Gagne $100 en $YZY – 5 gagnants à se partager le lot

✅ Commente ton UID ✅ Remplis le formulaire 👉 https://gleam.io/lOPaN/join-to-win-100-worth-of-yzy

⏰ 48h pour participer ⚡ Ne rate pas ta chance ! #YZY #crypto #Giveaway #Airdrop

Carmelita

2025-08-21 14:43

🎁 Giveaway Alert! 💙

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Chaque hausse = victoire signée par la communauté 💎🙌

💬 Team hodl ou team FOMO ? #JuCoin #crypto #ATH #Bullish

Carmelita

2025-08-19 13:36

🔥 $JU frappe un nouvel ATH : 19$ !

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

💡 Idées → déployées en secondes 👤 Utilisateurs → onboarding sans friction 🌱 Croissance → 100M$ pour l’écosystème

Ce n’est pas un rêve, c’est #JuChain aujourd’hui 🚀

Builders, rêveurs, leaders de communautés : Le futur n’attend pas — et vous non plus.

🔗 https://www.juchain.org/en/developer-support #Web3 #crypto #BUIDL #JuChain

Carmelita

2025-08-21 14:49

JuChain Genesis Ark Program

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Découvrez OnChain – la façon la plus rapide de trader les nouveaux projets et actifs émergents

✅ Exécution ultra-rapide ✅ Flexibilité maximale ✅ Tradez directement avec votre compte JuCoin – pas de wallet requis

https://www.jucoin.com/en/onchain/ #JuCoin #crypto #Web3 #EarlyAccess

Carmelita

2025-08-21 15:31

Envie de profiter des opportunités en avant-première ?

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Future Challenges for Global Crypto Adoption

As the world increasingly integrates digital currencies into everyday life, understanding the hurdles that could impede widespread crypto adoption becomes essential. While blockchain technology and cryptocurrencies have made significant strides, several persistent challenges threaten to slow or even halt their mainstream acceptance. This article explores these obstacles in detail, providing insights into regulatory, security, market, infrastructural, educational, environmental, and scalability issues that lie ahead.

Regulatory Uncertainty and Its Impact on Cryptocurrency Growth

One of the most significant barriers to global crypto adoption is the lack of clear and consistent regulatory frameworks across different jurisdictions. Countries vary widely in how they approach digital assets—some embrace cryptocurrencies with open arms; others impose strict bans or ambiguous rules. This patchwork creates a landscape fraught with legal ambiguity for investors and businesses alike.

Recent developments highlight this ongoing uncertainty. For instance, in April 2025, the U.S. Securities and Exchange Commission (SEC) issued a statement clarifying its stance on digital asset regulation—a move met with mixed reactions from industry stakeholders. Such regulatory ambiguity can deter institutional investors who seek clarity before committing substantial capital to crypto markets.

The absence of comprehensive regulations can lead to legal risks for companies operating within this space—potentially resulting in fines or shutdowns—and discourage mainstream financial institutions from integrating cryptocurrencies into their services. As governments worldwide continue to refine their policies on digital assets, achieving a balanced framework that fosters innovation while ensuring consumer protection remains a critical challenge.

Security Concerns Eroding Trust in Digital Assets

Security remains at the forefront of concerns surrounding cryptocurrency adoption. Despite advancements in blockchain security protocols, high-profile hacks continue to undermine confidence among users and potential adopters.

In March 2025 alone, a major cryptocurrency exchange suffered a significant breach resulting in millions of dollars worth of digital assets being stolen. Such incidents not only cause immediate financial losses but also damage long-term trust in crypto platforms' safety measures.

For broader acceptance—especially among institutional investors—the security infrastructure must be robust enough to prevent future breaches. Ongoing efforts include implementing multi-signature wallets, decentralized exchanges with enhanced security features—and increasing transparency around cybersecurity practices are vital steps forward.

Failure to address these concerns could lead users toward more traditional financial systems or alternative investments perceived as safer options—hindering overall growth within the cryptocurrency ecosystem.

Market Volatility as an Adoption Barrier

Cryptocurrency markets are notorious for their extreme price fluctuations over short periods—a characteristic that can deter both individual traders and large-scale enterprises from embracing digital currencies fully.

In early 2025 alone, Bitcoin and Ethereum experienced substantial swings causing major losses for some investors; Strategy (formerly MicroStrategy), which holds large Bitcoin reserves as part of its corporate strategy reported a $4.2 billion net loss due to volatile price movements during Q1 2025.

This volatility complicates use cases such as daily transactions or business payments where stable value is crucial. Companies may hesitate to accept cryptocurrencies if they fear rapid devaluation affecting profitability or operational costs significantly.

To mitigate this issue:

- Stablecoins pegged against fiat currencies are gaining popularity.

- Derivative products offer hedging options.

- Developing more mature markets with higher liquidity can reduce volatility over time.However—as long as speculative trading dominates crypto markets—the risk associated with sudden price swings will remain an obstacle for mass adoption.

Infrastructure Development: Building Reliable Payment Ecosystems

A well-developed infrastructure is fundamental for seamless cryptocurrency transactions—from user-friendly wallets to integrated payment systems capable of handling high transaction volumes efficiently.

Recent initiatives demonstrate progress: In April 2025 , firms like Cantor Financial Group partnered with Tether and SoftBank launching Twenty One Capital—aimingto become oneoftheworld’s largest bitcoin treasuries—which underscores ongoing efforts toward infrastructure expansion[3].

Despite such developments:

- Many regions still lack reliable payment gateways supporting cryptocurrencies.

- Transaction speeds remain inconsistent across networks.

- High fees during peak times hinder usability at scale.These limitations restrict everyday use cases like retail shopping or remittances—key drivers needed for mainstream acceptance—and highlight areas requiring further technological innovation such as layer 2 scaling solutions (e.g., Lightning Network)and sharding techniquesto improve throughputand reduce costs .

Education Gaps Hindering Broader Public Understanding

A significant portion of potential users still lacks foundational knowledge about how cryptocurrencies work—including blockchain technology's benefits versus risks—which hampers wider acceptance beyond tech-savvy communities .

Efforts are underway globally through educational campaigns aimed at demystifying cryptos’ mechanicsand promoting responsible investing practices . Nonetheless , misconceptions persist regarding issues like decentralization , privacy , taxation,and environmental impact .

Bridging this knowledge gap is crucial because informed consumers tendto make better decisions —whether adopting new payment methodsor investing responsibly —ultimately fostering trustand encouraging broader participationincryptocurrency ecosystems .

Environmental Concerns Affecting Regulatory Policies

The energy consumption associated with mining certain proof-of-work cryptocurrencies has sparked environmental debates worldwide . Critics argue that large-scale mining operations consume vast amountsof electricity —sometimes sourcedfrom fossil fuels—raising sustainability questions .

Some countries have responded by exploring greener alternatives:

- Transitioning towards renewable energy-powered mining farms

- Promoting proof-of-stake consensus mechanisms which require less energyNegative perceptions about environmental impact could influence future regulations , potentially leading tomore restrictive policiesthat limit mining activitiesor impose carbon taxeson miners[6].

Addressing these concerns involves balancing technological innovationwith ecological responsibility—to ensure sustainable growth without compromising environmental integrity .

Scalability Challenges Limiting Transaction Capacity

As demand increases,the current capacity limitsof many blockchain networks become apparent . High transaction feesand slow confirmation times during peak periods hinder practical usage scenarios like retail paymentsor microtransactions .

Research teams are actively working on solutions:1.Layer 2 scaling solutionssuch as state channelsand sidechains aimto offload transactionsfrom main chains .2.Sharding techniques distribute network loadacross multiple segmentsfor increased throughput .3.Blockchain interoperability protocols facilitate communication between different networks,to create unified ecosystems capableof handling larger volumes seamlessly[7].

Without effective scalability improvements,this bottleneck could resultin user frustration,reduced transaction speed,and higher costs—all factors discouraging mass adoption across diverse sectors including finance,e-commerce,and remittances.

Navigating Future Pathways Toward Widespread Adoption

Overcoming these multifaceted challenges requires coordinated efforts among regulators,businesses,and technologists alike.To foster trust,safety,and efficiency within cryptocurrency ecosystems,the industry must prioritize transparent regulation development,enforce rigorous security standards,and invest heavilyin infrastructural upgrades alongwith public education initiatives .

Furthermore,the evolution towards sustainable practices addressing environmental impacts will be critical—not only ethically but also politically—to avoid restrictive legislation that might stifle innovation.[8] As research progresseson scalability solutions,the promise remains high: creating faster,morereliable,inclusivecrypto networks capableof supporting global economic integration.

