s transparent application process ensures equitable access while prioritizing projects aligned with ecosystem growth.

Incentive Programs Driving Ecosystem Participation

Beyond direct funding via grants, incentivization plays a crucial role in motivating ongoing contributions from validators—those responsible for securing transactions—and liquidity providers within DeFi protocols built on Solana.

Validator Incentives

Validators are essential nodes that verify transactions on the network. To maintain decentralization while ensuring high performance standards akin to traditional centralized systems like Visa or Mastercard processing millions of transactions per second—the foundation offers rewards based on their contribution levels. This incentivizes reliable operation without compromising security—a key factor in maintaining trustworthiness within decentralized networks.

DeFi Protocol Incentives

The explosion of decentralized finance applications on Solana has prompted targeted incentive schemes such as liquidity mining programs where users earn tokens by providing liquidity pools with SOL tokens or other assets. Yield farming strategies further encourage users to lock assets into protocols temporarily in exchange for interest payments—thus boosting overall liquidity depth which benefits all participants by reducing slippage during trades.

These incentives help bootstrap early-stage DeFi platforms while attracting institutional investors seeking high-yield opportunities—all critical factors contributing toward mainstream adoption of blockchain-based financial services.

Recent Developments Enhancing Ecosystem Support

In recent years—including 2023—the foundation launched several major initiatives aimed at accelerating growth:

Solana Season 2: Announced as an extensive program involving multiple components such as hackathons targeting innovative dApp ideas; additional grant rounds focused specifically on scaling solutions; educational workshops designed to onboard new developers efficiently.

NFT-Focused Funding: Recognizing NFT's rising popularity globally—in 2024—the foundation dedicated specific resources toward supporting NFT marketplaces and artist collaborations built atop solanawith dedicated grant schemes encouraging creative use cases.

Strategic Partnerships & Collaborations: Partnering with other blockchains like Serum DEX exchange platform or integrating cross-chain bridges enhances interoperability—a vital aspect considering today’s multi-chain environment—and opens new avenues for project development supported via joint hackathons or co-funded research initiatives.

These developments demonstrate how targeted incentives can significantly accelerate ecosystem expansion while addressing emerging trends such as NFTs and cross-chain interoperability.

Challenges & Risks Associated With Grant & Incentive Programs

While these programs have undoubtedly contributed positively towards building a thriving environment around SOL tokens—for example attracting thousands of developers—they also pose certain risks:

Centralization Concerns: Heavy reliance on large-scale funding might lead some projects—or even certain entities—to dominate parts of the ecosystem if they secure disproportionate resources—which could threaten decentralization principles fundamental to blockchain technology.

Scalability Limitations: As more projects launch simultaneously due to increased incentives—especially during major events like Hackathons—it may strain existing infrastructure leading potentially to slower transaction speeds unless underlying scalability issues are addressed proactively.

Regulatory Uncertainty: The evolving legal landscape surrounding cryptocurrencies could impact future funding models—for instance if governments impose restrictions affecting token distributions associated with these programs—or limit international participation altogether.

Addressing these challenges requires ongoing oversight from governance bodies within ecosystems like Solano’s Foundation along with adaptive strategies aligned with global regulatory developments.

How Community Funding Shapes Long-Term Ecosystem Sustainability

Community-driven investment through grants fosters an environment where innovation is prioritized alongside security considerations—a balance critical for sustainable growth in decentralized networks Like solanawith its unique architecture leveraging proof-of-stake consensus mechanisms combined with data structures optimized for speed such as Turbine protocol layers . By continuously investing in foundational research alongside practical application development—including NFT markets , DeFi protocols , validator networks —the platform positions itself favorably against competitors aiming at mass adoption .

Furthermore,the transparency embedded into grant allocation processes builds trust among stakeholders—from individual contributors up through institutional partners—ensuring accountability remains central amid rapid technological evolution.

Key Milestones Marking Ecosystem Growth Through Funding Initiatives

Tracking progress over time reveals how targeted investments have translated into tangible results:

- In 2017: Launching solananetwork establishing initial technical groundwork

- In 2023: Introduction of “Solana Season 2” featuring multiple hackathon events

- In 2024: Launching specialized NFT project grants fueling creative use cases

These milestones highlight how strategic funding cycles directly correlate with increased developer activity,popular project launches,and broader adoption metrics across sectors including gaming,nft art,and enterprise integrations.

Resources For Staying Updated On Program Developments

For those interested in participating further—whether applying for a grant,supporting ongoing projects,making proposals—or simply tracking industry trends—the following sources provide authoritative information:

- Official Solana Foundation Website

- Reputable news outlets such as CoinDeskand CryptoSlate

- Developer forumsand community channels hosted via Discordor Telegram

Regularly reviewing updates from these sources ensures stakeholders remain informed about upcoming opportunities,new partnerships,and policy changes shaping future directions.

By understanding how community-focused funds bolster technological advancement alongside strategic incentives motivate active participation,the overall healthand resilienceofthesolanacommunityis strengthened.This integrated approach not only accelerates current innovations but also lays down pathwaysfor sustainable long-term growthin oneofcryptocurrency's most promising ecosystems

JCUSER-F1IIaxXA

2025-05-14 21:35

What community grants and incentive programs fund ecosystem growth for Solana (SOL)?

Solana Ecosystem Grants and Incentive Programs: Supporting Growth and Innovation

Overview of Solana’s Ecosystem Development Initiatives

Solana, a high-performance blockchain platform launched in 2017, has rapidly gained recognition for its ability to process transactions at lightning-fast speeds with minimal fees. To sustain this momentum and foster a vibrant developer community, the Solana Foundation has implemented various grants and incentive programs. These initiatives are designed to support innovative projects, encourage ecosystem participation, and ensure the long-term sustainability of the network.

By providing financial backing and strategic support through these programs, Solana aims to attract talented developers, researchers, entrepreneurs, and community members who can contribute to its decentralized infrastructure. This comprehensive approach not only accelerates technological advancements but also helps build a diverse ecosystem that spans DeFi applications, NFTs, gaming platforms, and more.

Types of Community Grants Offered by Solana

The primary mechanism for funding development within the Solana ecosystem is through community grants managed by the Solana Foundation. These grants serve as catalysts for innovation across different areas:

Developer Grants: Focused on supporting individual developers or teams working on projects that enhance the functionality or usability of the Solana network. These grants often cover expenses related to coding efforts, marketing campaigns for new dApps (decentralized applications), or operational costs necessary during development phases.