Final Thoughts

While numerous hurdles stand between current state-of-the-art blockchain applicationsand full-fledged global crypto adoption,it’s evident that proactive strategies targeting regulation clarity,safety enhancements,infrastructure robustness,population education,sustainability measures,and scalable technology development will shape future success stories . The path forward involves collaborative effortsto unlockcryptocurrencies’ transformative potential while mitigating risks inherent within emerging technologies.

References

1. [Link]

2. [Link]

3. [Link]

4. [Link]

5. [Link]

6. [Link]

7. [Link]

8. [Link]

JCUSER-WVMdslBw

2025-05-11 14:02

What are the future challenges for global crypto adoption?

Future Challenges for Global Crypto Adoption

As the world increasingly integrates digital currencies into everyday life, understanding the hurdles that could impede widespread crypto adoption becomes essential. While blockchain technology and cryptocurrencies have made significant strides, several persistent challenges threaten to slow or even halt their mainstream acceptance. This article explores these obstacles in detail, providing insights into regulatory, security, market, infrastructural, educational, environmental, and scalability issues that lie ahead.

Regulatory Uncertainty and Its Impact on Cryptocurrency Growth

One of the most significant barriers to global crypto adoption is the lack of clear and consistent regulatory frameworks across different jurisdictions. Countries vary widely in how they approach digital assets—some embrace cryptocurrencies with open arms; others impose strict bans or ambiguous rules. This patchwork creates a landscape fraught with legal ambiguity for investors and businesses alike.

Recent developments highlight this ongoing uncertainty. For instance, in April 2025, the U.S. Securities and Exchange Commission (SEC) issued a statement clarifying its stance on digital asset regulation—a move met with mixed reactions from industry stakeholders. Such regulatory ambiguity can deter institutional investors who seek clarity before committing substantial capital to crypto markets.

The absence of comprehensive regulations can lead to legal risks for companies operating within this space—potentially resulting in fines or shutdowns—and discourage mainstream financial institutions from integrating cryptocurrencies into their services. As governments worldwide continue to refine their policies on digital assets, achieving a balanced framework that fosters innovation while ensuring consumer protection remains a critical challenge.

Security Concerns Eroding Trust in Digital Assets

Security remains at the forefront of concerns surrounding cryptocurrency adoption. Despite advancements in blockchain security protocols, high-profile hacks continue to undermine confidence among users and potential adopters.

In March 2025 alone, a major cryptocurrency exchange suffered a significant breach resulting in millions of dollars worth of digital assets being stolen. Such incidents not only cause immediate financial losses but also damage long-term trust in crypto platforms' safety measures.

For broader acceptance—especially among institutional investors—the security infrastructure must be robust enough to prevent future breaches. Ongoing efforts include implementing multi-signature wallets, decentralized exchanges with enhanced security features—and increasing transparency around cybersecurity practices are vital steps forward.

Failure to address these concerns could lead users toward more traditional financial systems or alternative investments perceived as safer options—hindering overall growth within the cryptocurrency ecosystem.

Market Volatility as an Adoption Barrier

Cryptocurrency markets are notorious for their extreme price fluctuations over short periods—a characteristic that can deter both individual traders and large-scale enterprises from embracing digital currencies fully.

In early 2025 alone, Bitcoin and Ethereum experienced substantial swings causing major losses for some investors; Strategy (formerly MicroStrategy), which holds large Bitcoin reserves as part of its corporate strategy reported a $4.2 billion net loss due to volatile price movements during Q1 2025.

This volatility complicates use cases such as daily transactions or business payments where stable value is crucial. Companies may hesitate to accept cryptocurrencies if they fear rapid devaluation affecting profitability or operational costs significantly.

To mitigate this issue:

- Stablecoins pegged against fiat currencies are gaining popularity.

- Derivative products offer hedging options.

- Developing more mature markets with higher liquidity can reduce volatility over time.However—as long as speculative trading dominates crypto markets—the risk associated with sudden price swings will remain an obstacle for mass adoption.

Infrastructure Development: Building Reliable Payment Ecosystems

A well-developed infrastructure is fundamental for seamless cryptocurrency transactions—from user-friendly wallets to integrated payment systems capable of handling high transaction volumes efficiently.

Recent initiatives demonstrate progress: In April 2025 , firms like Cantor Financial Group partnered with Tether and SoftBank launching Twenty One Capital—aimingto become oneoftheworld’s largest bitcoin treasuries—which underscores ongoing efforts toward infrastructure expansion[3].

Despite such developments:

- Many regions still lack reliable payment gateways supporting cryptocurrencies.

- Transaction speeds remain inconsistent across networks.

- High fees during peak times hinder usability at scale.These limitations restrict everyday use cases like retail shopping or remittances—key drivers needed for mainstream acceptance—and highlight areas requiring further technological innovation such as layer 2 scaling solutions (e.g., Lightning Network)and sharding techniquesto improve throughputand reduce costs .

Education Gaps Hindering Broader Public Understanding

A significant portion of potential users still lacks foundational knowledge about how cryptocurrencies work—including blockchain technology's benefits versus risks—which hampers wider acceptance beyond tech-savvy communities .

Efforts are underway globally through educational campaigns aimed at demystifying cryptos’ mechanicsand promoting responsible investing practices . Nonetheless , misconceptions persist regarding issues like decentralization , privacy , taxation,and environmental impact .

Bridging this knowledge gap is crucial because informed consumers tendto make better decisions —whether adopting new payment methodsor investing responsibly —ultimately fostering trustand encouraging broader participationincryptocurrency ecosystems .

Environmental Concerns Affecting Regulatory Policies

The energy consumption associated with mining certain proof-of-work cryptocurrencies has sparked environmental debates worldwide . Critics argue that large-scale mining operations consume vast amountsof electricity —sometimes sourcedfrom fossil fuels—raising sustainability questions .

Some countries have responded by exploring greener alternatives:

- Transitioning towards renewable energy-powered mining farms

- Promoting proof-of-stake consensus mechanisms which require less energyNegative perceptions about environmental impact could influence future regulations , potentially leading tomore restrictive policiesthat limit mining activitiesor impose carbon taxeson miners[6].

Addressing these concerns involves balancing technological innovationwith ecological responsibility—to ensure sustainable growth without compromising environmental integrity .

Scalability Challenges Limiting Transaction Capacity

As demand increases,the current capacity limitsof many blockchain networks become apparent . High transaction feesand slow confirmation times during peak periods hinder practical usage scenarios like retail paymentsor microtransactions .

Research teams are actively working on solutions:1.Layer 2 scaling solutionssuch as state channelsand sidechains aimto offload transactionsfrom main chains .2.Sharding techniques distribute network loadacross multiple segmentsfor increased throughput .3.Blockchain interoperability protocols facilitate communication between different networks,to create unified ecosystems capableof handling larger volumes seamlessly[7].

Without effective scalability improvements,this bottleneck could resultin user frustration,reduced transaction speed,and higher costs—all factors discouraging mass adoption across diverse sectors including finance,e-commerce,and remittances.

Navigating Future Pathways Toward Widespread Adoption

Overcoming these multifaceted challenges requires coordinated efforts among regulators,businesses,and technologists alike.To foster trust,safety,and efficiency within cryptocurrency ecosystems,the industry must prioritize transparent regulation development,enforce rigorous security standards,and invest heavilyin infrastructural upgrades alongwith public education initiatives .

Furthermore,the evolution towards sustainable practices addressing environmental impacts will be critical—not only ethically but also politically—to avoid restrictive legislation that might stifle innovation.[8] As research progresseson scalability solutions,the promise remains high: creating faster,morereliable,inclusivecrypto networks capableof supporting global economic integration.

Final Thoughts

While numerous hurdles stand between current state-of-the-art blockchain applicationsand full-fledged global crypto adoption,it’s evident that proactive strategies targeting regulation clarity,safety enhancements,infrastructure robustness,population education,sustainability measures,and scalable technology development will shape future success stories . The path forward involves collaborative effortsto unlockcryptocurrencies’ transformative potential while mitigating risks inherent within emerging technologies.

References

1. [Link]

2. [Link]

3. [Link]

4. [Link]

5. [Link]

6. [Link]

7. [Link]

8. [Link]

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

$JU Savings arrive demain ! Ne clignez pas des yeux — saisissez-le. verrouillez-le. faites-le croître. https://jucoin.online/en/accounts/register?ref=USJYGL

Carmelita

2025-09-01 22:54

Tick. Tock.

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Effective Strategies for Managing Risk When Investing in Cryptocurrency

Investing in cryptocurrencies offers exciting opportunities but also comes with significant risks. As the market remains highly volatile, understanding and implementing effective risk management strategies is essential for protecting your investments and maximizing potential returns. This guide provides a comprehensive overview of proven methods to manage crypto investment risks effectively.