Research Grants: Aimed at advancing blockchain technology itself—improving scalability solutions like sharding or layer-two integrations; enhancing security protocols; or optimizing consensus algorithms such as proof-of-stake (PoS). Such research ensures that Solana remains competitive in terms of performance while maintaining robust security standards.

Community Engagement Grants: Designed to promote active participation among users and developers through events like hackathons, meetups, workshops—and even online campaigns—aimed at increasing awareness about solan-based projects. These initiatives foster collaboration within local communities worldwide.

Each grant type aligns with specific strategic goals: fostering innovation (developer grants), improving core infrastructure (research grants), or expanding user engagement (community grants). The foundation’s transparent application process ensures equitable access while prioritizing projects aligned with ecosystem growth.

Incentive Programs Driving Ecosystem Participation

Beyond direct funding via grants, incentivization plays a crucial role in motivating ongoing contributions from validators—those responsible for securing transactions—and liquidity providers within DeFi protocols built on Solana.

Validator Incentives

Validators are essential nodes that verify transactions on the network. To maintain decentralization while ensuring high performance standards akin to traditional centralized systems like Visa or Mastercard processing millions of transactions per second—the foundation offers rewards based on their contribution levels. This incentivizes reliable operation without compromising security—a key factor in maintaining trustworthiness within decentralized networks.

DeFi Protocol Incentives

The explosion of decentralized finance applications on Solana has prompted targeted incentive schemes such as liquidity mining programs where users earn tokens by providing liquidity pools with SOL tokens or other assets. Yield farming strategies further encourage users to lock assets into protocols temporarily in exchange for interest payments—thus boosting overall liquidity depth which benefits all participants by reducing slippage during trades.

These incentives help bootstrap early-stage DeFi platforms while attracting institutional investors seeking high-yield opportunities—all critical factors contributing toward mainstream adoption of blockchain-based financial services.

Recent Developments Enhancing Ecosystem Support

In recent years—including 2023—the foundation launched several major initiatives aimed at accelerating growth:

Solana Season 2: Announced as an extensive program involving multiple components such as hackathons targeting innovative dApp ideas; additional grant rounds focused specifically on scaling solutions; educational workshops designed to onboard new developers efficiently.

NFT-Focused Funding: Recognizing NFT's rising popularity globally—in 2024—the foundation dedicated specific resources toward supporting NFT marketplaces and artist collaborations built atop solanawith dedicated grant schemes encouraging creative use cases.

Strategic Partnerships & Collaborations: Partnering with other blockchains like Serum DEX exchange platform or integrating cross-chain bridges enhances interoperability—a vital aspect considering today’s multi-chain environment—and opens new avenues for project development supported via joint hackathons or co-funded research initiatives.

These developments demonstrate how targeted incentives can significantly accelerate ecosystem expansion while addressing emerging trends such as NFTs and cross-chain interoperability.

Challenges & Risks Associated With Grant & Incentive Programs

While these programs have undoubtedly contributed positively towards building a thriving environment around SOL tokens—for example attracting thousands of developers—they also pose certain risks:

Centralization Concerns: Heavy reliance on large-scale funding might lead some projects—or even certain entities—to dominate parts of the ecosystem if they secure disproportionate resources—which could threaten decentralization principles fundamental to blockchain technology.

Scalability Limitations: As more projects launch simultaneously due to increased incentives—especially during major events like Hackathons—it may strain existing infrastructure leading potentially to slower transaction speeds unless underlying scalability issues are addressed proactively.

Regulatory Uncertainty: The evolving legal landscape surrounding cryptocurrencies could impact future funding models—for instance if governments impose restrictions affecting token distributions associated with these programs—or limit international participation altogether.

Addressing these challenges requires ongoing oversight from governance bodies within ecosystems like Solano’s Foundation along with adaptive strategies aligned with global regulatory developments.

How Community Funding Shapes Long-Term Ecosystem Sustainability

Community-driven investment through grants fosters an environment where innovation is prioritized alongside security considerations—a balance critical for sustainable growth in decentralized networks Like solanawith its unique architecture leveraging proof-of-stake consensus mechanisms combined with data structures optimized for speed such as Turbine protocol layers . By continuously investing in foundational research alongside practical application development—including NFT markets , DeFi protocols , validator networks —the platform positions itself favorably against competitors aiming at mass adoption .

Furthermore,the transparency embedded into grant allocation processes builds trust among stakeholders—from individual contributors up through institutional partners—ensuring accountability remains central amid rapid technological evolution.

Key Milestones Marking Ecosystem Growth Through Funding Initiatives

Tracking progress over time reveals how targeted investments have translated into tangible results:

- In 2017: Launching solananetwork establishing initial technical groundwork

- In 2023: Introduction of “Solana Season 2” featuring multiple hackathon events

- In 2024: Launching specialized NFT project grants fueling creative use cases

These milestones highlight how strategic funding cycles directly correlate with increased developer activity,popular project launches,and broader adoption metrics across sectors including gaming,nft art,and enterprise integrations.

Resources For Staying Updated On Program Developments

For those interested in participating further—whether applying for a grant,supporting ongoing projects,making proposals—or simply tracking industry trends—the following sources provide authoritative information:

- Official Solana Foundation Website

- Reputable news outlets such as CoinDeskand CryptoSlate

- Developer forumsand community channels hosted via Discordor Telegram

Regularly reviewing updates from these sources ensures stakeholders remain informed about upcoming opportunities,new partnerships,and policy changes shaping future directions.

By understanding how community-focused funds bolster technological advancement alongside strategic incentives motivate active participation,the overall healthand resilienceofthesolanacommunityis strengthened.This integrated approach not only accelerates current innovations but also lays down pathwaysfor sustainable long-term growthin oneofcryptocurrency's most promising ecosystems

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

How Community Grants and Incentive Programs Drive Ecosystem Growth on Solana (SOL)

Solana (SOL) has rapidly gained recognition as a high-performance blockchain platform, renowned for its impressive transaction speeds and low fees. As the ecosystem around Solana expands, community-driven initiatives such as grants and incentive programs play a pivotal role in fostering innovation, attracting developers, and supporting new projects. Understanding how these programs function provides insight into the strategic efforts behind Solana’s growth trajectory.

The Role of Ecosystem Growth in Blockchain Success

Ecosystem growth refers to the expansion of activities within a blockchain network—ranging from decentralized applications (dApps) to DeFi protocols, NFT marketplaces, gaming platforms, and more. A vibrant ecosystem not only enhances user engagement but also increases the network’s utility and value. For Solana specifically, fostering this growth is essential for maintaining its competitive edge amid other blockchain platforms like Ethereum or Binance Smart Chain.

A thriving ecosystem attracts developers who build innovative solutions that leverage Solana's high throughput capabilities. This diversification helps ensure long-term sustainability by reducing reliance on any single project or sector while encouraging continuous experimentation within the community.

How Community Grants Support Project Development

Community grants are financial awards provided by organizations like the Solana Foundation to support promising projects aligned with the platform's vision of decentralization and open-source development. These grants serve multiple purposes:

- Funding Innovation: They enable startups and developers to bring their ideas to life without immediate financial pressure.

- Encouraging Diversity: Grants often target various sectors such as DeFi, NFTs, gaming, or infrastructure tools—broadening what can be built on Solana.

- Building Credibility: Receiving a grant can boost project visibility within the community and attract further investment or partnerships.

The selection process typically involves submitting proposals that demonstrate potential impact, technical feasibility, alignment with ecosystem goals, and sustainability plans. An expert review committee evaluates these proposals based on merit before awarding funds.

Incentive Programs: Motivating Participation & Security

Incentive programs complement grants by encouraging active participation from developers and security researchers alike:

Bug Bounty Initiatives: These reward individuals who identify vulnerabilities in the network’s codebase or smart contracts. By incentivizing security testing from external researchers—often called white-hat hackers—the program enhances overall platform safety.

Developer Challenges & Hackathons: Organized events challenge participants to develop specific applications or solve particular problems using Solana’s technology stack. Such challenges often come with monetary prizes or recognition that motivate talent acquisition while accelerating product development.

These incentives foster an environment where continuous innovation is rewarded while ensuring robust security measures are maintained through proactive vulnerability discovery.

Recent Developments Enhancing Ecosystem Support

In 2023 alone, significant strides have been made toward strengthening community support mechanisms:

The Solana Foundation announced increased funding allocations for its grant program aimed at expanding project diversity across sectors like DeFi protocols—and even emerging fields such as metaverse integrations.

New tools—including developer SDKs (Software Development Kits), documentation improvements—and resources have been introduced to lower entry barriers for builders interested in deploying on Solana.

Such developments reflect an active approach by foundation leaders committed to nurturing sustainable growth through accessible support channels.

Potential Challenges in Grant & Incentive Program Management

While these initiatives are vital for ecosystem expansion—they also pose certain risks if not managed effectively:

Misallocation of Funds: Without rigorous vetting processes or clear impact metrics—funds might be awarded inefficiently—leading to suboptimal use of resources.

High Entry Barriers: Competitive grant processes could discourage smaller teams or individual developers from participating if criteria are perceived as overly stringent—or if access is limited due to lack of awareness.

Addressing these issues requires transparent evaluation procedures coupled with outreach efforts aimed at broadening participation across diverse developer communities.

Impact on Long-Term Ecosystem Sustainability

By strategically deploying community grants alongside incentive programs like bug bounties and hackathons—which promote both innovation AND security—Solana aims for sustainable growth rooted in strong developer engagement. These initiatives help create an environment where new ideas flourish while existing systems remain secure; ultimately increasing adoption rates among users seeking reliable decentralized solutions.

Furthermore,

- Increased funding allows more projects—from DeFi apps to NFT marketplaces—to emerge,

- Developer challenges stimulate creative problem-solving,

- Bug bounty rewards improve platform resilience over time,

all contributing towards building a resilient ecosystem capable of competing globally against other leading blockchains.

Understanding how community grants and incentive programs fuel ecosystems offers valuable insights into blockchain development strategies today. For investors considering SOL tokens—or enthusiasts eager about future innovations—it underscores why supporting such initiatives is crucial: they lay down foundational layers necessary for sustained technological advancement—and ultimately—increased value creation within the broader crypto landscape.

kai

2025-05-11 08:04

What community grants and incentive programs fund ecosystem growth for Solana (SOL)?

How Community Grants and Incentive Programs Drive Ecosystem Growth on Solana (SOL)

Solana (SOL) has rapidly gained recognition as a high-performance blockchain platform, renowned for its impressive transaction speeds and low fees. As the ecosystem around Solana expands, community-driven initiatives such as grants and incentive programs play a pivotal role in fostering innovation, attracting developers, and supporting new projects. Understanding how these programs function provides insight into the strategic efforts behind Solana’s growth trajectory.

The Role of Ecosystem Growth in Blockchain Success

Ecosystem growth refers to the expansion of activities within a blockchain network—ranging from decentralized applications (dApps) to DeFi protocols, NFT marketplaces, gaming platforms, and more. A vibrant ecosystem not only enhances user engagement but also increases the network’s utility and value. For Solana specifically, fostering this growth is essential for maintaining its competitive edge amid other blockchain platforms like Ethereum or Binance Smart Chain.

A thriving ecosystem attracts developers who build innovative solutions that leverage Solana's high throughput capabilities. This diversification helps ensure long-term sustainability by reducing reliance on any single project or sector while encouraging continuous experimentation within the community.

How Community Grants Support Project Development

Community grants are financial awards provided by organizations like the Solana Foundation to support promising projects aligned with the platform's vision of decentralization and open-source development. These grants serve multiple purposes:

- Funding Innovation: They enable startups and developers to bring their ideas to life without immediate financial pressure.

- Encouraging Diversity: Grants often target various sectors such as DeFi, NFTs, gaming, or infrastructure tools—broadening what can be built on Solana.

- Building Credibility: Receiving a grant can boost project visibility within the community and attract further investment or partnerships.

The selection process typically involves submitting proposals that demonstrate potential impact, technical feasibility, alignment with ecosystem goals, and sustainability plans. An expert review committee evaluates these proposals based on merit before awarding funds.

Incentive Programs: Motivating Participation & Security

Incentive programs complement grants by encouraging active participation from developers and security researchers alike:

Bug Bounty Initiatives: These reward individuals who identify vulnerabilities in the network’s codebase or smart contracts. By incentivizing security testing from external researchers—often called white-hat hackers—the program enhances overall platform safety.

Developer Challenges & Hackathons: Organized events challenge participants to develop specific applications or solve particular problems using Solana’s technology stack. Such challenges often come with monetary prizes or recognition that motivate talent acquisition while accelerating product development.

These incentives foster an environment where continuous innovation is rewarded while ensuring robust security measures are maintained through proactive vulnerability discovery.