Understanding the Risks of Cryptocurrency Investment

Cryptocurrency markets are known for their rapid price fluctuations, which can lead to substantial gains or losses within short periods. Several factors contribute to this volatility, including regulatory developments, technological innovations, market sentiment shifts, and liquidity issues. Recognizing these risks helps investors develop appropriate strategies to navigate the unpredictable landscape.

Regulatory uncertainty is a prominent concern; governments worldwide are still formulating policies regarding digital assets. Changes in regulations can significantly impact cryptocurrency prices—either boosting confidence or causing sharp declines. Security threats also pose serious challenges; hacking incidents on exchanges or wallets have resulted in irreversible losses for many investors. Additionally, low liquidity in certain cryptocurrencies makes it difficult to buy or sell large amounts without affecting prices adversely.

Key Risk Management Strategies for Crypto Investors

Implementing structured risk management techniques can help mitigate potential losses while allowing investors to participate actively in the market's growth prospects.

Diversification remains one of the most fundamental strategies—spreading investments across various cryptocurrencies and other asset classes reduces exposure to any single asset’s downturns. For example, holding a mix of Bitcoin, Ethereum, and emerging altcoins can balance out volatility inherent in individual tokens.

Stop-loss orders are automated instructions that trigger sales when an asset reaches a predetermined price point. This approach limits downside risk by ensuring that losses do not escalate beyond acceptable levels during sudden market drops.

Regular portfolio rebalancing involves reviewing your holdings periodically and adjusting allocations based on current market conditions or changing investment goals. This practice maintains an optimal risk-return profile over time.

Staying informed through educational research is vital—keeping up with news about regulatory changes, technological advancements like blockchain upgrades, and security best practices helps make informed decisions rather than reacting impulsively during volatile periods.

Utilizing risk assessment tools, such as analytics platforms that evaluate historical data trends or simulate different scenarios based on current conditions, enables more precise evaluation of potential risks associated with specific assets or portfolios.

Recent Developments Impacting Crypto Risk Management

The introduction of financial products like Bitcoin ETFs has increased institutional interest but also added layers of complexity concerning regulation and market behavior. While ETFs facilitate easier access for traditional investors—and potentially stabilize some aspects—they may also introduce new vulnerabilities if not managed carefully due to increased inflows leading to heightened volatility during certain periods [2].

Industry forecasts suggest Bitcoin could reach $200,000 or more by 2025 as adoption expands and volatility decreases [3]. Such optimistic projections highlight both opportunity and caution: rapid growth could attract new investors but might also lead to speculative bubbles if not tempered by prudent risk controls.

Furthermore, recent trends emphasize the importance of close monitoring—especially amid ongoing regulatory discussions—that could influence overall sentiment negatively if policies become restrictive [1].

The Potential Fallout from Poor Risk Management

Failure to implement proper risk mitigation measures can result in severe consequences:

- Increased Market Volatility: Without safeguards like stop-loss orders or diversification strategies, investors may suffer outsized losses during sudden downturns.

- Regulatory Uncertainty: Lack of awareness about evolving legal frameworks might expose investors to compliance issues or forced liquidations.

- Security Breaches: Inadequate security practices increase vulnerability; hacking incidents have led many into losing their crypto holdings permanently unless proper safeguards are employed (e.g., hardware wallets).

Being proactive about these risks ensures resilience against adverse events while positioning oneself advantageously within this dynamic environment.

Practical Tips for Managing Crypto Investment Risks

To build a robust approach toward managing cryptocurrency risks effectively:

- Diversify your portfolio across multiple digital assets rather than concentrating holdings solely on one coin.

- Use stop-loss orders strategically—set them at levels aligned with your risk tolerance.

- Regularly review your portfolio’s composition; rebalance as needed based on performance metrics.

- Stay updated through reputable sources about regulatory changes impacting cryptocurrencies.

- Prioritize secure storage solutions such as hardware wallets instead of leaving funds exposed on exchanges prone to hacks.

- Leverage analytical tools designed specifically for crypto markets that assess historical data patterns and forecast potential movements.

- Avoid emotional decision-making; develop clear investment plans grounded in research rather than speculation alone.

By integrating these practices into your investment routine—and continuously educating yourself—you enhance your ability not only to survive turbulent markets but potentially thrive amid them.

Navigating Future Risks & Opportunities in Cryptocurrency Markets

As industry forecasts project continued growth alongside increasing adoption rates [3], it’s crucial for investors always remain vigilant regarding emerging threats such as evolving regulations—or technological vulnerabilities—and capitalize on opportunities through disciplined strategy implementation today.

Understanding how recent developments influence overall stability allows you better prepare against unforeseen shocks while positioning yourself advantageously within this rapidly changing ecosystem.

Final Thoughts: Building Resilience Through Knowledge & Strategy

Effective risk management isn’t just about avoiding losses—it’s about creating sustainable investing habits rooted in knowledge-based decision-making processes tailored specifically toward cryptocurrency's unique landscape . By diversifying investments wisely , employing protective order types , staying informed via credible sources , securing assets properly , leveraging analytical tools ,and maintaining discipline throughout fluctuating markets —you set yourself up not only for survival but long-term success amidst inherent uncertainties.

Remember: The key lies in balancing opportunity with caution — embracing innovation responsibly while safeguarding against its pitfalls ensures you’re well-positioned today—and tomorrow—in the exciting world of crypto investing

JCUSER-IC8sJL1q

2025-05-22 18:42

What are effective strategies for managing risk when investing in crypto?

Effective Strategies for Managing Risk When Investing in Cryptocurrency

Investing in cryptocurrencies offers exciting opportunities but also comes with significant risks. As the market remains highly volatile, understanding and implementing effective risk management strategies is essential for protecting your investments and maximizing potential returns. This guide provides a comprehensive overview of proven methods to manage crypto investment risks effectively.

Understanding the Risks of Cryptocurrency Investment

Cryptocurrency markets are known for their rapid price fluctuations, which can lead to substantial gains or losses within short periods. Several factors contribute to this volatility, including regulatory developments, technological innovations, market sentiment shifts, and liquidity issues. Recognizing these risks helps investors develop appropriate strategies to navigate the unpredictable landscape.

Regulatory uncertainty is a prominent concern; governments worldwide are still formulating policies regarding digital assets. Changes in regulations can significantly impact cryptocurrency prices—either boosting confidence or causing sharp declines. Security threats also pose serious challenges; hacking incidents on exchanges or wallets have resulted in irreversible losses for many investors. Additionally, low liquidity in certain cryptocurrencies makes it difficult to buy or sell large amounts without affecting prices adversely.

Key Risk Management Strategies for Crypto Investors

Implementing structured risk management techniques can help mitigate potential losses while allowing investors to participate actively in the market's growth prospects.

Diversification remains one of the most fundamental strategies—spreading investments across various cryptocurrencies and other asset classes reduces exposure to any single asset’s downturns. For example, holding a mix of Bitcoin, Ethereum, and emerging altcoins can balance out volatility inherent in individual tokens.

Stop-loss orders are automated instructions that trigger sales when an asset reaches a predetermined price point. This approach limits downside risk by ensuring that losses do not escalate beyond acceptable levels during sudden market drops.

Regular portfolio rebalancing involves reviewing your holdings periodically and adjusting allocations based on current market conditions or changing investment goals. This practice maintains an optimal risk-return profile over time.

Staying informed through educational research is vital—keeping up with news about regulatory changes, technological advancements like blockchain upgrades, and security best practices helps make informed decisions rather than reacting impulsively during volatile periods.

Utilizing risk assessment tools, such as analytics platforms that evaluate historical data trends or simulate different scenarios based on current conditions, enables more precise evaluation of potential risks associated with specific assets or portfolios.

Recent Developments Impacting Crypto Risk Management

The introduction of financial products like Bitcoin ETFs has increased institutional interest but also added layers of complexity concerning regulation and market behavior. While ETFs facilitate easier access for traditional investors—and potentially stabilize some aspects—they may also introduce new vulnerabilities if not managed carefully due to increased inflows leading to heightened volatility during certain periods [2].

Industry forecasts suggest Bitcoin could reach $200,000 or more by 2025 as adoption expands and volatility decreases [3]. Such optimistic projections highlight both opportunity and caution: rapid growth could attract new investors but might also lead to speculative bubbles if not tempered by prudent risk controls.

Furthermore, recent trends emphasize the importance of close monitoring—especially amid ongoing regulatory discussions—that could influence overall sentiment negatively if policies become restrictive [1].

The Potential Fallout from Poor Risk Management

Failure to implement proper risk mitigation measures can result in severe consequences:

- Increased Market Volatility: Without safeguards like stop-loss orders or diversification strategies, investors may suffer outsized losses during sudden downturns.

- Regulatory Uncertainty: Lack of awareness about evolving legal frameworks might expose investors to compliance issues or forced liquidations.

- Security Breaches: Inadequate security practices increase vulnerability; hacking incidents have led many into losing their crypto holdings permanently unless proper safeguards are employed (e.g., hardware wallets).

Being proactive about these risks ensures resilience against adverse events while positioning oneself advantageously within this dynamic environment.

Practical Tips for Managing Crypto Investment Risks

To build a robust approach toward managing cryptocurrency risks effectively:

- Diversify your portfolio across multiple digital assets rather than concentrating holdings solely on one coin.

- Use stop-loss orders strategically—set them at levels aligned with your risk tolerance.

- Regularly review your portfolio’s composition; rebalance as needed based on performance metrics.

- Stay updated through reputable sources about regulatory changes impacting cryptocurrencies.

- Prioritize secure storage solutions such as hardware wallets instead of leaving funds exposed on exchanges prone to hacks.

- Leverage analytical tools designed specifically for crypto markets that assess historical data patterns and forecast potential movements.

- Avoid emotional decision-making; develop clear investment plans grounded in research rather than speculation alone.

By integrating these practices into your investment routine—and continuously educating yourself—you enhance your ability not only to survive turbulent markets but potentially thrive amid them.

Navigating Future Risks & Opportunities in Cryptocurrency Markets

As industry forecasts project continued growth alongside increasing adoption rates [3], it’s crucial for investors always remain vigilant regarding emerging threats such as evolving regulations—or technological vulnerabilities—and capitalize on opportunities through disciplined strategy implementation today.

Understanding how recent developments influence overall stability allows you better prepare against unforeseen shocks while positioning yourself advantageously within this rapidly changing ecosystem.

Final Thoughts: Building Resilience Through Knowledge & Strategy

Effective risk management isn’t just about avoiding losses—it’s about creating sustainable investing habits rooted in knowledge-based decision-making processes tailored specifically toward cryptocurrency's unique landscape . By diversifying investments wisely , employing protective order types , staying informed via credible sources , securing assets properly , leveraging analytical tools ,and maintaining discipline throughout fluctuating markets —you set yourself up not only for survival but long-term success amidst inherent uncertainties.

Remember: The key lies in balancing opportunity with caution — embracing innovation responsibly while safeguarding against its pitfalls ensures you’re well-positioned today—and tomorrow—in the exciting world of crypto investing

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

$BTC/USDT vient de clôturer au-dessus de $111K. 👉 Les analystes fixent le pire scénario à ~$100K (-10%).

⚡ Petit rappel historique : lors des cycles passés, Bitcoin encaissait des corrections de 30–40% avant de repartir en orbite.

➡️ Si -10% est désormais le maximum de douleur… alors les taureaux mènent la danse.

#Bitcoin #BTC #crypto #CryptoMarkets

Carmelita

2025-09-07 22:38

📊 Bitcoin bulls flexing their dominance

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

What Is Sharding in Blockchain?

Sharding is a transformative scalability solution designed to enhance the performance and efficiency of blockchain networks. As blockchain technology gains widespread adoption, the need to process increasing numbers of transactions quickly and securely becomes critical. Sharding addresses this challenge by dividing the entire network into smaller, manageable segments called shards, each capable of processing transactions independently. This division allows multiple transactions to be processed simultaneously, significantly reducing congestion and improving overall throughput.

In essence, sharding enables a blockchain network to operate more like a distributed database rather than a single monolithic ledger. Each shard functions as its own mini-blockchain with its unique state and transaction history but remains interconnected within the larger network framework. This structure not only boosts transaction speeds but also helps in scaling blockchain solutions for real-world applications such as decentralized finance (DeFi), supply chain management, and enterprise solutions.

How Does Sharding Work in Blockchain Networks?

The core idea behind sharding involves splitting the workload across various smaller components—shards—that work concurrently. Each shard processes a subset of all transactions based on specific criteria such as user accounts or data types. For example, one shard might handle payment transactions while another manages smart contract interactions.

To maintain consistency across these independent shards, mechanisms like cross-shard communication are implemented. These protocols ensure that when users perform transactions involving multiple shards—say transferring assets from one account managed by one shard to another managed by different shards—the system can verify and record these operations accurately without compromising security or integrity.

Shards typically operate as separate blockchains known as "shard chains." They maintain their own states—such as account balances or smart contract data—and process their designated set of transactions independently before periodically syncing with other shards through consensus protocols designed for cross-shard validation.

Types of Sharding

There are primarily two types of sharding used in blockchain systems:

Horizontal Sharding: This approach divides the network based on transaction types or user groups—for instance, separating payment processing from smart contract execution.

Vertical Sharding: Here, data is partitioned based on storage needs or data categories—for example, storing different kinds of information (user profiles vs transactional logs) separately across various shards.

Both methods aim to optimize resource utilization while maintaining security and decentralization principles inherent in blockchain technology.

Benefits of Implementing Sharding

Implementing sharding offers several significant advantages:

Enhanced Scalability: By distributing transaction loads across multiple shards, networks can handle many more operations per second compared to traditional single-chain architectures.

Reduced Transaction Fees: Faster processing times mean less congestion; consequently, users often experience lower fees during peak usage periods.

Improved Network Efficiency: Smaller nodes manage fewer tasks within each shard—they require less computational power and storage capacity—making participation easier for more validators.

Parallel Processing: Multiple parts of the network work simultaneously rather than sequentially; this parallelism accelerates overall throughput significantly.

These benefits make sharded blockchains suitable for large-scale applications where high speed and low latency are essential requirements.

Challenges Associated With Blockchain Sharding

Despite its promising potential, implementing sharding introduces complex technical challenges that must be addressed:

Inter-Shard Communication

Ensuring seamless communication between different shards is vital yet difficult. Transactions involving multiple shards require secure protocols that prevent double-spending or inconsistencies—a problem known as cross-shard communication complexity.

Consensus Mechanisms Across Multiple Shards

Traditional consensus algorithms like Proof-of-Work (PoW) are not inherently designed for multi-shard environments. Developing efficient consensus models that work reliably across numerous independent chains remains an ongoing research area within blockchain development communities.

Security Concerns

Dividing a network into smaller segments increases vulnerability risks; if one shard becomes compromised due to an attack or bug exploitation—a scenario called "shard takeover"—it could threaten the entire ecosystem's security integrity unless robust safeguards are implemented effectively throughout all parts of the system.

Standardization & Adoption Barriers

For widespread adoption beyond experimental phases requires industry-wide standards governing how sharded networks communicate and interoperate seamlessly. Without standardization efforts among developers and stakeholders worldwide—including major platforms like Ethereum—the risk exists that fragmentation could hinder progress rather than accelerate it.

Recent Developments in Blockchain Sharding Technology

Major projects have made notable strides toward integrating sharding into their ecosystems:

Ethereum 2.0 has been at the forefront with plans for scalable upgrades through its phased rollout strategy involving beacon chains (launched December 2020). The next steps include deploying dedicated shard chains alongside cross-shard communication protocols aimed at enabling Ethereum’s massive ecosystem to scale efficiently without sacrificing decentralization or security standards.

Polkadot employs relay chains connecting parachains—independent blockchains optimized for specific use cases—that communicate via shared security models facilitating interoperability among diverse networks.

Cosmos, utilizing Tendermint Core consensus algorithm architecture allows developers to create zones (independent blockchains) capable of interoperation within an overarching hub-and-spoke model similar to Polkadot’s relay chain approach.

Research continues globally exploring innovative techniques such as state sharding, which aims at optimizing how state information is stored across nodes—a crucial factor influencing scalability limits further improvements.

Potential Risks Impacting Future Adoption

While promising solutions exist today—and ongoing research promises even better approaches—the path forward faces hurdles related mainly to:

Security Risks: Smaller individual shards may become targets due to reduced validation power compared with full nodes operating on entire networks.

Interoperability Challenges: Achieving flawless interaction between diverse systems requires standardized protocols; otherwise fragmentation may occur leading toward isolated ecosystems instead of unified platforms.

Adoption Hurdles & Industry Standardization

Without broad agreement on technical standards governing cross-shard communications—as well as regulatory considerations—widespread deployment might slow down considerably despite technological readiness.

Understanding How Blockchain Scaling Evolves Through Sharding

As demand grows exponentially—from DeFi applications demanding rapid trades versus enterprise-level integrations requiring high throughput—the importance lies not just in creating faster blockchains but ensuring they remain secure against evolving threats while interoperable enough for global adoption.

By addressing current limitations through continuous innovation—in protocol design improvements like state sharing techniques—and fostering collaboration among industry leaders worldwide who develop open standards —the future landscape looks promising: scalable yet secure decentralized systems capable enough for mainstream use.