Recent Developments Enhancing Ecosystem Support

In 2023 alone, significant strides have been made toward strengthening community support mechanisms:

The Solana Foundation announced increased funding allocations for its grant program aimed at expanding project diversity across sectors like DeFi protocols—and even emerging fields such as metaverse integrations.

New tools—including developer SDKs (Software Development Kits), documentation improvements—and resources have been introduced to lower entry barriers for builders interested in deploying on Solana.

Such developments reflect an active approach by foundation leaders committed to nurturing sustainable growth through accessible support channels.

Potential Challenges in Grant & Incentive Program Management

While these initiatives are vital for ecosystem expansion—they also pose certain risks if not managed effectively:

Misallocation of Funds: Without rigorous vetting processes or clear impact metrics—funds might be awarded inefficiently—leading to suboptimal use of resources.

High Entry Barriers: Competitive grant processes could discourage smaller teams or individual developers from participating if criteria are perceived as overly stringent—or if access is limited due to lack of awareness.

Addressing these issues requires transparent evaluation procedures coupled with outreach efforts aimed at broadening participation across diverse developer communities.

Impact on Long-Term Ecosystem Sustainability

By strategically deploying community grants alongside incentive programs like bug bounties and hackathons—which promote both innovation AND security—Solana aims for sustainable growth rooted in strong developer engagement. These initiatives help create an environment where new ideas flourish while existing systems remain secure; ultimately increasing adoption rates among users seeking reliable decentralized solutions.

Furthermore,

- Increased funding allows more projects—from DeFi apps to NFT marketplaces—to emerge,

- Developer challenges stimulate creative problem-solving,

- Bug bounty rewards improve platform resilience over time,

all contributing towards building a resilient ecosystem capable of competing globally against other leading blockchains.

Understanding how community grants and incentive programs fuel ecosystems offers valuable insights into blockchain development strategies today. For investors considering SOL tokens—or enthusiasts eager about future innovations—it underscores why supporting such initiatives is crucial: they lay down foundational layers necessary for sustained technological advancement—and ultimately—increased value creation within the broader crypto landscape.

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

How Does Solana Address Network Congestion and Downtime?

Solana is renowned for its high throughput and low latency, making it a popular choice among developers building decentralized applications (dApps) and DeFi platforms. However, despite its technological advancements, Solana has faced recurring challenges related to network congestion and occasional downtime events. Understanding the measures implemented by the Solana development team provides insight into how they are working to enhance network stability and performance.

Technical Foundations of Solana’s Network Stability

At the core of Solana’s architecture is a proof-of-stake (PoS) consensus mechanism combined with innovative data structures like Turbine, Gulf Stream, Sealevel, Pipelining, Cloudbreak, and Archivers. These components work together to facilitate rapid transaction processing—often thousands per second—while maintaining decentralization. However, this high-performance design can be susceptible to congestion during periods of intense activity such as token launches or market surges.

Network congestion occurs when transaction volume exceeds the capacity of validators or nodes to process requests efficiently. This results in slower confirmation times and increased fees for users. Downtime events typically stem from technical issues such as node failures or bugs within the protocol codebase that temporarily disable parts of the network.

Protocol Upgrades Focused on Enhancing Stability

One significant approach toward mitigating these issues has been through protocol upgrades aimed at optimizing performance. For instance:

- Version 1.9 Release (October 2022): This update introduced several improvements targeting resource utilization efficiency and stability enhancements in Turbine's data propagation methods.

- Version 1.10 Release (February 2023): Building upon previous updates, this version further optimized validator efficiency by refining data handling processes within Turbine while addressing bottlenecks that could lead to congestion.

These upgrades reflect an ongoing commitment by Solana developers to refine their core infrastructure based on real-world stress tests and community feedback.

Load Balancing Strategies for Transaction Distribution

To prevent overloads on individual nodes or clusters within the network—a common cause of congestion—Solana has adopted load balancing techniques across its validator set:

- Distributing incoming transactions more evenly ensures no single point becomes overwhelmed.

- Dynamic adjustment mechanisms help redirect traffic away from congested nodes toward healthier ones.

This strategy enhances overall throughput capacity during peak periods while reducing latency spikes that frustrate users.

Improving Validator Performance Through Hardware & Software Optimization

Validators play a crucial role in maintaining blockchain integrity; their performance directly impacts network health. Recognizing this importance:

- The Solana team actively works with validators to optimize hardware configurations—such as faster SSDs or higher RAM—to handle increased workloads.

- Software improvements include refining consensus algorithms for better resource management under heavy loads.

By incentivizing validators through rewards programs tied to uptime and performance metrics, Solana encourages operators to maintain high-quality infrastructure essential for minimizing downtime risks.

Community Engagement & Open Source Collaboration

Community involvement remains vital in addressing scalability challenges effectively:

- Developers contribute via open-source repositories proposing fixes or new features aimed at reducing bottlenecks.

- The community participates in testing new releases before deployment across mainnet environments.

This collaborative approach fosters transparency while accelerating innovation tailored toward resolving specific issues like congestion spikes during high-demand events.

Efforts Toward Reducing Technical Debt

Technical debt refers to shortcuts taken during development that may cause future vulnerabilities or inefficiencies if left unaddressed. To combat this:

- The team undertakes regular refactoring efforts focused on cleaning up legacy code segments prone to bugs under load conditions.

- Bug fixes target known vulnerabilities linked with past downtime incidents—for example: software crashes caused by unhandled edge cases during peak activity periods.

Addressing technical debt ensures long-term resilience against future disruptions stemming from unresolved underlying issues.

Stakeholder Engagement & Proactive Monitoring

Proactive monitoring tools enable early detection of potential problems before they escalate into outages:

- Validators report anomalies via dashboards monitored continuously by core developers.

- Automated alerts trigger immediate investigation when unusual patterns emerge indicating possible overloads or failures.

Regular stakeholder engagement sessions facilitate sharing insights about ongoing improvements while gathering feedback from end-users about their experiences during congested periods.

Recent Developments Improving Network Resilience

The continuous evolution of Solana’s protocol demonstrates a proactive stance towards enhancing reliability amid persistent challenges:

Enhanced Validator Incentives: Higher rewards motivate operators not only for participation but also for maintaining optimal hardware setups capable of handling increased transaction volumes without degradation in service quality.

Open Governance Initiatives: Through proposals like SOLANA Improvement Proposals (SIPs), community members can suggest targeted solutions—ranging from technical optimizations to governance policies—that address specific causes behind congestion episodes effectively.

Focus on Resilience Testing: Regular stress tests simulate extreme scenarios allowing developers identify weak points before real-world occurrences impact users significantly.