This comprehensive overview provides clarity about what sharding entails within blockchain technology: how it works technically; why it matters; what benefits it offers; what challenges lie ahead; along with recent advancements shaping its future trajectory—all aligned towards helping users understand both foundational concepts and cutting-edge developments effectively.

Lo

2025-05-15 02:38

What is sharding in blockchain?

What Is Sharding in Blockchain?

Sharding is a transformative scalability solution designed to enhance the performance and efficiency of blockchain networks. As blockchain technology gains widespread adoption, the need to process increasing numbers of transactions quickly and securely becomes critical. Sharding addresses this challenge by dividing the entire network into smaller, manageable segments called shards, each capable of processing transactions independently. This division allows multiple transactions to be processed simultaneously, significantly reducing congestion and improving overall throughput.

In essence, sharding enables a blockchain network to operate more like a distributed database rather than a single monolithic ledger. Each shard functions as its own mini-blockchain with its unique state and transaction history but remains interconnected within the larger network framework. This structure not only boosts transaction speeds but also helps in scaling blockchain solutions for real-world applications such as decentralized finance (DeFi), supply chain management, and enterprise solutions.

How Does Sharding Work in Blockchain Networks?

The core idea behind sharding involves splitting the workload across various smaller components—shards—that work concurrently. Each shard processes a subset of all transactions based on specific criteria such as user accounts or data types. For example, one shard might handle payment transactions while another manages smart contract interactions.

To maintain consistency across these independent shards, mechanisms like cross-shard communication are implemented. These protocols ensure that when users perform transactions involving multiple shards—say transferring assets from one account managed by one shard to another managed by different shards—the system can verify and record these operations accurately without compromising security or integrity.

Shards typically operate as separate blockchains known as "shard chains." They maintain their own states—such as account balances or smart contract data—and process their designated set of transactions independently before periodically syncing with other shards through consensus protocols designed for cross-shard validation.

Types of Sharding

There are primarily two types of sharding used in blockchain systems:

Horizontal Sharding: This approach divides the network based on transaction types or user groups—for instance, separating payment processing from smart contract execution.

Vertical Sharding: Here, data is partitioned based on storage needs or data categories—for example, storing different kinds of information (user profiles vs transactional logs) separately across various shards.

Both methods aim to optimize resource utilization while maintaining security and decentralization principles inherent in blockchain technology.

Benefits of Implementing Sharding

Implementing sharding offers several significant advantages:

Enhanced Scalability: By distributing transaction loads across multiple shards, networks can handle many more operations per second compared to traditional single-chain architectures.

Reduced Transaction Fees: Faster processing times mean less congestion; consequently, users often experience lower fees during peak usage periods.

Improved Network Efficiency: Smaller nodes manage fewer tasks within each shard—they require less computational power and storage capacity—making participation easier for more validators.

Parallel Processing: Multiple parts of the network work simultaneously rather than sequentially; this parallelism accelerates overall throughput significantly.

These benefits make sharded blockchains suitable for large-scale applications where high speed and low latency are essential requirements.

Challenges Associated With Blockchain Sharding

Despite its promising potential, implementing sharding introduces complex technical challenges that must be addressed:

Inter-Shard Communication

Ensuring seamless communication between different shards is vital yet difficult. Transactions involving multiple shards require secure protocols that prevent double-spending or inconsistencies—a problem known as cross-shard communication complexity.

Consensus Mechanisms Across Multiple Shards

Traditional consensus algorithms like Proof-of-Work (PoW) are not inherently designed for multi-shard environments. Developing efficient consensus models that work reliably across numerous independent chains remains an ongoing research area within blockchain development communities.

Security Concerns

Dividing a network into smaller segments increases vulnerability risks; if one shard becomes compromised due to an attack or bug exploitation—a scenario called "shard takeover"—it could threaten the entire ecosystem's security integrity unless robust safeguards are implemented effectively throughout all parts of the system.

Standardization & Adoption Barriers

For widespread adoption beyond experimental phases requires industry-wide standards governing how sharded networks communicate and interoperate seamlessly. Without standardization efforts among developers and stakeholders worldwide—including major platforms like Ethereum—the risk exists that fragmentation could hinder progress rather than accelerate it.

Recent Developments in Blockchain Sharding Technology

Major projects have made notable strides toward integrating sharding into their ecosystems:

Ethereum 2.0 has been at the forefront with plans for scalable upgrades through its phased rollout strategy involving beacon chains (launched December 2020). The next steps include deploying dedicated shard chains alongside cross-shard communication protocols aimed at enabling Ethereum’s massive ecosystem to scale efficiently without sacrificing decentralization or security standards.

Polkadot employs relay chains connecting parachains—independent blockchains optimized for specific use cases—that communicate via shared security models facilitating interoperability among diverse networks.

Cosmos, utilizing Tendermint Core consensus algorithm architecture allows developers to create zones (independent blockchains) capable of interoperation within an overarching hub-and-spoke model similar to Polkadot’s relay chain approach.

Research continues globally exploring innovative techniques such as state sharding, which aims at optimizing how state information is stored across nodes—a crucial factor influencing scalability limits further improvements.

Potential Risks Impacting Future Adoption

While promising solutions exist today—and ongoing research promises even better approaches—the path forward faces hurdles related mainly to:

Security Risks: Smaller individual shards may become targets due to reduced validation power compared with full nodes operating on entire networks.

Interoperability Challenges: Achieving flawless interaction between diverse systems requires standardized protocols; otherwise fragmentation may occur leading toward isolated ecosystems instead of unified platforms.

Adoption Hurdles & Industry Standardization

Without broad agreement on technical standards governing cross-shard communications—as well as regulatory considerations—widespread deployment might slow down considerably despite technological readiness.

Understanding How Blockchain Scaling Evolves Through Sharding

As demand grows exponentially—from DeFi applications demanding rapid trades versus enterprise-level integrations requiring high throughput—the importance lies not just in creating faster blockchains but ensuring they remain secure against evolving threats while interoperable enough for global adoption.

By addressing current limitations through continuous innovation—in protocol design improvements like state sharing techniques—and fostering collaboration among industry leaders worldwide who develop open standards —the future landscape looks promising: scalable yet secure decentralized systems capable enough for mainstream use.

This comprehensive overview provides clarity about what sharding entails within blockchain technology: how it works technically; why it matters; what benefits it offers; what challenges lie ahead; along with recent advancements shaping its future trajectory—all aligned towards helping users understand both foundational concepts and cutting-edge developments effectively.

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Nous sommes désormais intégrés à @BitgetWallet, l’un des leaders mondiaux des portefeuilles Web3, utilisé par plus de 20M d’utilisateurs 🌍💎

💡 Pourquoi c’est important : ✅ Accès simplifié pour des millions de nouveaux utilisateurs ✅ Barrière d’entrée réduite pour l’adoption on-chain ✅ Expansion de JuChain au cœur de la communauté Web3

🔥 Une étape majeure vers la scalabilité et l’adoption de masse. L’avenir du Web3 se construit ensemble.

#JuChain #crypto #BitgetWallet #Adoption

Carmelita

2025-08-22 09:47

Grande nouvelle pour l’écosystème #JuChain !