Impact on Users & Market Dynamics

Repeated episodes involving network slowdowns or outages inevitably influence user experience negatively; delays can hinder trading activities or disrupt dApp functionalities leading users’ frustration over perceived unreliability—a critical factor affecting adoption rates over time.

Market sentiment also reacts swiftly; prolonged downtimes tend to erode investor confidence resulting in price volatility within SOL markets as traders reassess risk exposure amidst uncertainty surrounding platform robustness compared with competitors like Ethereum which boasts different scalability solutions such as sharding via Layer 2 protocols.

Future Outlook: Sustaining Improvements Amid Challenges

While recent updates demonstrate tangible progress towards stabilizing the network under heavy loads, ongoing vigilance remains essential given evolving demands placed upon blockchain infrastructures today—including increasing user base sizes and complex application requirements.

Key areas likely prioritized moving forward include:

- Further optimization techniques leveraging emerging technologies such as zero knowledge proofs

- Enhanced decentralization strategies ensuring broader validator participation

- Continued refinement based on community feedback through transparent governance channels

By maintaining focus on these strategic initiatives alongside technological innovations—and fostering active stakeholder collaboration—Solana aims not only at overcoming current limitations but also establishing itself firmly among scalable blockchain platforms capable of supporting mainstream adoption.

In summary, addressing network congestion and downtime involves a multi-layered approach combining protocol upgrades, load balancing strategies, hardware/software optimization efforts, active community engagement—and continuous monitoring—to ensure resilient operation even under demanding conditions. As these measures evolve alongside growing demand for decentralized applications worldwide, stakeholders can expect ongoing improvements that bolster both reliability and trustworthiness within the ecosystem.

JCUSER-WVMdslBw

2025-05-11 07:47

What measures address network congestion and downtime events on Solana (SOL)?

How Does Solana Address Network Congestion and Downtime?

Solana is renowned for its high throughput and low latency, making it a popular choice among developers building decentralized applications (dApps) and DeFi platforms. However, despite its technological advancements, Solana has faced recurring challenges related to network congestion and occasional downtime events. Understanding the measures implemented by the Solana development team provides insight into how they are working to enhance network stability and performance.

Technical Foundations of Solana’s Network Stability

At the core of Solana’s architecture is a proof-of-stake (PoS) consensus mechanism combined with innovative data structures like Turbine, Gulf Stream, Sealevel, Pipelining, Cloudbreak, and Archivers. These components work together to facilitate rapid transaction processing—often thousands per second—while maintaining decentralization. However, this high-performance design can be susceptible to congestion during periods of intense activity such as token launches or market surges.

Network congestion occurs when transaction volume exceeds the capacity of validators or nodes to process requests efficiently. This results in slower confirmation times and increased fees for users. Downtime events typically stem from technical issues such as node failures or bugs within the protocol codebase that temporarily disable parts of the network.

Protocol Upgrades Focused on Enhancing Stability

One significant approach toward mitigating these issues has been through protocol upgrades aimed at optimizing performance. For instance:

- Version 1.9 Release (October 2022): This update introduced several improvements targeting resource utilization efficiency and stability enhancements in Turbine's data propagation methods.

- Version 1.10 Release (February 2023): Building upon previous updates, this version further optimized validator efficiency by refining data handling processes within Turbine while addressing bottlenecks that could lead to congestion.

These upgrades reflect an ongoing commitment by Solana developers to refine their core infrastructure based on real-world stress tests and community feedback.

Load Balancing Strategies for Transaction Distribution

To prevent overloads on individual nodes or clusters within the network—a common cause of congestion—Solana has adopted load balancing techniques across its validator set:

- Distributing incoming transactions more evenly ensures no single point becomes overwhelmed.

- Dynamic adjustment mechanisms help redirect traffic away from congested nodes toward healthier ones.

This strategy enhances overall throughput capacity during peak periods while reducing latency spikes that frustrate users.

Improving Validator Performance Through Hardware & Software Optimization

Validators play a crucial role in maintaining blockchain integrity; their performance directly impacts network health. Recognizing this importance:

- The Solana team actively works with validators to optimize hardware configurations—such as faster SSDs or higher RAM—to handle increased workloads.

- Software improvements include refining consensus algorithms for better resource management under heavy loads.

By incentivizing validators through rewards programs tied to uptime and performance metrics, Solana encourages operators to maintain high-quality infrastructure essential for minimizing downtime risks.

Community Engagement & Open Source Collaboration

Community involvement remains vital in addressing scalability challenges effectively:

- Developers contribute via open-source repositories proposing fixes or new features aimed at reducing bottlenecks.

- The community participates in testing new releases before deployment across mainnet environments.

This collaborative approach fosters transparency while accelerating innovation tailored toward resolving specific issues like congestion spikes during high-demand events.

Efforts Toward Reducing Technical Debt

Technical debt refers to shortcuts taken during development that may cause future vulnerabilities or inefficiencies if left unaddressed. To combat this:

- The team undertakes regular refactoring efforts focused on cleaning up legacy code segments prone to bugs under load conditions.

- Bug fixes target known vulnerabilities linked with past downtime incidents—for example: software crashes caused by unhandled edge cases during peak activity periods.

Addressing technical debt ensures long-term resilience against future disruptions stemming from unresolved underlying issues.

Stakeholder Engagement & Proactive Monitoring

Proactive monitoring tools enable early detection of potential problems before they escalate into outages:

- Validators report anomalies via dashboards monitored continuously by core developers.

- Automated alerts trigger immediate investigation when unusual patterns emerge indicating possible overloads or failures.

Regular stakeholder engagement sessions facilitate sharing insights about ongoing improvements while gathering feedback from end-users about their experiences during congested periods.

Recent Developments Improving Network Resilience

The continuous evolution of Solana’s protocol demonstrates a proactive stance towards enhancing reliability amid persistent challenges:

Enhanced Validator Incentives: Higher rewards motivate operators not only for participation but also for maintaining optimal hardware setups capable of handling increased transaction volumes without degradation in service quality.

Open Governance Initiatives: Through proposals like SOLANA Improvement Proposals (SIPs), community members can suggest targeted solutions—ranging from technical optimizations to governance policies—that address specific causes behind congestion episodes effectively.

Focus on Resilience Testing: Regular stress tests simulate extreme scenarios allowing developers identify weak points before real-world occurrences impact users significantly.

Impact on Users & Market Dynamics

Repeated episodes involving network slowdowns or outages inevitably influence user experience negatively; delays can hinder trading activities or disrupt dApp functionalities leading users’ frustration over perceived unreliability—a critical factor affecting adoption rates over time.

Market sentiment also reacts swiftly; prolonged downtimes tend to erode investor confidence resulting in price volatility within SOL markets as traders reassess risk exposure amidst uncertainty surrounding platform robustness compared with competitors like Ethereum which boasts different scalability solutions such as sharding via Layer 2 protocols.

Future Outlook: Sustaining Improvements Amid Challenges

While recent updates demonstrate tangible progress towards stabilizing the network under heavy loads, ongoing vigilance remains essential given evolving demands placed upon blockchain infrastructures today—including increasing user base sizes and complex application requirements.

Key areas likely prioritized moving forward include:

- Further optimization techniques leveraging emerging technologies such as zero knowledge proofs

- Enhanced decentralization strategies ensuring broader validator participation

- Continued refinement based on community feedback through transparent governance channels

By maintaining focus on these strategic initiatives alongside technological innovations—and fostering active stakeholder collaboration—Solana aims not only at overcoming current limitations but also establishing itself firmly among scalable blockchain platforms capable of supporting mainstream adoption.

In summary, addressing network congestion and downtime involves a multi-layered approach combining protocol upgrades, load balancing strategies, hardware/software optimization efforts, active community engagement—and continuous monitoring—to ensure resilient operation even under demanding conditions. As these measures evolve alongside growing demand for decentralized applications worldwide, stakeholders can expect ongoing improvements that bolster both reliability and trustworthiness within the ecosystem.

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

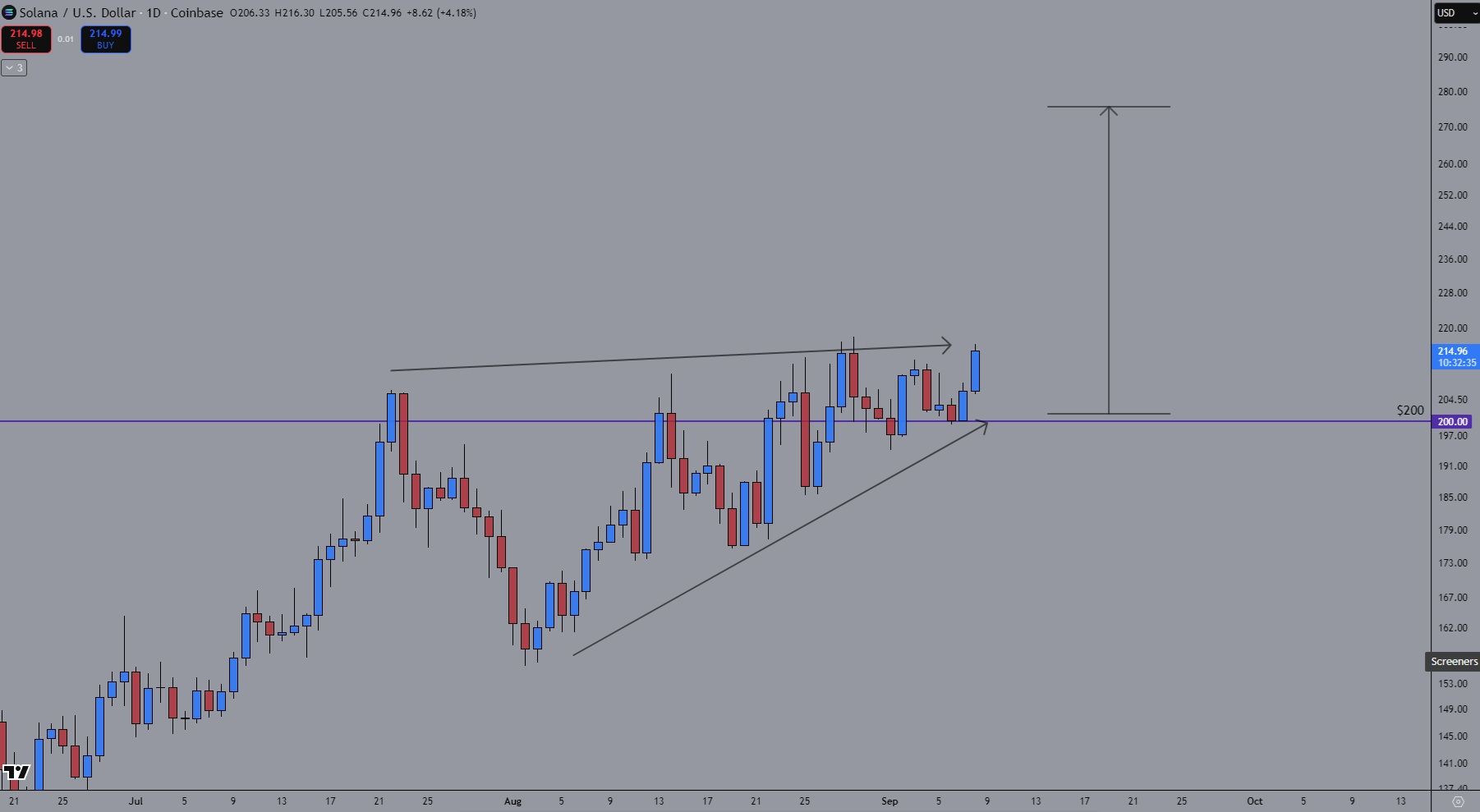

👀 Après des semaines de squeeze, notre plan était clair : acheter sous $200.

📊 Désormais, le prix repasse au-dessus de ce niveau et le momentum suggère une poursuite haussière.

👉 Prêt à capter le prochain move de Solana avant qu’il ne s’emballe ? 🚀

#Solana #SOL #cryptocurrency #crypto trading #blockchain

Carmelita

2025-09-08 23:12

💥 $SOL sort enfin de l’étau : cap sur plus haut ?

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

What is Solana (SOL) Known For?

Introduction to Solana (SOL)

Solana (SOL) has rapidly gained recognition in the blockchain and cryptocurrency communities for its innovative approach to solving common issues faced by traditional blockchain platforms. Launched in March 2020, Solana is an open-source, decentralized platform designed to support high-performance decentralized applications (dApps). Its primary appeal lies in its ability to process transactions quickly and at a low cost, making it a preferred choice for developers and users involved in DeFi, NFTs, and gaming sectors.