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

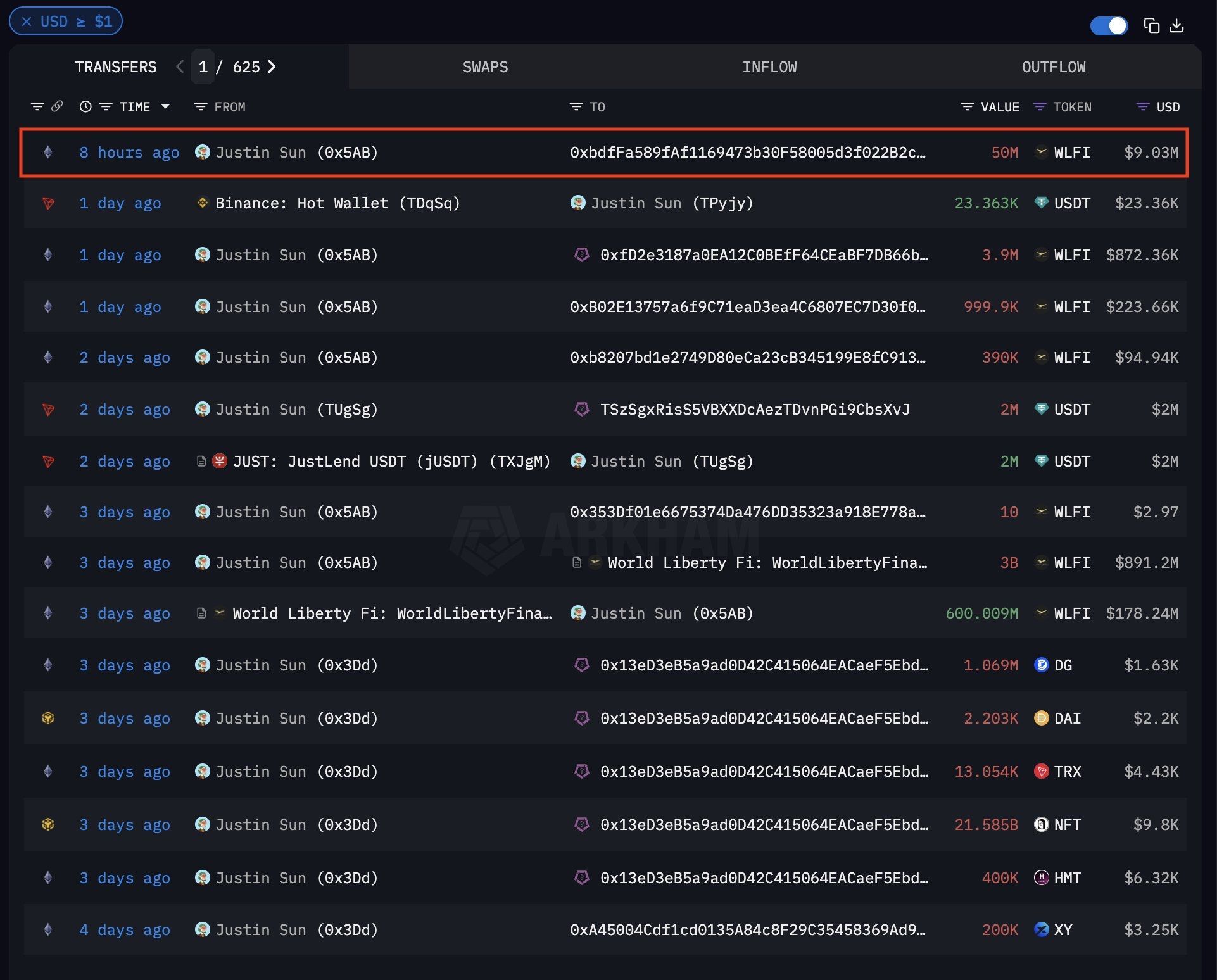

👉 Quand une baleine de ce calibre bouge, tout l’écosystème s’interroge. Le fait que Justin affirme “ne pas vouloir vendre” ne suffit pas à calmer les spéculations :

Risque de pression réglementaire accrue sur les fondateurs influents. Impact potentiel sur la liquidité et la confiance autour de $WLFI. Opportunité pour ceux qui savent lire au-delà du bruit médiatique.

📊 Le marché crypto ne dort jamais, et chaque mouvement de baleine peut redessiner les équilibres. La vraie question : serez-vous observateur ou acteur quand le prochain signal tombera ?

#crypto #blockchain #WLFI #cryptocurrency #blockchain

Carmelita

2025-09-04 23:06

🔥 “9M$ en $WLFI, wallet de Justin Sun blacklisté : simple transfert ou signal caché pour le march

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

Début de mois = possible dip 📉 2ᵉ moitié = éventuelle étincelle si la Fed coupe les taux 🔥

👉 Septembre pourrait être le mois pour se positionner avant le prochain leg haussier. 🚀

#Ethereum #crypto

Carmelita

2025-08-30 23:40

$ETH – Septembre en ligne de mire

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

What Is Impermanent Loss in Crypto?

Impermanent loss is a fundamental concept in the decentralized finance (DeFi) ecosystem that every liquidity provider (LP) should understand. It refers to the potential financial loss that can occur when providing liquidity to a decentralized exchange (DEX). While offering liquidity can generate passive income through trading fees, impermanent loss highlights the risks involved, especially during volatile market conditions.

Understanding Impermanent Loss

At its core, impermanent loss happens because of price fluctuations between two tokens within a liquidity pool. When LPs deposit tokens into a pool—say ETH and USDT—they are effectively supplying both assets to facilitate trades on platforms like Uniswap or SushiSwap. The pool uses an automated market maker (AMM) algorithm to maintain balance and enable seamless trading.

However, if one token's price changes significantly relative to the other after your deposit, the value of your pooled assets may be less than simply holding those tokens outside the pool. This discrepancy is what we call "impermanent" because it isn't realized as an actual loss until you withdraw your funds; if prices revert or stabilize before withdrawal, some or all of this potential loss can be mitigated.

Why Does Impermanent Loss Occur?

Impermanent loss results from how AMMs manage token ratios based on current prices rather than fixed quantities. When traders swap tokens within a pool, they cause shifts in token balances which impact LPs' holdings. For example:

- If Token A's price increases significantly compared to Token B,

- The AMM automatically adjusts by selling some of Token A for more of Token B,

- Leading to an imbalance where LPs hold fewer high-value tokens and more low-value ones upon withdrawal.

This process means that even though trading fees earned might offset some losses, substantial price swings can still lead LPs into negative returns relative to simply holding their original assets.

Factors That Influence Impermanent Loss

Several factors determine how much impermanent loss an LP might experience:

Market Volatility: High volatility causes larger price swings and increases risk.

Token Pair Correlation: Well-correlated pairs like stablecoins tend to have lower impermanence risk compared with volatile pairs such as ETH/ALT coins.

Pool Size and Liquidity Depth: Larger pools with deep liquidity tend to absorb shocks better; smaller pools are more susceptible to manipulation or large swings.

Market Trends: Rapid upward or downward trends amplify potential losses during periods of significant movement.

Understanding these factors helps LPs assess whether providing liquidity aligns with their risk appetite and investment goals.

Strategies for Managing Impermanent Loss

While impermanent loss cannot be entirely eliminated without sacrificing potential earnings from trading fees, several strategies help mitigate its impact:

Diversification: Spreading investments across multiple pools reduces exposure concentrated in one asset pair.

Choosing Stablecoin Pairs: Pools involving stablecoins like USDC/USDT minimize volatility-related risks.

Monitoring Market Conditions: Staying informed about market trends allows timely decisions about adding or removing liquidity.

Utilizing Risk Management Tools: Some DeFi platforms offer features such as dynamic fee adjustments or insurance options designed specifically for reducing impermanence risks.

Yield Farming & Incentives: Combining staking rewards with fee earnings can offset potential losses over time.

By applying these approaches thoughtfully, users can better balance earning opportunities against associated risks.

Recent Developments Addressing Impermanent Loss

The DeFi sector has seen ongoing innovation aimed at reducing impermanence concerns:

Several platforms now incorporate dynamic fee structures that increase transaction costs during high volatility periods—compensating LPs for increased risk.

New protocols are experimenting with hybrid models combining AMMs with order book mechanisms for improved stability.

Education initiatives focus on increasing user awareness around impermanent loss so investors make informed decisions rather than relying solely on platform marketing claims.

Additionally, regulatory scrutiny has increased transparency requirements around disclosures related to impermanence risks—a move aimed at protecting retail investors from unexpected losses while fostering trust in DeFi ecosystems.

Potential Risks Beyond Financial Losses

Impermanent loss not only affects individual users but also has broader implications:

Reduced user confidence could slow down adoption if participants perceive high risks without adequate safeguards.

Lack of transparency regarding possible losses may attract regulatory attention—potentially leading toward stricter compliance standards across jurisdictions.

Furthermore, significant instances of large-scale withdrawals due to perceived unrecoverable losses could contribute negatively toward overall market stability within DeFi ecosystems.

Navigating Impermanent Loss Effectively

For anyone considering participating as an LP in crypto markets via DEXes, understanding how impermanent loss works is crucial for making informed decisions aligned with personal investment strategies. While it presents inherent risks tied closely with market volatility and asset selection choices, ongoing innovations aim at minimizing its impact through smarter protocol design and better educational resources.

By staying updated on recent developments—and employing sound risk management practices—investors can enjoy the benefits offered by DeFi’s yield opportunities while safeguarding their capital against unnecessary exposure.

Keywords: Imper permanentloss crypto | Decentralized Finance Risks | Liquidity Pool Management | Crypto Market Volatility | DeFi Investment Strategies

Lo

2025-05-14 06:40

What is impermanent loss?

What Is Impermanent Loss in Crypto?

Impermanent loss is a fundamental concept in the decentralized finance (DeFi) ecosystem that every liquidity provider (LP) should understand. It refers to the potential financial loss that can occur when providing liquidity to a decentralized exchange (DEX). While offering liquidity can generate passive income through trading fees, impermanent loss highlights the risks involved, especially during volatile market conditions.