Key Features of Solana

High Transaction Speed and Scalability

One of the most defining features of Solana is its exceptional transaction throughput. Unlike many other blockchains that struggle with scalability issues, Solana employs a unique consensus mechanism called "Proof of History" (PoH), combined with proof-of-stake (PoS). This hybrid approach allows the network to process thousands of transactions per second—significantly faster than Bitcoin or Ethereum. This high speed makes it suitable for applications requiring real-time data processing such as gaming platforms or financial trading systems.

Low Transaction Fees

Another critical aspect that sets Solana apart is its minimal transaction costs. The network's efficiency ensures that users can perform numerous transactions without incurring substantial fees. This affordability attracts both individual traders and large-scale projects looking to minimize operational costs while maintaining high performance standards.

Support for Decentralized Finance (DeFi)

Solana has become a hub for DeFi innovations due to its scalability capabilities. The platform hosts various lending protocols, stablecoins, yield farming projects, and decentralized exchanges. Its fast confirmation times enable seamless user experiences essential for DeFi activities like borrowing or liquidity provision without delays or excessive costs.

Growth in NFTs and Gaming Ecosystems

The rise of non-fungible tokens (NFTs) on Solana highlights its versatility beyond finance. Artists, creators, and game developers leverage the platform’s speed and low fees to mint digital assets efficiently—facilitating quick trades on NFT marketplaces or developing immersive blockchain-based games where real-time interactions are crucial.

Recent Developments Impacting SOL

In recent years, several notable events have shaped public perception around Solana’s ecosystem:

Meme Coin Controversy: In 2025, the launch of $TRUMP—a meme coin associated with former U.S. President Donald Trump—sparked controversy due to rapid price fluctuations shortly after launch. Blockchain analytics revealed significant wallet concentration among early holders which raised concerns about market manipulation.

Market Volatility: The price volatility surrounding SOL has been notable; however, market indicators like the VIX index showed decreased anxiety levels during certain periods such as May 2025 when global trade tensions eased temporarily.

These developments underscore both opportunities within the ecosystem as well as challenges related to regulatory scrutiny and market stability.

Regulatory Concerns & Market Sentiment

The launch of controversial tokens like $TRUMP on Solana has attracted attention from regulators worldwide who are increasingly scrutinizing crypto markets for potential manipulation practices or unregulated securities offerings. Such incidents influence investor confidence; consequently affecting SOL’s market value amid fears over possible restrictions or crackdowns on certain types of tokens issued on blockchain platforms like Solana.

Market sentiment remains sensitive; investors closely monitor news regarding regulatory actions alongside technological upgrades within the ecosystem that could enhance security measures against malicious activities or centralization risks posed by token concentration among few wallets.

Why Is Solana Considered a Leading Blockchain Platform?

Solano’s reputation stems from several core strengths:

- Its technical architecture enables unparalleled transaction speeds.

- Low fees make it accessible across different user segments.

- Growing adoption across DeFi projects enhances utility.

- Expanding NFT marketplace activity boosts cultural relevance.

Furthermore, ongoing development efforts aim at improving decentralization levels while maintaining performance benchmarks—an essential factor attracting institutional interest alongside individual developers seeking scalable solutions.

Key Facts About Solana

| Attribute | Details |

|---|---|

| Launch Date | March 2020 |

| Consensus Algorithm | Proof-of-Stake + Proof-of-History |

| Transaction Speed | Thousands per second |

| Native Token Symbol | SOL |

| Market Capitalization | Approximately $10 billion USD as of May 2025 |

These facts highlight how relatively recent but impactful this blockchain platform has become within the broader crypto landscape.

Future Outlook & Challenges Ahead

Looking forward, continued innovation will be vital for sustaining growth on solan networks amidst increasing competition from other scalable blockchains such as Avalanche or Polygon. Addressing concerns related to decentralization—particularly wallet concentration—and navigating evolving regulatory environments will also be crucial factors influencing long-term success.

While recent controversies have temporarily affected market sentiment around SOL tokens’ value stability—they also serve as lessons emphasizing transparency requirements necessary under evolving legal frameworks—the overall trajectory remains positive given ongoing technological advancements coupled with expanding use cases across industries.

Summary: What Makes Solano Stand Out?

In essence,

- It combines cutting-edge technology with practical usability,

- Supports diverse sectors including finance & entertainment,

- Offers fast transaction processing at minimal cost,

- Continues attracting new projects despite occasional setbacks caused by regulatory debates,

making it one of today’s most prominent names in blockchain innovation recognized globally not only for technical prowess but also strategic adaptability amidst dynamic markets.

Keywords: what is solona known for?, solona features?, solona ecosystem?, solona vs ethereum?, best uses case solona

Lo

2025-05-15 00:20

What is Solana (SOL) known for?

What is Solana (SOL) Known For?

Introduction to Solana (SOL)

Solana (SOL) has rapidly gained recognition in the blockchain and cryptocurrency communities for its innovative approach to solving common issues faced by traditional blockchain platforms. Launched in March 2020, Solana is an open-source, decentralized platform designed to support high-performance decentralized applications (dApps). Its primary appeal lies in its ability to process transactions quickly and at a low cost, making it a preferred choice for developers and users involved in DeFi, NFTs, and gaming sectors.

Key Features of Solana

High Transaction Speed and Scalability

One of the most defining features of Solana is its exceptional transaction throughput. Unlike many other blockchains that struggle with scalability issues, Solana employs a unique consensus mechanism called "Proof of History" (PoH), combined with proof-of-stake (PoS). This hybrid approach allows the network to process thousands of transactions per second—significantly faster than Bitcoin or Ethereum. This high speed makes it suitable for applications requiring real-time data processing such as gaming platforms or financial trading systems.

Low Transaction Fees

Another critical aspect that sets Solana apart is its minimal transaction costs. The network's efficiency ensures that users can perform numerous transactions without incurring substantial fees. This affordability attracts both individual traders and large-scale projects looking to minimize operational costs while maintaining high performance standards.

Support for Decentralized Finance (DeFi)

Solana has become a hub for DeFi innovations due to its scalability capabilities. The platform hosts various lending protocols, stablecoins, yield farming projects, and decentralized exchanges. Its fast confirmation times enable seamless user experiences essential for DeFi activities like borrowing or liquidity provision without delays or excessive costs.

Growth in NFTs and Gaming Ecosystems

The rise of non-fungible tokens (NFTs) on Solana highlights its versatility beyond finance. Artists, creators, and game developers leverage the platform’s speed and low fees to mint digital assets efficiently—facilitating quick trades on NFT marketplaces or developing immersive blockchain-based games where real-time interactions are crucial.