Understanding Impermanent Loss

At its core, impermanent loss happens because of price fluctuations between two tokens within a liquidity pool. When LPs deposit tokens into a pool—say ETH and USDT—they are effectively supplying both assets to facilitate trades on platforms like Uniswap or SushiSwap. The pool uses an automated market maker (AMM) algorithm to maintain balance and enable seamless trading.

However, if one token's price changes significantly relative to the other after your deposit, the value of your pooled assets may be less than simply holding those tokens outside the pool. This discrepancy is what we call "impermanent" because it isn't realized as an actual loss until you withdraw your funds; if prices revert or stabilize before withdrawal, some or all of this potential loss can be mitigated.

Why Does Impermanent Loss Occur?

Impermanent loss results from how AMMs manage token ratios based on current prices rather than fixed quantities. When traders swap tokens within a pool, they cause shifts in token balances which impact LPs' holdings. For example:

- If Token A's price increases significantly compared to Token B,

- The AMM automatically adjusts by selling some of Token A for more of Token B,

- Leading to an imbalance where LPs hold fewer high-value tokens and more low-value ones upon withdrawal.

This process means that even though trading fees earned might offset some losses, substantial price swings can still lead LPs into negative returns relative to simply holding their original assets.

Factors That Influence Impermanent Loss

Several factors determine how much impermanent loss an LP might experience:

Market Volatility: High volatility causes larger price swings and increases risk.

Token Pair Correlation: Well-correlated pairs like stablecoins tend to have lower impermanence risk compared with volatile pairs such as ETH/ALT coins.

Pool Size and Liquidity Depth: Larger pools with deep liquidity tend to absorb shocks better; smaller pools are more susceptible to manipulation or large swings.

Market Trends: Rapid upward or downward trends amplify potential losses during periods of significant movement.

Understanding these factors helps LPs assess whether providing liquidity aligns with their risk appetite and investment goals.

Strategies for Managing Impermanent Loss

While impermanent loss cannot be entirely eliminated without sacrificing potential earnings from trading fees, several strategies help mitigate its impact:

Diversification: Spreading investments across multiple pools reduces exposure concentrated in one asset pair.

Choosing Stablecoin Pairs: Pools involving stablecoins like USDC/USDT minimize volatility-related risks.

Monitoring Market Conditions: Staying informed about market trends allows timely decisions about adding or removing liquidity.

Utilizing Risk Management Tools: Some DeFi platforms offer features such as dynamic fee adjustments or insurance options designed specifically for reducing impermanence risks.

Yield Farming & Incentives: Combining staking rewards with fee earnings can offset potential losses over time.

By applying these approaches thoughtfully, users can better balance earning opportunities against associated risks.

Recent Developments Addressing Impermanent Loss

The DeFi sector has seen ongoing innovation aimed at reducing impermanence concerns:

Several platforms now incorporate dynamic fee structures that increase transaction costs during high volatility periods—compensating LPs for increased risk.

New protocols are experimenting with hybrid models combining AMMs with order book mechanisms for improved stability.

Education initiatives focus on increasing user awareness around impermanent loss so investors make informed decisions rather than relying solely on platform marketing claims.

Additionally, regulatory scrutiny has increased transparency requirements around disclosures related to impermanence risks—a move aimed at protecting retail investors from unexpected losses while fostering trust in DeFi ecosystems.

Potential Risks Beyond Financial Losses

Impermanent loss not only affects individual users but also has broader implications:

Reduced user confidence could slow down adoption if participants perceive high risks without adequate safeguards.

Lack of transparency regarding possible losses may attract regulatory attention—potentially leading toward stricter compliance standards across jurisdictions.

Furthermore, significant instances of large-scale withdrawals due to perceived unrecoverable losses could contribute negatively toward overall market stability within DeFi ecosystems.

Navigating Impermanent Loss Effectively

For anyone considering participating as an LP in crypto markets via DEXes, understanding how impermanent loss works is crucial for making informed decisions aligned with personal investment strategies. While it presents inherent risks tied closely with market volatility and asset selection choices, ongoing innovations aim at minimizing its impact through smarter protocol design and better educational resources.

By staying updated on recent developments—and employing sound risk management practices—investors can enjoy the benefits offered by DeFi’s yield opportunities while safeguarding their capital against unnecessary exposure.

Keywords: Imper permanentloss crypto | Decentralized Finance Risks | Liquidity Pool Management | Crypto Market Volatility | DeFi Investment Strategies

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

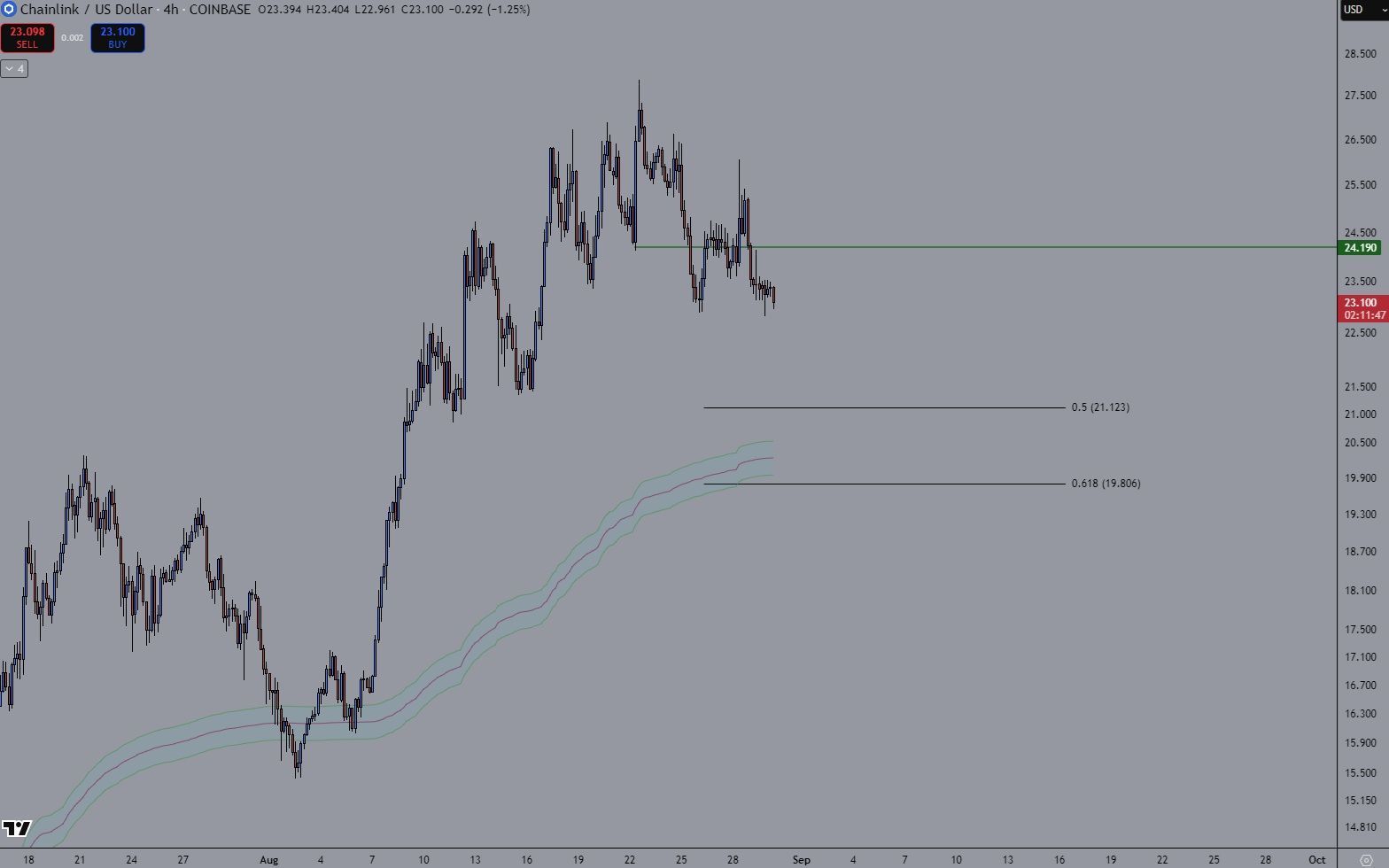

La zone des $20 reste notre buy zone stratégique.

⏳ Patience = puissance. On attend le bon signal avant de frapper. 🚀

👉 Tu accumules ou tu restes en sidelines ?

#Chainlink #crypto

Carmelita

2025-08-30 23:42

$LINK toujours sous surveillance.

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

👀 Les regards sont braqués sur $0.20 comme zone d’accumulation idéale.