Recent Developments Impacting SOL

In recent years, several notable events have shaped public perception around Solana’s ecosystem:

Meme Coin Controversy: In 2025, the launch of $TRUMP—a meme coin associated with former U.S. President Donald Trump—sparked controversy due to rapid price fluctuations shortly after launch. Blockchain analytics revealed significant wallet concentration among early holders which raised concerns about market manipulation.

Market Volatility: The price volatility surrounding SOL has been notable; however, market indicators like the VIX index showed decreased anxiety levels during certain periods such as May 2025 when global trade tensions eased temporarily.

These developments underscore both opportunities within the ecosystem as well as challenges related to regulatory scrutiny and market stability.

Regulatory Concerns & Market Sentiment

The launch of controversial tokens like $TRUMP on Solana has attracted attention from regulators worldwide who are increasingly scrutinizing crypto markets for potential manipulation practices or unregulated securities offerings. Such incidents influence investor confidence; consequently affecting SOL’s market value amid fears over possible restrictions or crackdowns on certain types of tokens issued on blockchain platforms like Solana.

Market sentiment remains sensitive; investors closely monitor news regarding regulatory actions alongside technological upgrades within the ecosystem that could enhance security measures against malicious activities or centralization risks posed by token concentration among few wallets.

Why Is Solana Considered a Leading Blockchain Platform?

Solano’s reputation stems from several core strengths:

- Its technical architecture enables unparalleled transaction speeds.

- Low fees make it accessible across different user segments.

- Growing adoption across DeFi projects enhances utility.

- Expanding NFT marketplace activity boosts cultural relevance.

Furthermore, ongoing development efforts aim at improving decentralization levels while maintaining performance benchmarks—an essential factor attracting institutional interest alongside individual developers seeking scalable solutions.

Key Facts About Solana

| Attribute | Details |

|---|---|

| Launch Date | March 2020 |

| Consensus Algorithm | Proof-of-Stake + Proof-of-History |

| Transaction Speed | Thousands per second |

| Native Token Symbol | SOL |

| Market Capitalization | Approximately $10 billion USD as of May 2025 |

These facts highlight how relatively recent but impactful this blockchain platform has become within the broader crypto landscape.

Future Outlook & Challenges Ahead

Looking forward, continued innovation will be vital for sustaining growth on solan networks amidst increasing competition from other scalable blockchains such as Avalanche or Polygon. Addressing concerns related to decentralization—particularly wallet concentration—and navigating evolving regulatory environments will also be crucial factors influencing long-term success.

While recent controversies have temporarily affected market sentiment around SOL tokens’ value stability—they also serve as lessons emphasizing transparency requirements necessary under evolving legal frameworks—the overall trajectory remains positive given ongoing technological advancements coupled with expanding use cases across industries.

Summary: What Makes Solano Stand Out?

In essence,

- It combines cutting-edge technology with practical usability,

- Supports diverse sectors including finance & entertainment,

- Offers fast transaction processing at minimal cost,

- Continues attracting new projects despite occasional setbacks caused by regulatory debates,

making it one of today’s most prominent names in blockchain innovation recognized globally not only for technical prowess but also strategic adaptability amidst dynamic markets.

Keywords: what is solona known for?, solona features?, solona ecosystem?, solona vs ethereum?, best uses case solona

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Three crypto industry titans Galaxy Digital, Multicoin Capital, and Jump Crypto are raising $1 billion to build the world's largest Solana treasury fund, potentially positioning SOL as the third major corporate treasury asset alongside Bitcoin and Ethereum!

💰 What's Breaking:

-

$1 billion fund would more than double existing SOL corporate reserves

Backed by Cantor Fitzgerald as lead banker

Official endorsement from Solana Foundation

Target closing: September 2025 via public company acquisition

🎯 Scale Comparison:

-

Current largest holder: Upexi with 2M+ SOL (~$400M)

Proposed fund: Could accumulate 5M+ SOL tokens

Market impact: Removing ~1% of total SOL supply from circulation

🏆 Strategic Powerhouse Behind the Fund:

-

Multicoin Capital: Early Solana investor, led $20M Series A in 2019

Galaxy Digital: Post-FTX invested $600M+ in SOL recovery play

Jump Crypto: Advanced trading infrastructure and ecosystem expertise

💡 Solana's Unique Treasury Advantages:

-

Staking rewards (unlike Bitcoin's store-of-value only)

DeFi ecosystem participation (48% of DEX retail trading volume)

Direct collaboration with Solana Foundation

High-performance blockchain infrastructure benefits

📊 Market Dynamics & Price Outlook:

-

Current price: ~$197 (hit $293.31 ATH in January 2025)

Expert predictions: $220-$1,000 range for 2025 (avg $425)

ETF probability: Bloomberg analysts see 95% approval chance by year-end

Technical support: $174-$190 consolidation zone

🔥 Game-Changing Impact:

-

Supply shock: 5M SOL tokens removed from active trading

Institutional confidence signal for alternative L1s

Potential catalyst for sustained price appreciation

New model beyond Bitcoin-only treasury strategies

⚠️ Key Risks to Monitor:

-

Crypto market volatility during execution phase

Evolving regulatory frameworks for digital asset treasuries

Technical challenges in large-scale staking operations

Single blockchain ecosystem concentration risk

🎯 Bottom Line: This initiative could fundamentally reshape institutional crypto adoption, moving from Bitcoin-only strategies to diversified digital asset treasury models. If successful, expect accelerated institutional FOMO and sustained buying pressure similar to MicroStrategy's Bitcoin playbook.

With SOL ETF approval likely and network fundamentals strong, this $1B commitment validates Solana's position as a serious institutional-grade blockchain asset.

Read the complete analysis with technical details and risk assessment: 👇 https://blog.jucoin.com/billion-dollar-solana-treasury-fund/?utm_source=blog

#Solana #SOL #GalaxyDigital #MulticoinCapital #JumpCrypto

JU Blog

2025-08-26 11:47

$1 Billion Solana Treasury Fund: Institutional Giants Signal Major Confidence in SOL

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

👀 Forward Industries (NASDAQ: FORD), soutenu par Galaxy Digital, Jump Crypto & Multicoin Capital, lance une

trésorerie massive sur Solana.

📊 Résultat immédiat : l’action FORD bondit de +128% en pré-market — preuve que $SOL entre clairement dans le viseur des institutionnels.

👉 La question : simple coup d’éclat… ou début d’un nouveau cycle institutionnel pour Solana ? 🔥

#Solana #SOL #cryptocurrency #blockchain

Carmelita

2025-09-08 22:40