✅ R/R setup explosif : les acheteurs pourraient déclencher le breakout attendu. 🚀

👉 Tu stackes $HBAR ou tu attends le décollage ?

#HBAR #crypto

Carmelita

2025-08-30 23:41

$HBAR se resserre dans une zone clé de volume.

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

MakerDAO Governance Mechanisms: An In-Depth Overview

Understanding MakerDAO and Its Role in DeFi

MakerDAO is a pioneering decentralized finance (DeFi) protocol built on the Ethereum blockchain. It enables users to generate the DAI stablecoin, which is pegged to the US dollar, through collateralized debt positions (CDPs). As one of the earliest DeFi projects launched in 2017 by Rune Christensen, MakerDAO has played a significant role in shaping decentralized governance and stablecoin ecosystems. Its core mission is to provide a transparent, censorship-resistant financial system where decisions are made collectively by its community of stakeholders.

How Does MakerDAO's Governance Work?

At its core, MakerDAO’s governance model emphasizes decentralization and community participation. The protocol employs several mechanisms that empower MKR token holders—its native governance tokens—to influence key parameters and future development directions.

MKR Tokens as Governance Tools

MKR tokens are central to MakerDAO’s decision-making process. Holders of MKR have voting rights that allow them to approve or reject proposals affecting the protocol’s operations. These tokens are not just voting instruments; their value also reflects confidence in the system's stability and growth prospects. Market dynamics influence MKR prices, aligning stakeholder incentives with long-term health rather than short-term gains.

Proposal Submission System

Anyone with an Ethereum wallet can submit proposals for changes within the ecosystem—be it adjusting stability fees, modifying collateral types, or implementing upgrades. This open approach encourages broad participation from developers, users, investors, and other stakeholders who wish to shape how MakerDAO evolves over time.

Voting Process Dynamics

Once a proposal is submitted, it enters a voting phase where MKR token holders cast their votes during designated periods. Typically conducted via snapshot votes at specific block heights or timestamps—ensuring transparency—the outcome depends on whether proposals meet predefined approval thresholds such as supermajorities or simple majorities depending on their significance.

Emergency Shutdown Protocols

In scenarios where immediate action is necessary—such as security breaches or critical vulnerabilities—MakerDAO incorporates an emergency shutdown mechanism. This feature allows a supermajority of MKR holders to temporarily halt operations for safety reasons until issues are resolved or mitigated effectively.

Recent Developments Enhancing Governance Effectiveness

The evolution of MakerDAO’s governance mechanisms reflects ongoing efforts toward increased efficiency and inclusivity within decentralized decision-making frameworks.

Adjustments to Stability Fees Based on Market Conditions

The stability fee functions akin to interest rates charged on borrowed DAI against collateralized assets like ETH or WBTC. During volatile market periods—for example in 2022—the DAO adjusted these fees upward strategically to maintain DAI's peg amid fluctuating asset prices. Such dynamic management helps stabilize supply-demand balances but also influences borrowing costs for users seeking liquidity through CDPs.

Expansion Through Collateral Type Additions

Diversification remains vital for risk mitigation; hence recent years saw MakerDAO adding new collateral options such as USDC (a fiat-backed stablecoin), WBTC (wrapped Bitcoin), among others. These additions broaden access points for users while increasing liquidity pools within the ecosystem—a move aligned with broader DeFi trends emphasizing interoperability across protocols.

Upgrades in Governance Infrastructure

To improve transparency and user engagement further, recent upgrades introduced more sophisticated voting tools—including better proposal submission interfaces—and enhanced transparency measures like detailed dashboards tracking vote outcomes over time. These improvements aim at fostering higher participation levels among community members while ensuring decisions reflect collective consensus accurately.

Challenges Facing MakerDAO's Governance Model

Despite its strengths, certain risks threaten the robustness of MakerDAO’s governance framework:

Market Volatility: Rapid price swings can necessitate frequent adjustments like changing stability fees—a process that might lead to increased costs for borrowers and reduced activity if not managed carefully.

Regulatory Scrutiny: As regulators worldwide scrutinize DeFi protocols more intensely—including stablecoins like DAI—potential legal challenges could impose restrictions that impact operational flexibility.

Security Concerns: Smart contract vulnerabilities remain an inherent risk; exploits could lead directly to loss of funds or destabilization if malicious actors manipulate protocol parameters before safeguards activate.

These challenges underscore why continuous innovation—not only technologically but also from regulatory compliance perspectives—is essential for maintaining trustworthiness within decentralized communities.

The Future Outlook: Maintaining Decentralized Control Amid Evolving Risks

As DeFi continues expanding rapidly across global markets—with increasing user adoption—the importance of resilient governance mechanisms becomes even more critical for protocols like MakerDAO aiming at long-term sustainability. Ongoing developments include exploring multi-signature approaches for critical decisions alongside automated safeguards driven by smart contracts designed explicitly with security best practices in mind.

By fostering active community engagement through transparent processes—and adapting swiftly when faced with market shifts—they can uphold decentralization principles while mitigating emerging risks effectively.

Keywords: makerdao governance mechanisms | how does makerdao work | mkr token voting | decentralized finance protocols | stablecoin regulation | smart contract security | DAO proposal system | collateral types makerdao

JCUSER-F1IIaxXA

2025-05-14 13:05

What governance mechanisms does MakerDAO use?

MakerDAO Governance Mechanisms: An In-Depth Overview

Understanding MakerDAO and Its Role in DeFi

MakerDAO is a pioneering decentralized finance (DeFi) protocol built on the Ethereum blockchain. It enables users to generate the DAI stablecoin, which is pegged to the US dollar, through collateralized debt positions (CDPs). As one of the earliest DeFi projects launched in 2017 by Rune Christensen, MakerDAO has played a significant role in shaping decentralized governance and stablecoin ecosystems. Its core mission is to provide a transparent, censorship-resistant financial system where decisions are made collectively by its community of stakeholders.

How Does MakerDAO's Governance Work?

At its core, MakerDAO’s governance model emphasizes decentralization and community participation. The protocol employs several mechanisms that empower MKR token holders—its native governance tokens—to influence key parameters and future development directions.

MKR Tokens as Governance Tools

MKR tokens are central to MakerDAO’s decision-making process. Holders of MKR have voting rights that allow them to approve or reject proposals affecting the protocol’s operations. These tokens are not just voting instruments; their value also reflects confidence in the system's stability and growth prospects. Market dynamics influence MKR prices, aligning stakeholder incentives with long-term health rather than short-term gains.

Proposal Submission System

Anyone with an Ethereum wallet can submit proposals for changes within the ecosystem—be it adjusting stability fees, modifying collateral types, or implementing upgrades. This open approach encourages broad participation from developers, users, investors, and other stakeholders who wish to shape how MakerDAO evolves over time.

Voting Process Dynamics

Once a proposal is submitted, it enters a voting phase where MKR token holders cast their votes during designated periods. Typically conducted via snapshot votes at specific block heights or timestamps—ensuring transparency—the outcome depends on whether proposals meet predefined approval thresholds such as supermajorities or simple majorities depending on their significance.

Emergency Shutdown Protocols

In scenarios where immediate action is necessary—such as security breaches or critical vulnerabilities—MakerDAO incorporates an emergency shutdown mechanism. This feature allows a supermajority of MKR holders to temporarily halt operations for safety reasons until issues are resolved or mitigated effectively.

Recent Developments Enhancing Governance Effectiveness

The evolution of MakerDAO’s governance mechanisms reflects ongoing efforts toward increased efficiency and inclusivity within decentralized decision-making frameworks.

Adjustments to Stability Fees Based on Market Conditions

The stability fee functions akin to interest rates charged on borrowed DAI against collateralized assets like ETH or WBTC. During volatile market periods—for example in 2022—the DAO adjusted these fees upward strategically to maintain DAI's peg amid fluctuating asset prices. Such dynamic management helps stabilize supply-demand balances but also influences borrowing costs for users seeking liquidity through CDPs.

Expansion Through Collateral Type Additions

Diversification remains vital for risk mitigation; hence recent years saw MakerDAO adding new collateral options such as USDC (a fiat-backed stablecoin), WBTC (wrapped Bitcoin), among others. These additions broaden access points for users while increasing liquidity pools within the ecosystem—a move aligned with broader DeFi trends emphasizing interoperability across protocols.

Upgrades in Governance Infrastructure

To improve transparency and user engagement further, recent upgrades introduced more sophisticated voting tools—including better proposal submission interfaces—and enhanced transparency measures like detailed dashboards tracking vote outcomes over time. These improvements aim at fostering higher participation levels among community members while ensuring decisions reflect collective consensus accurately.

Challenges Facing MakerDAO's Governance Model

Despite its strengths, certain risks threaten the robustness of MakerDAO’s governance framework: