Popular Posts

What Is Slashing Insurance for Stakers?

Slashing insurance is an increasingly important concept in the world of blockchain, especially within proof-of-stake (PoS) networks. As more projects transition from traditional proof-of-work (PoW) systems to PoS, understanding how validators are protected against financial risks becomes crucial for investors and network participants alike. This article provides a comprehensive overview of slashing insurance, explaining its purpose, mechanisms, benefits, challenges, and recent developments.

Understanding Slashing in Proof-of-Stake Networks

In PoS blockchain systems, validators play a vital role by confirming transactions and maintaining network security. To become a validator, participants must stake a certain amount of cryptocurrency as collateral. This stake acts as both an economic incentive to behave honestly and a security deposit that can be forfeited if they act maliciously or fail to meet protocol requirements.

Slashing is the penalty mechanism designed to punish validators who violate rules—such as double signing or being offline during validation periods. When slashed, part or all of their staked tokens are confiscated and redistributed according to protocol rules. While this process helps secure the network by discouraging malicious behavior, it also introduces significant financial risk for validators.

Why Is Slashing Insurance Necessary?

Given the inherent risks associated with slashing events—especially false accusations or accidental misbehavior—validators seek ways to mitigate potential losses. Without safeguards in place, many might hesitate to participate fully in staking activities due to fear of losing their investment over mistakes or technical issues.

Slashing insurance emerged as a solution aimed at providing financial protection against these penalties. It allows stakers and validators to hedge against unexpected slashes by purchasing coverage that compensates them if they suffer losses due to penalties imposed by the network.

Types of Slashing Insurance Mechanisms

There are several approaches through which slashing insurance can be implemented:

Self-Insurance: Validators allocate part of their own stake into reserve funds specifically designated for covering potential slashes. This method requires significant capital upfront but offers direct control over risk management.

Third-Party Insurance Providers: Specialized companies now offer dedicated insurance products tailored for crypto stakers. These providers assess risks and offer policies that pay out if a validator experiences a slash event.

Protocol-Based Solutions: Some blockchain protocols incorporate built-in mechanisms such as automatic redistribution of lost tokens among remaining honest validators or other safety nets designed within the network's codebase itself.

Each approach has its advantages and trade-offs concerning cost-effectiveness, ease of access, transparency, and trustworthiness.

Benefits Offered by Slashing Insurance

Implementing slashing insurance brings several notable benefits:

Risk Management: Validators can participate confidently without fearing immediate loss from accidental errors or false accusations.

Enhanced Network Stability: When fewer validators withdraw due to fear of penalties—and more remain active—the overall security and robustness of the blockchain improve.

Encourages Participation: Lower perceived risks attract more participants into staking pools or validator roles — increasing decentralization.

Market Confidence: The availability of insurances signals maturity within the ecosystem; it reassures investors about safety measures protecting their assets.

These factors collectively contribute toward healthier networks with higher participation rates—a key factor in achieving scalability and resilience in decentralized systems.

Challenges Facing Slashing Insurance

Despite its advantages, deploying effective slashing insurance faces several hurdles:

Cost Implications: Premiums charged by third-party insurers may be high depending on perceived risk levels; this could deter smaller stakeholders from purchasing coverage.

Complex Risk Assessment: Accurately evaluating individual validator risk profiles requires sophisticated models considering technical reliability data alongside market conditions.

Regulatory Uncertainty: As regulatory bodies scrutinize cryptocurrencies more closely worldwide—including aspects like consumer protection—insurance products may face compliance challenges that could hinder growth.

Potential Moral Hazard Risks: If not properly structured—for example: overly generous coverage—validators might take excessive risks knowing they’re insured against penalties rather than adhering strictly to protocol rules.

Addressing these issues involves ongoing innovation both technically (improving risk assessment tools) and legally (clarifying regulatory frameworks).

Recent Trends & Developments

The landscape surrounding slashing insurance continues evolving rapidly:

Growing Adoption

As Ethereum 2.x transitions from PoW towards full PoS consensus mechanisms—with plans involving thousands of validators—the need for reliable insurances has surged significantly across various platforms aiming at securing large-scale staking operations.

New Product Offerings

Several startups have launched innovative products offering customizable coverage options tailored specifically for individual stakers’ needs—including flexible premium structures based on stake size or duration commitments—which makes insuring assets more accessible than ever before.

Protocol Innovations

Some blockchains now embed advanced features such as automatic redistribution algorithms following slash events instead of simply burning tokens; this reduces economic shocks on stakeholders while maintaining incentivization structures aligned with honest participation.

Regulatory Environment

As governments develop clearer policies around digital assets—including classifications related directly or indirectly linked with staking activities—the legal landscape will influence how insurers operate across jurisdictions moving forward.

How Slaching Insurance Could Impact Blockchain Ecosystems

The expansion of slasher-insurance markets holds promising implications:

- Increased Validator Participation: By reducing fears associated with potential losses during validation processes,more individuals are encouraged into staking roles,which enhances decentralization,security,and resilience across networks,

2.Market Stability:Insurance reduces panic-driven withdrawals caused by unforeseen slash events,leading toward steadier asset prices,

3.Ecosystem Growth:With increased confidence among users/investors,more developers build decentralized applications (dApps),and transaction volumes grow organically,

4.Regulatory Clarity:As formalized frameworks emerge around crypto-insurance offerings,industry standards will solidify leading toward broader adoption globally.

Final Thoughts on Slaring Insurance’s Role in Blockchain Security

Slaring insurance plays an essential role in fostering trust within proof-of-stake ecosystems by offering financial safeguards against punitive measures like token slashings.. Its development reflects broader trends towards mature infrastructure supporting decentralized finance (DeFi). While challenges remain—from cost barriers through regulatory uncertainties—the ongoing innovations suggest that such protective mechanisms will become standard components enabling wider participation while safeguarding asset integrity.. As blockchain technology advances further into mainstream adoption,, understanding these protective layers remains critical for investors,, developers,, regulators,,and users alike seeking secure,, transparent,, resilient networks..

JCUSER-F1IIaxXA

2025-05-09 19:54

What is slashing insurance for stakers?

What Is Slashing Insurance for Stakers?

Slashing insurance is an increasingly important concept in the world of blockchain, especially within proof-of-stake (PoS) networks. As more projects transition from traditional proof-of-work (PoW) systems to PoS, understanding how validators are protected against financial risks becomes crucial for investors and network participants alike. This article provides a comprehensive overview of slashing insurance, explaining its purpose, mechanisms, benefits, challenges, and recent developments.

Understanding Slashing in Proof-of-Stake Networks

In PoS blockchain systems, validators play a vital role by confirming transactions and maintaining network security. To become a validator, participants must stake a certain amount of cryptocurrency as collateral. This stake acts as both an economic incentive to behave honestly and a security deposit that can be forfeited if they act maliciously or fail to meet protocol requirements.

Slashing is the penalty mechanism designed to punish validators who violate rules—such as double signing or being offline during validation periods. When slashed, part or all of their staked tokens are confiscated and redistributed according to protocol rules. While this process helps secure the network by discouraging malicious behavior, it also introduces significant financial risk for validators.

Why Is Slashing Insurance Necessary?

Given the inherent risks associated with slashing events—especially false accusations or accidental misbehavior—validators seek ways to mitigate potential losses. Without safeguards in place, many might hesitate to participate fully in staking activities due to fear of losing their investment over mistakes or technical issues.

Slashing insurance emerged as a solution aimed at providing financial protection against these penalties. It allows stakers and validators to hedge against unexpected slashes by purchasing coverage that compensates them if they suffer losses due to penalties imposed by the network.

Types of Slashing Insurance Mechanisms

There are several approaches through which slashing insurance can be implemented:

Self-Insurance: Validators allocate part of their own stake into reserve funds specifically designated for covering potential slashes. This method requires significant capital upfront but offers direct control over risk management.

Third-Party Insurance Providers: Specialized companies now offer dedicated insurance products tailored for crypto stakers. These providers assess risks and offer policies that pay out if a validator experiences a slash event.

Protocol-Based Solutions: Some blockchain protocols incorporate built-in mechanisms such as automatic redistribution of lost tokens among remaining honest validators or other safety nets designed within the network's codebase itself.

Each approach has its advantages and trade-offs concerning cost-effectiveness, ease of access, transparency, and trustworthiness.

Benefits Offered by Slashing Insurance

Implementing slashing insurance brings several notable benefits:

Risk Management: Validators can participate confidently without fearing immediate loss from accidental errors or false accusations.

Enhanced Network Stability: When fewer validators withdraw due to fear of penalties—and more remain active—the overall security and robustness of the blockchain improve.

Encourages Participation: Lower perceived risks attract more participants into staking pools or validator roles — increasing decentralization.

Market Confidence: The availability of insurances signals maturity within the ecosystem; it reassures investors about safety measures protecting their assets.

These factors collectively contribute toward healthier networks with higher participation rates—a key factor in achieving scalability and resilience in decentralized systems.

Challenges Facing Slashing Insurance

Despite its advantages, deploying effective slashing insurance faces several hurdles:

Cost Implications: Premiums charged by third-party insurers may be high depending on perceived risk levels; this could deter smaller stakeholders from purchasing coverage.

Complex Risk Assessment: Accurately evaluating individual validator risk profiles requires sophisticated models considering technical reliability data alongside market conditions.

Regulatory Uncertainty: As regulatory bodies scrutinize cryptocurrencies more closely worldwide—including aspects like consumer protection—insurance products may face compliance challenges that could hinder growth.

Potential Moral Hazard Risks: If not properly structured—for example: overly generous coverage—validators might take excessive risks knowing they’re insured against penalties rather than adhering strictly to protocol rules.

Addressing these issues involves ongoing innovation both technically (improving risk assessment tools) and legally (clarifying regulatory frameworks).

Recent Trends & Developments

The landscape surrounding slashing insurance continues evolving rapidly:

Growing Adoption

As Ethereum 2.x transitions from PoW towards full PoS consensus mechanisms—with plans involving thousands of validators—the need for reliable insurances has surged significantly across various platforms aiming at securing large-scale staking operations.

New Product Offerings

Several startups have launched innovative products offering customizable coverage options tailored specifically for individual stakers’ needs—including flexible premium structures based on stake size or duration commitments—which makes insuring assets more accessible than ever before.

Protocol Innovations

Some blockchains now embed advanced features such as automatic redistribution algorithms following slash events instead of simply burning tokens; this reduces economic shocks on stakeholders while maintaining incentivization structures aligned with honest participation.

Regulatory Environment

As governments develop clearer policies around digital assets—including classifications related directly or indirectly linked with staking activities—the legal landscape will influence how insurers operate across jurisdictions moving forward.

How Slaching Insurance Could Impact Blockchain Ecosystems

The expansion of slasher-insurance markets holds promising implications:

- Increased Validator Participation: By reducing fears associated with potential losses during validation processes,more individuals are encouraged into staking roles,which enhances decentralization,security,and resilience across networks,

2.Market Stability:Insurance reduces panic-driven withdrawals caused by unforeseen slash events,leading toward steadier asset prices,

3.Ecosystem Growth:With increased confidence among users/investors,more developers build decentralized applications (dApps),and transaction volumes grow organically,

4.Regulatory Clarity:As formalized frameworks emerge around crypto-insurance offerings,industry standards will solidify leading toward broader adoption globally.

Final Thoughts on Slaring Insurance’s Role in Blockchain Security

Slaring insurance plays an essential role in fostering trust within proof-of-stake ecosystems by offering financial safeguards against punitive measures like token slashings.. Its development reflects broader trends towards mature infrastructure supporting decentralized finance (DeFi). While challenges remain—from cost barriers through regulatory uncertainties—the ongoing innovations suggest that such protective mechanisms will become standard components enabling wider participation while safeguarding asset integrity.. As blockchain technology advances further into mainstream adoption,, understanding these protective layers remains critical for investors,, developers,, regulators,,and users alike seeking secure,, transparent,, resilient networks..

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Zero-Knowledge Proofs Enable Private Credentials on Blockchain

Blockchain technology has revolutionized the way we think about digital transactions, decentralization, and data security. However, its inherent transparency can pose significant privacy challenges, especially when sensitive information is involved. Zero-Knowledge Proofs (ZKPs) have emerged as a powerful cryptographic tool to address these concerns by enabling private credentials on-chain without compromising security or integrity.

Understanding Zero-Knowledge Proofs

Zero-Knowledge Proofs are cryptographic protocols that allow one party—the prover—to convince another—the verifier—that a specific statement is true without revealing any additional information beyond the validity of that statement. This means users can prove ownership or authenticity without exposing underlying data such as personal details or transaction amounts.

The core properties of ZKPs include:

- Soundness: Ensures that false statements cannot be convincingly proven.

- Completeness: Valid statements can always be proven if they are true.

- Zero-Knowledge: The verifier gains no knowledge about the actual data behind the proof.

These properties make ZKPs particularly suitable for privacy-preserving applications in blockchain environments where transparency often conflicts with confidentiality needs.

The Role of ZKPs in Blockchain Privacy

Traditional blockchain networks like Bitcoin and Ethereum operate transparently; every transaction is publicly recorded and accessible to anyone. While this promotes trustlessness and auditability, it also exposes sensitive user data—such as identities, transaction amounts, or asset holdings—which may not be desirable for all use cases.

Zero-Knowledge Proofs offer a solution by allowing users to perform transactions and demonstrate ownership or compliance with certain rules without revealing their identities or transaction specifics. This capability transforms how privacy is managed on-chain:

- Users can execute private transactions that hide sender details and amounts while still being verifiable.

- Identity verification processes become more secure since proofs confirm attributes (e.g., age over 18) without disclosing personal information.

- Smart contracts can enforce conditions based on private data inputs verified through ZKPs rather than exposing raw data.

This approach enhances user privacy while maintaining the trustless nature of blockchain systems.

How ZKPs Facilitate Private Credentials On-Chain

Private credentials refer to proofs of ownership or rights over assets, identities, or permissions that do not reveal sensitive details during validation. Zero-Knowledge Proofs enable this functionality through several mechanisms:

1. Private Transactions

Using ZKPs like zk-SNARKs (Succinct Non-interactive Arguments of Knowledge), users can submit proof that they possess sufficient funds for a transfer without revealing their account balance or identity. These proofs are succinct enough to be verified quickly within smart contracts, ensuring efficiency alongside privacy.

2. Confidential Asset Ownership

With zero-knowledge techniques, individuals can demonstrate ownership of specific tokens or assets—such as NFTs—without disclosing detailed metadata associated with those assets. This preserves confidentiality while confirming possession during exchanges or transfers.

3. Privacy-Preserving Identity Verification

In identity-focused applications like KYC (Know Your Customer), users generate zero-knowledge proofs attesting they meet certain criteria (e.g., age threshold) without sharing personal documents directly with service providers—a process crucial for compliant yet private onboarding procedures.

4. Secure Smart Contracts

Smart contracts integrated with ZKP capabilities verify complex conditions based on encrypted inputs rather than raw data disclosures—enabling functionalities such as confidential voting systems where individual votes remain hidden but overall results are transparent and trustworthy.

5. Decentralized Finance Applications

In DeFi platforms aiming for user anonymity alongside financial integrity, zero-knowledge protocols facilitate anonymous lending/borrowing operations while ensuring collateralization ratios are maintained correctly through verifiable proofs rather than exposed account balances.

Recent Innovations in Zero-Knowledge Technology

The field has seen rapid advancements aimed at improving efficiency and scalability:

SNARKs: These provide highly compact proofs suitable for large-scale deployment due to their small size and fast verification times.

zk-STARKs: An alternative offering transparent setup processes with increased resistance against quantum attacks; zk-STARKs also boast faster proof generation times compared to earlier SNARK implementations.

These innovations have been integrated into major blockchain projects such as Ethereum’s Layer 2 solutions — including zk-rollups — which bundle multiple transactions into a single proof submitted on-chain efficiently reducing costs while preserving privacy.

Industry Adoption & Practical Implementations

Several projects exemplify how zero-knowledge technology enables private credentials:

| Project | Focus Area | Key Features |

|---|---|---|

| Aztec Network | Private Transactions | Enables confidential transfers within Ethereum using zk-SNARKS |

| Tornado Cash | Transaction Privacy | Mixes ETH deposits anonymously via zero knowledge protocols |

| Matter Labs’ zkSync | Scalable Payments & Smart Contracts | Combines scalability with privacy features using zk-rollups |

Ethereum’s ongoing research into integrating ZKP-based solutions aims at making decentralized applications more secure by default regarding user confidentiality.

Challenges Facing Widespread Adoption

Despite promising developments, several hurdles remain before widespread adoption becomes mainstream:

Security Concerns

Implementing robust zero-knowledge protocols requires meticulous design; vulnerabilities could compromise entire systems if not properly validated during development phases.

Scalability Limitations

While recent algorithms improve performance significantly compared to earlier versions, high computational overhead still poses challenges—especially in high-frequency transactional environments requiring real-time processing capabilities.

Regulatory Environment

As regulators scrutinize privacy-enhancing technologies more closely—for instance under anti-money laundering laws—they may impose restrictions impacting how privately transacted assets are used across jurisdictions worldwide.

Future Outlook: Balancing Privacy With Compliance

The evolution of zero-knowledge proof technology suggests an increasingly sophisticated landscape where enhanced user privacy coexists alongside regulatory compliance frameworks designed to prevent misuse such as illicit activities—all within decentralized ecosystems striving for transparency when necessary but respecting individual rights otherwise.

Advances in protocol standardization will likely facilitate interoperability across different blockchains—a critical step toward seamless integration into existing financial infrastructure—and foster broader industry acceptance driven by both technological maturity and regulatory clarity.

By enabling private credentials directly on-chain through advanced cryptography like ZKPs, blockchain platforms unlock new possibilities—from confidential finance operations to secure identity management—all while maintaining decentralization principles rooted in trustless verification methods. As research progresses and implementation barriers diminish over time, expect these tools to become integral components shaping the future landscape of digital asset security and user sovereignty online.

JCUSER-F1IIaxXA

2025-05-09 18:59

How do ZK proofs enable private credentials on-chain?

How Zero-Knowledge Proofs Enable Private Credentials on Blockchain

Blockchain technology has revolutionized the way we think about digital transactions, decentralization, and data security. However, its inherent transparency can pose significant privacy challenges, especially when sensitive information is involved. Zero-Knowledge Proofs (ZKPs) have emerged as a powerful cryptographic tool to address these concerns by enabling private credentials on-chain without compromising security or integrity.

Understanding Zero-Knowledge Proofs

Zero-Knowledge Proofs are cryptographic protocols that allow one party—the prover—to convince another—the verifier—that a specific statement is true without revealing any additional information beyond the validity of that statement. This means users can prove ownership or authenticity without exposing underlying data such as personal details or transaction amounts.

The core properties of ZKPs include:

- Soundness: Ensures that false statements cannot be convincingly proven.

- Completeness: Valid statements can always be proven if they are true.

- Zero-Knowledge: The verifier gains no knowledge about the actual data behind the proof.

These properties make ZKPs particularly suitable for privacy-preserving applications in blockchain environments where transparency often conflicts with confidentiality needs.

The Role of ZKPs in Blockchain Privacy

Traditional blockchain networks like Bitcoin and Ethereum operate transparently; every transaction is publicly recorded and accessible to anyone. While this promotes trustlessness and auditability, it also exposes sensitive user data—such as identities, transaction amounts, or asset holdings—which may not be desirable for all use cases.

Zero-Knowledge Proofs offer a solution by allowing users to perform transactions and demonstrate ownership or compliance with certain rules without revealing their identities or transaction specifics. This capability transforms how privacy is managed on-chain:

- Users can execute private transactions that hide sender details and amounts while still being verifiable.

- Identity verification processes become more secure since proofs confirm attributes (e.g., age over 18) without disclosing personal information.

- Smart contracts can enforce conditions based on private data inputs verified through ZKPs rather than exposing raw data.

This approach enhances user privacy while maintaining the trustless nature of blockchain systems.

How ZKPs Facilitate Private Credentials On-Chain

Private credentials refer to proofs of ownership or rights over assets, identities, or permissions that do not reveal sensitive details during validation. Zero-Knowledge Proofs enable this functionality through several mechanisms:

1. Private Transactions

Using ZKPs like zk-SNARKs (Succinct Non-interactive Arguments of Knowledge), users can submit proof that they possess sufficient funds for a transfer without revealing their account balance or identity. These proofs are succinct enough to be verified quickly within smart contracts, ensuring efficiency alongside privacy.

2. Confidential Asset Ownership

With zero-knowledge techniques, individuals can demonstrate ownership of specific tokens or assets—such as NFTs—without disclosing detailed metadata associated with those assets. This preserves confidentiality while confirming possession during exchanges or transfers.

3. Privacy-Preserving Identity Verification

In identity-focused applications like KYC (Know Your Customer), users generate zero-knowledge proofs attesting they meet certain criteria (e.g., age threshold) without sharing personal documents directly with service providers—a process crucial for compliant yet private onboarding procedures.

4. Secure Smart Contracts

Smart contracts integrated with ZKP capabilities verify complex conditions based on encrypted inputs rather than raw data disclosures—enabling functionalities such as confidential voting systems where individual votes remain hidden but overall results are transparent and trustworthy.

5. Decentralized Finance Applications

In DeFi platforms aiming for user anonymity alongside financial integrity, zero-knowledge protocols facilitate anonymous lending/borrowing operations while ensuring collateralization ratios are maintained correctly through verifiable proofs rather than exposed account balances.

Recent Innovations in Zero-Knowledge Technology

The field has seen rapid advancements aimed at improving efficiency and scalability:

SNARKs: These provide highly compact proofs suitable for large-scale deployment due to their small size and fast verification times.

zk-STARKs: An alternative offering transparent setup processes with increased resistance against quantum attacks; zk-STARKs also boast faster proof generation times compared to earlier SNARK implementations.

These innovations have been integrated into major blockchain projects such as Ethereum’s Layer 2 solutions — including zk-rollups — which bundle multiple transactions into a single proof submitted on-chain efficiently reducing costs while preserving privacy.

Industry Adoption & Practical Implementations

Several projects exemplify how zero-knowledge technology enables private credentials:

| Project | Focus Area | Key Features |

|---|---|---|

| Aztec Network | Private Transactions | Enables confidential transfers within Ethereum using zk-SNARKS |

| Tornado Cash | Transaction Privacy | Mixes ETH deposits anonymously via zero knowledge protocols |

| Matter Labs’ zkSync | Scalable Payments & Smart Contracts | Combines scalability with privacy features using zk-rollups |

Ethereum’s ongoing research into integrating ZKP-based solutions aims at making decentralized applications more secure by default regarding user confidentiality.

Challenges Facing Widespread Adoption

Despite promising developments, several hurdles remain before widespread adoption becomes mainstream:

Security Concerns

Implementing robust zero-knowledge protocols requires meticulous design; vulnerabilities could compromise entire systems if not properly validated during development phases.

Scalability Limitations

While recent algorithms improve performance significantly compared to earlier versions, high computational overhead still poses challenges—especially in high-frequency transactional environments requiring real-time processing capabilities.

Regulatory Environment

As regulators scrutinize privacy-enhancing technologies more closely—for instance under anti-money laundering laws—they may impose restrictions impacting how privately transacted assets are used across jurisdictions worldwide.

Future Outlook: Balancing Privacy With Compliance

The evolution of zero-knowledge proof technology suggests an increasingly sophisticated landscape where enhanced user privacy coexists alongside regulatory compliance frameworks designed to prevent misuse such as illicit activities—all within decentralized ecosystems striving for transparency when necessary but respecting individual rights otherwise.

Advances in protocol standardization will likely facilitate interoperability across different blockchains—a critical step toward seamless integration into existing financial infrastructure—and foster broader industry acceptance driven by both technological maturity and regulatory clarity.

By enabling private credentials directly on-chain through advanced cryptography like ZKPs, blockchain platforms unlock new possibilities—from confidential finance operations to secure identity management—all while maintaining decentralization principles rooted in trustless verification methods. As research progresses and implementation barriers diminish over time, expect these tools to become integral components shaping the future landscape of digital asset security and user sovereignty online.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Does SPV (Simplified Payment Verification) Work in Bitcoin?

Understanding the Basics of SPV in Bitcoin

Simplified Payment Verification (SPV) is a method that allows Bitcoin users to verify transactions without downloading and storing the entire blockchain. This approach is especially beneficial for lightweight clients like mobile wallets, which have limited storage capacity and computational resources. Unlike full nodes that maintain a complete copy of all transaction data, SPV enables users to confirm that their transactions are included in the blockchain efficiently and securely.

At its core, SPV relies on a minimal set of data—specifically, block headers—to verify transaction validity. This design significantly reduces resource requirements while maintaining a reasonable level of security for everyday use. As Bitcoin continues to grow, SPV remains an essential tool for increasing accessibility and scalability within the network.

The Mechanics Behind SPV: How It Verifies Transactions

The process begins with downloading only the block headers rather than entire blocks filled with transaction data. Each block header contains critical information such as:

- The hash of the previous block

- A timestamp

- The Merkle root (a cryptographic summary of all transactions within that block)

- Other metadata like difficulty target and nonce

This compact data structure allows clients to track the blockchain's overall state without handling every individual transaction.

To verify whether a specific transaction has been confirmed on the network, an SPV client requests a proof of inclusion from a full node—an entity that maintains complete blockchain data. This proof includes:

- The transaction ID

- A sequence of hashes forming a path through the Merkle tree from the specific transaction up to its Merkle root

Using this proof, users can perform two key checks:

- Merkle Proof Validation: Confirming that their transaction is part of the Merkle tree by reconstructing hashes along the provided path.

- Block Header Validation: Ensuring that this particular Merkle root matches one present in an accepted block header.

If both checks pass successfully, it indicates with high confidence that their transaction was included in an accepted block on the Bitcoin network.

Why Was SPV Introduced? Its Historical Context

SPV was first introduced by Greg Maxwell in 2011 as part of efforts to make Bitcoin more accessible beyond technical enthusiasts running full nodes. Prior to this innovation, verifying transactions required downloading and validating every piece of blockchain data—a process impractical for devices with limited resources like smartphones or web-based wallets.

The goal was clear: enable lightweight clients to participate securely without demanding extensive hardware capabilities or bandwidth consumption. Since then, SPV has become integral for many wallet implementations worldwide due to its simplicity and efficiency.

Security Considerations When Using SPV

While SPV offers significant advantages regarding resource efficiency and user convenience, it does come with inherent security risks worth understanding:

Susceptibility to Fake Chains: Because lightweight clients rely on external full nodes for proofs but do not independently validate all chain history fully, they could be misled if connected to malicious nodes controlling false information.

51% Attacks: If an attacker gains majority control over mining power (a 51% attack), they could potentially manipulate which blocks are considered valid or produce fraudulent proofs affecting verification accuracy.

Centralization Risks: Heavy reliance on trusted full nodes might inadvertently lead toward centralization tendencies if most users depend on few providers for validation services.

Despite these concerns, various protocol enhancements—such as better proof-of-inclusion methods—and best practices like connecting only trusted nodes help mitigate potential vulnerabilities associated with using SPV-based wallets.

Recent Advances Improving Security & Efficiency

Over recent years, developers have focused on refining how proofs are generated and verified within SPI protocols:

Enhanced Merkle Tree Structures:

- Newer algorithms optimize how hashes are combined into trees.

- These improvements reduce verification time while increasing resistance against manipulation attempts.

Better Proof Generation Methods:

- Techniques such as Compact Block Filters allow faster validation processes.

- They also minimize bandwidth usage during synchronization between peers.

Integration With Layer 2 Solutions

- Technologies like Lightning Network leverage simplified verification methods alongside traditional protocols.

- These integrations aim at scaling Bitcoin further while maintaining security standards suitable for lightweight clients.

Furthermore, ongoing research aims at developing more robust mechanisms against potential attacks targeting light client verification processes—ensuring safer participation even under adversarial conditions.

Key Milestones & Facts About SPV Development

| Year | Event |

|---|---|

| 2011 | Introduction of Simplified Payment Verification by Greg Maxwell |

| 2012 | Inclusion into early versions of Bitcoin Core software |

| 2013 | Identification of vulnerabilities related to fake chain attacks |

| Present | Continuous protocol improvements focusing on security enhancements |

These milestones highlight both foundational development efforts and ongoing innovations aimed at strengthening trustworthiness across different types of wallet implementations utilizing SPI techniques.

How Light Clients Benefit From Using SPI Protocols

Lightweight wallets employing SPI protocols benefit primarily through reduced storage needs—they only store minimal blockchain summaries rather than entire histories—and faster synchronization times compared with full node setups. This makes them ideal choices for mobile devices where hardware limitations restrict traditional node operation capabilities.

Limitations & Future Directions in Blockchain Verification

Despite advancements made over recent years—including improved proof structures—the reliance on external full nodes still introduces some trust assumptions not present when operating fully validating nodes independently; thus emphasizing importance around selecting reputable sources during verification processes.

Looking ahead , ongoing research focuses heavily upon enhancing decentralization aspects by enabling more secure peer-to-peer validation schemes alongside integrating new cryptographic techniques such as zero-knowledge proofs — promising even greater privacy-preserving features combined with scalable verification solutions suited specifically for future decentralized ecosystems.

Final Thoughts

Understanding how Simplified Payment Verification works provides valuable insight into making cryptocurrency networks more accessible without compromising too much security or decentralization principles . As technology evolves—with continuous protocol improvements addressing current vulnerabilities—SPV remains vital within broader efforts toward scalable adoption across diverse user bases worldwide.

JCUSER-IC8sJL1q

2025-05-09 16:37

How does SPV (Simplified Payment Verification) work in Bitcoin?

How Does SPV (Simplified Payment Verification) Work in Bitcoin?

Understanding the Basics of SPV in Bitcoin

Simplified Payment Verification (SPV) is a method that allows Bitcoin users to verify transactions without downloading and storing the entire blockchain. This approach is especially beneficial for lightweight clients like mobile wallets, which have limited storage capacity and computational resources. Unlike full nodes that maintain a complete copy of all transaction data, SPV enables users to confirm that their transactions are included in the blockchain efficiently and securely.

At its core, SPV relies on a minimal set of data—specifically, block headers—to verify transaction validity. This design significantly reduces resource requirements while maintaining a reasonable level of security for everyday use. As Bitcoin continues to grow, SPV remains an essential tool for increasing accessibility and scalability within the network.

The Mechanics Behind SPV: How It Verifies Transactions

The process begins with downloading only the block headers rather than entire blocks filled with transaction data. Each block header contains critical information such as:

- The hash of the previous block

- A timestamp

- The Merkle root (a cryptographic summary of all transactions within that block)

- Other metadata like difficulty target and nonce

This compact data structure allows clients to track the blockchain's overall state without handling every individual transaction.

To verify whether a specific transaction has been confirmed on the network, an SPV client requests a proof of inclusion from a full node—an entity that maintains complete blockchain data. This proof includes:

- The transaction ID

- A sequence of hashes forming a path through the Merkle tree from the specific transaction up to its Merkle root

Using this proof, users can perform two key checks:

- Merkle Proof Validation: Confirming that their transaction is part of the Merkle tree by reconstructing hashes along the provided path.

- Block Header Validation: Ensuring that this particular Merkle root matches one present in an accepted block header.

If both checks pass successfully, it indicates with high confidence that their transaction was included in an accepted block on the Bitcoin network.

Why Was SPV Introduced? Its Historical Context

SPV was first introduced by Greg Maxwell in 2011 as part of efforts to make Bitcoin more accessible beyond technical enthusiasts running full nodes. Prior to this innovation, verifying transactions required downloading and validating every piece of blockchain data—a process impractical for devices with limited resources like smartphones or web-based wallets.

The goal was clear: enable lightweight clients to participate securely without demanding extensive hardware capabilities or bandwidth consumption. Since then, SPV has become integral for many wallet implementations worldwide due to its simplicity and efficiency.

Security Considerations When Using SPV

While SPV offers significant advantages regarding resource efficiency and user convenience, it does come with inherent security risks worth understanding:

Susceptibility to Fake Chains: Because lightweight clients rely on external full nodes for proofs but do not independently validate all chain history fully, they could be misled if connected to malicious nodes controlling false information.

51% Attacks: If an attacker gains majority control over mining power (a 51% attack), they could potentially manipulate which blocks are considered valid or produce fraudulent proofs affecting verification accuracy.

Centralization Risks: Heavy reliance on trusted full nodes might inadvertently lead toward centralization tendencies if most users depend on few providers for validation services.

Despite these concerns, various protocol enhancements—such as better proof-of-inclusion methods—and best practices like connecting only trusted nodes help mitigate potential vulnerabilities associated with using SPV-based wallets.

Recent Advances Improving Security & Efficiency

Over recent years, developers have focused on refining how proofs are generated and verified within SPI protocols:

Enhanced Merkle Tree Structures:

- Newer algorithms optimize how hashes are combined into trees.

- These improvements reduce verification time while increasing resistance against manipulation attempts.

Better Proof Generation Methods:

- Techniques such as Compact Block Filters allow faster validation processes.

- They also minimize bandwidth usage during synchronization between peers.

Integration With Layer 2 Solutions

- Technologies like Lightning Network leverage simplified verification methods alongside traditional protocols.

- These integrations aim at scaling Bitcoin further while maintaining security standards suitable for lightweight clients.

Furthermore, ongoing research aims at developing more robust mechanisms against potential attacks targeting light client verification processes—ensuring safer participation even under adversarial conditions.

Key Milestones & Facts About SPV Development

| Year | Event |

|---|---|

| 2011 | Introduction of Simplified Payment Verification by Greg Maxwell |

| 2012 | Inclusion into early versions of Bitcoin Core software |

| 2013 | Identification of vulnerabilities related to fake chain attacks |

| Present | Continuous protocol improvements focusing on security enhancements |

These milestones highlight both foundational development efforts and ongoing innovations aimed at strengthening trustworthiness across different types of wallet implementations utilizing SPI techniques.

How Light Clients Benefit From Using SPI Protocols

Lightweight wallets employing SPI protocols benefit primarily through reduced storage needs—they only store minimal blockchain summaries rather than entire histories—and faster synchronization times compared with full node setups. This makes them ideal choices for mobile devices where hardware limitations restrict traditional node operation capabilities.

Limitations & Future Directions in Blockchain Verification

Despite advancements made over recent years—including improved proof structures—the reliance on external full nodes still introduces some trust assumptions not present when operating fully validating nodes independently; thus emphasizing importance around selecting reputable sources during verification processes.

Looking ahead , ongoing research focuses heavily upon enhancing decentralization aspects by enabling more secure peer-to-peer validation schemes alongside integrating new cryptographic techniques such as zero-knowledge proofs — promising even greater privacy-preserving features combined with scalable verification solutions suited specifically for future decentralized ecosystems.

Final Thoughts

Understanding how Simplified Payment Verification works provides valuable insight into making cryptocurrency networks more accessible without compromising too much security or decentralization principles . As technology evolves—with continuous protocol improvements addressing current vulnerabilities—SPV remains vital within broader efforts toward scalable adoption across diverse user bases worldwide.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Why is Volume Confirmation Critical for Pattern Validity in Crypto Trading?

In the fast-paced world of cryptocurrency trading, understanding market signals is essential for making informed decisions. Among these signals, chart patterns such as head and shoulders, triangles, or double bottoms are widely used by traders to predict future price movements. However, not all patterns are equally reliable on their own. This is where volume confirmation plays a vital role—adding a layer of validation that can significantly improve the accuracy of pattern-based predictions.

What Is Volume Confirmation in Cryptocurrency Trading?

Volume confirmation involves analyzing trading volume alongside price movements to verify the legitimacy of technical patterns. When a pattern forms on a chart—say, an ascending triangle—the accompanying trading volume provides insight into whether this pattern reflects genuine market interest or if it’s potentially misleading. High trading volume during the formation or breakout of a pattern suggests strong participation and conviction among traders, increasing confidence that the trend will continue in the predicted direction.

Conversely, low volume may indicate lack of interest or even manipulation—such as wash trading or fakeouts—that can produce false signals. Therefore, integrating volume data helps traders distinguish between authentic trends and deceptive moves driven by short-term speculation or market manipulation.

The Role of Volume Confirmation in Technical Analysis

Technical analysis relies heavily on identifying consistent patterns within historical price data to forecast future movements. However, without considering trade activity levels (volume), these patterns can sometimes be unreliable indicators due to false breakouts or reversals.

Volume acts as an additional filter: when combined with chart formations like flags or pennants, it confirms whether buyers and sellers genuinely support the move. For example:

- Bullish Signals: A breakout from resistance accompanied by high volume indicates strong buying interest.

- Bearish Signals: A breakdown below support with increased selling activity suggests genuine downward momentum.

This synergy between price action and trade activity enhances decision-making accuracy and reduces exposure to false positives—a common pitfall in crypto markets characterized by rapid swings and speculative behavior.

Key Benefits of Using Volume Confirmation

1. Validating Market Sentiment

High volumes during upward moves reflect robust buying pressure; similarly, elevated selling volumes during declines signal strong bearish sentiment. Recognizing these cues helps traders gauge overall market mood more precisely than relying solely on price charts.

2. Improving Pattern Reliability

Patterns confirmed with significant trade volumes tend to be more trustworthy than those formed on thin liquidity conditions. For instance:

- An ascending triangle with rising volume before breakout indicates genuine accumulation.

- Conversely, if breakout occurs on low volume amid sideways movement, caution is warranted as it might be a false signal.

3. Enhancing Risk Management Strategies

By observing how volumes behave around key levels (support/resistance), traders can better assess entry points and set stop-loss orders accordingly—reducing potential losses from sudden reversals caused by manipulated trades or fakeouts prevalent in unregulated crypto markets.

4. Detecting Market Manipulation

Large players (whales) often attempt to manipulate prices through coordinated trades that generate artificial spikes in volume without real underlying demand—a tactic known as "pump-and-dump." Recognizing discrepancies between price action and abnormal surges in traded volumes allows experienced traders to avoid falling victim to such schemes.

Recent Trends Impacting Volume Confirmation Practices

The last few years have seen notable developments affecting how traders utilize volume confirmation:

Market Volatility: The rise of DeFi projects and NFTs has increased overall trading activity but also introduced higher volatility levels—making careful analysis crucial.

Regulatory Changes: Authorities like the U.S SEC have issued guidelines impacting transparency standards across exchanges; this influences how accurately traded volumes reflect true market interest.

Technological Advancements: Modern platforms now offer real-time analytics powered by AI algorithms capable of detecting suspicious activities related to abnormal trade volumes.

Community Insights: Social media buzz often correlates with spikes in trading activity; monitoring community sentiment alongside technical signals adds depth for validating patterns through social listening tools integrated into many platforms today.

Risks Associated With Relying Solely on Volume Data

While incorporating volume confirmation improves prediction reliability significantly, over-reliance carries risks:

False Signals Due To Manipulation: Large-volume trades orchestrated by whales can create misleading impressions about true supply/demand dynamics.

Market Noise During High Volatility Periods: Rapid swings may distort typical relationships between price movement and traded volumes.

Limited Contextual Information: Sole focus on one indicator ignores other critical factors like macroeconomic news events influencing trader behavior globally.

To mitigate these risks effectively:

- Use multiple indicators (e.g., RSI , Bollinger Bands) alongside volume data

- Confirm signals across different timeframes

- Stay updated about regulatory changes affecting exchange transparency

Educational resources—including webinars & courses—are increasingly available for traders seeking mastery over combining various analytical tools responsibly.

How Traders Can Effectively Use Volume Confirmation Today

For optimal results:

Look for confluence — situations where multiple indicators align—for example:

- Price breaking resistance with increasing high-volume candles

- Divergence where declining prices occur despite rising volumes indicating potential exhaustion

Pay attention during volatile periods: heightened caution ensures you don’t misinterpret fakeouts caused by manipulative tactics

3.. Incorporate community insights: social media trends often precede large moves; combining this qualitative data with quantitative analysis enhances decision-making

4.. Regularly review recent market trends: understanding broader shifts helps contextualize individual pattern validity

In summary, integrating volume confirmation into your crypto trading strategy isn’t just advisable—it’s essential for validating chart patterns' authenticity amidst unpredictable markets filled with noise & manipulation risks . By paying close attention not only to what prices are doing but also how actively they’re being traded at each step along the way , you position yourself better against false signals while gaining deeper insights into genuine shifts within dynamic digital asset markets .

Lo

2025-05-09 06:20

Why is volume confirmation critical for pattern validity?

Why is Volume Confirmation Critical for Pattern Validity in Crypto Trading?

In the fast-paced world of cryptocurrency trading, understanding market signals is essential for making informed decisions. Among these signals, chart patterns such as head and shoulders, triangles, or double bottoms are widely used by traders to predict future price movements. However, not all patterns are equally reliable on their own. This is where volume confirmation plays a vital role—adding a layer of validation that can significantly improve the accuracy of pattern-based predictions.

What Is Volume Confirmation in Cryptocurrency Trading?

Volume confirmation involves analyzing trading volume alongside price movements to verify the legitimacy of technical patterns. When a pattern forms on a chart—say, an ascending triangle—the accompanying trading volume provides insight into whether this pattern reflects genuine market interest or if it’s potentially misleading. High trading volume during the formation or breakout of a pattern suggests strong participation and conviction among traders, increasing confidence that the trend will continue in the predicted direction.

Conversely, low volume may indicate lack of interest or even manipulation—such as wash trading or fakeouts—that can produce false signals. Therefore, integrating volume data helps traders distinguish between authentic trends and deceptive moves driven by short-term speculation or market manipulation.

The Role of Volume Confirmation in Technical Analysis

Technical analysis relies heavily on identifying consistent patterns within historical price data to forecast future movements. However, without considering trade activity levels (volume), these patterns can sometimes be unreliable indicators due to false breakouts or reversals.

Volume acts as an additional filter: when combined with chart formations like flags or pennants, it confirms whether buyers and sellers genuinely support the move. For example:

- Bullish Signals: A breakout from resistance accompanied by high volume indicates strong buying interest.

- Bearish Signals: A breakdown below support with increased selling activity suggests genuine downward momentum.

This synergy between price action and trade activity enhances decision-making accuracy and reduces exposure to false positives—a common pitfall in crypto markets characterized by rapid swings and speculative behavior.

Key Benefits of Using Volume Confirmation

1. Validating Market Sentiment

High volumes during upward moves reflect robust buying pressure; similarly, elevated selling volumes during declines signal strong bearish sentiment. Recognizing these cues helps traders gauge overall market mood more precisely than relying solely on price charts.

2. Improving Pattern Reliability

Patterns confirmed with significant trade volumes tend to be more trustworthy than those formed on thin liquidity conditions. For instance:

- An ascending triangle with rising volume before breakout indicates genuine accumulation.

- Conversely, if breakout occurs on low volume amid sideways movement, caution is warranted as it might be a false signal.

3. Enhancing Risk Management Strategies

By observing how volumes behave around key levels (support/resistance), traders can better assess entry points and set stop-loss orders accordingly—reducing potential losses from sudden reversals caused by manipulated trades or fakeouts prevalent in unregulated crypto markets.

4. Detecting Market Manipulation

Large players (whales) often attempt to manipulate prices through coordinated trades that generate artificial spikes in volume without real underlying demand—a tactic known as "pump-and-dump." Recognizing discrepancies between price action and abnormal surges in traded volumes allows experienced traders to avoid falling victim to such schemes.

Recent Trends Impacting Volume Confirmation Practices

The last few years have seen notable developments affecting how traders utilize volume confirmation:

Market Volatility: The rise of DeFi projects and NFTs has increased overall trading activity but also introduced higher volatility levels—making careful analysis crucial.

Regulatory Changes: Authorities like the U.S SEC have issued guidelines impacting transparency standards across exchanges; this influences how accurately traded volumes reflect true market interest.

Technological Advancements: Modern platforms now offer real-time analytics powered by AI algorithms capable of detecting suspicious activities related to abnormal trade volumes.

Community Insights: Social media buzz often correlates with spikes in trading activity; monitoring community sentiment alongside technical signals adds depth for validating patterns through social listening tools integrated into many platforms today.

Risks Associated With Relying Solely on Volume Data

While incorporating volume confirmation improves prediction reliability significantly, over-reliance carries risks:

False Signals Due To Manipulation: Large-volume trades orchestrated by whales can create misleading impressions about true supply/demand dynamics.

Market Noise During High Volatility Periods: Rapid swings may distort typical relationships between price movement and traded volumes.

Limited Contextual Information: Sole focus on one indicator ignores other critical factors like macroeconomic news events influencing trader behavior globally.

To mitigate these risks effectively:

- Use multiple indicators (e.g., RSI , Bollinger Bands) alongside volume data

- Confirm signals across different timeframes

- Stay updated about regulatory changes affecting exchange transparency

Educational resources—including webinars & courses—are increasingly available for traders seeking mastery over combining various analytical tools responsibly.

How Traders Can Effectively Use Volume Confirmation Today

For optimal results:

Look for confluence — situations where multiple indicators align—for example:

- Price breaking resistance with increasing high-volume candles

- Divergence where declining prices occur despite rising volumes indicating potential exhaustion

Pay attention during volatile periods: heightened caution ensures you don’t misinterpret fakeouts caused by manipulative tactics

3.. Incorporate community insights: social media trends often precede large moves; combining this qualitative data with quantitative analysis enhances decision-making

4.. Regularly review recent market trends: understanding broader shifts helps contextualize individual pattern validity

In summary, integrating volume confirmation into your crypto trading strategy isn’t just advisable—it’s essential for validating chart patterns' authenticity amidst unpredictable markets filled with noise & manipulation risks . By paying close attention not only to what prices are doing but also how actively they’re being traded at each step along the way , you position yourself better against false signals while gaining deeper insights into genuine shifts within dynamic digital asset markets .

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 Announcement on Abnormal Application Data of Mini IPO AJE Project

Due to the abnormal application data of the AJE project in the Mini IPO section, we have received feedback from multiple community users that the AJE project application has been unable to complete the withdrawal operation for several consecutive days. The platform attaches great importance to the safety of user assets, has initiated a risk control mechanism, suspended trading at the request of the project party, verified the situation with the AJE team, and assisted the project team in completing the data verification work.

👉 Details: https://support.jucoin.blog/hc/en-001/articles/49548798192025?utm_campaign=relisting_AJE&utm_source=twitter&utm_medium=post

JuCoin Official

2025-08-06 08:12

🚨 Announcement on Abnormal Application Data of Mini IPO AJE Project

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔹Trading Time: August 6, 2025, 07:00 (UTC)

🪧More: https://bit.ly/45k4icb

JuCoin Community

2025-08-06 05:14

JuCoin to List PROVE/USDT Trading Pair on August 6, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

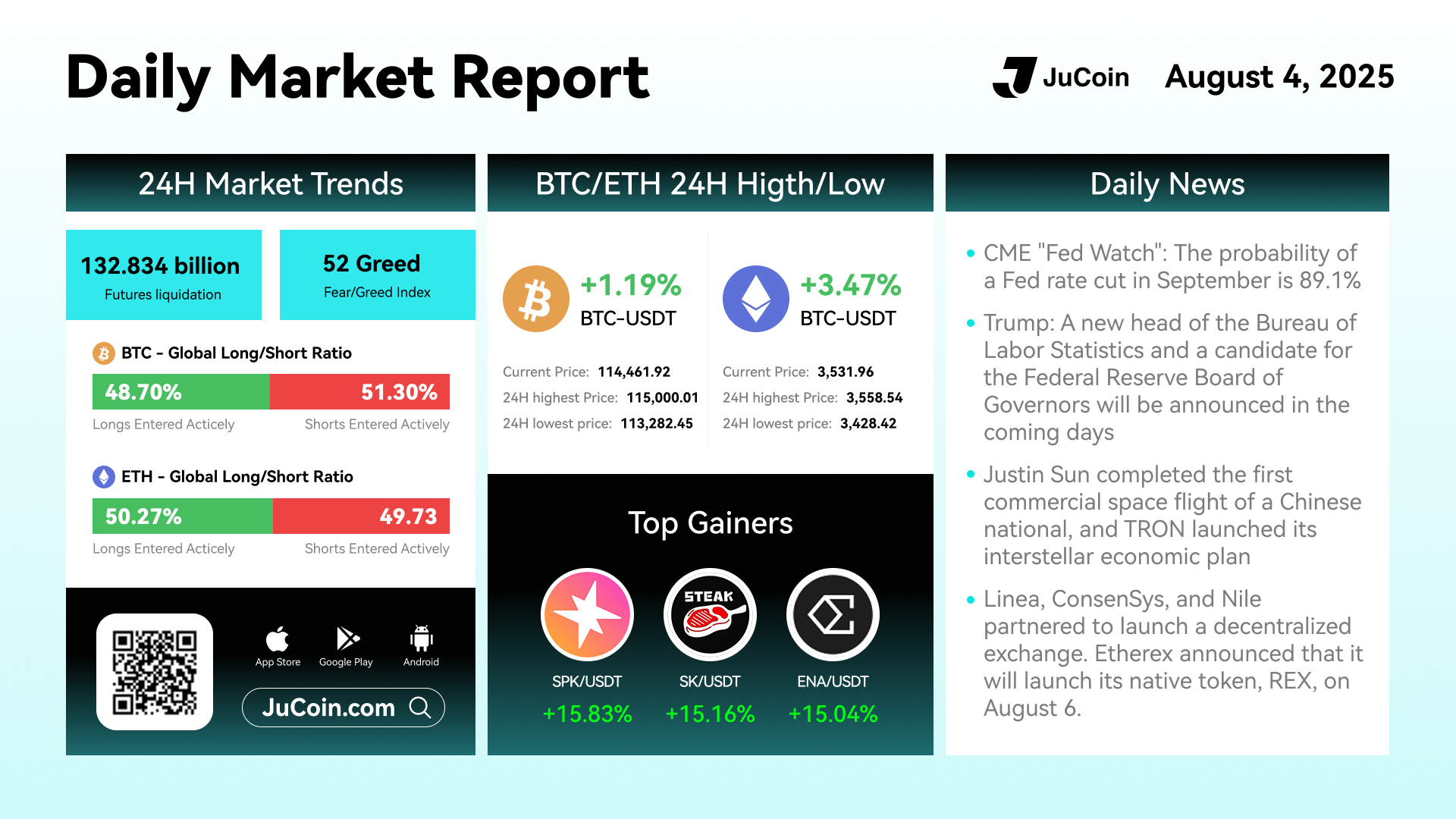

📅 August 4 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-04 04:34

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

From 16:06 to 16:09 (UTC+8) on August 1, ETHUSDT futures experienced a price spike, resulting in approximately $2.87M in abnormal profits for some users and $7.3M in abnormal losses for others.

💪🏻To fully protect the interests of all platform users, we have decided:

✅Full release of abnormal profits: Users who profited during the incident will not be subject to clawbacks, with a total of approximately 2.87million USDT being distributed.

✅Full compensation for abnormal losses: Users who incurred losses during the incident will be fully compensated by the platform, including those in unrealized loss positions. The total compensation amounts to approximately 7.3 million USDT.

👌JuCoin will bear a total compensation exceeding $10 million USDT for this incident. All compensations will be completed by 24:00 (UTC+8) on August 8.

We will continue to optimize system stability to ensure every user receives the protection they deserve, even in extreme market conditions.

👉More: https://bit.ly/46E2woC

JuCoin Community

2025-08-01 16:58

🚨Statement on August 1, 2025 Futures System Anomaly and Compensation Decision

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Decentralized Physical Infrastructure Networks (DePINs) are revolutionizing how we build and operate real-world infrastructure by leveraging blockchain technology and community participation. With a market cap exceeding $50 billion in 2025, DePINs are poised for explosive growth!

💰 What Are DePINs:

- Blockchain-based networks for physical infrastructure (Wi-Fi, storage, energy)

- Community-owned and operated systems with crypto token rewards

- Distributed control eliminating single points of failure

- $5 trillion addressable market with $3.5 trillion potential by 2028

🎯 Key Advantages:

1️⃣ Cost Efficiency: Drastically reduce CapEx through distributed contributions

2️⃣ Enhanced Security: No single points of failure with encrypted, distributed data

3️⃣ Community Ownership: Token incentives align user and provider interests

4️⃣ Permissionless Scaling: Rapid deployment across jurisdictions without regulatory hurdles

🏆 Real-World Applications:

- Wireless Networks: Helium's community-owned 5G/IoT coverage

- Decentralized Storage: Filecoin's peer-to-peer cloud alternatives

- Energy Grids: Community microgrids with renewable energy trading

- AI Computing: Decentralized GPU marketplaces for AI training

- Mapping Services: Crowdsourced spatial data from smart devices

💡 How It Works:

- Deploy hardware (hotspots, storage devices, sensors)

- Contribute resources to the network

- Smart contracts verify contributions automatically

- Earn native tokens for participation

- Participate in decentralized governance decisions

🚨 2025 Growth Drivers:

- Mainstream enterprise adoption beyond supply-side expansion

- Deep integration with AI and IoT ecosystems

- Advanced cross-chain interoperability (Solana, Ethereum, IoTeX)

- Refined multi-token economic models

- Improving regulatory clarity worldwide

- ESG focus with carbon credit integration

⚠️ Key Challenges:

- Scalability and network efficiency at scale

- Data quality verification from distributed devices

- Regulatory uncertainty across jurisdictions

- User adoption complexity for non-technical users

- Hardware deployment costs and sustainable tokenomics

With over 1,500 DePIN projects globally and massive market potential, DePINs represent the paradigm shift towards community-owned, transparent, and resilient infrastructure that will power the decentralized future.

👇 Read the complete analysis with detailed use cases and future projections:

https://blog.jucoin.com/explore-depin-protocols-and-their-potential/

#DePIN #DecentralizedInfrastructure #Blockchain #Web3 #AI #IoT #Helium #Filecoin #Crypto #Infrastructure #Community #Decentralization #SmartContracts #TokenEconomy #JuCoin #5G #Storage #Energy #Computing #ESG

JU Blog

2025-07-31 10:22

🚀 DePIN Protocols: The $3.5 Trillion Infrastructure Revolution is Here!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

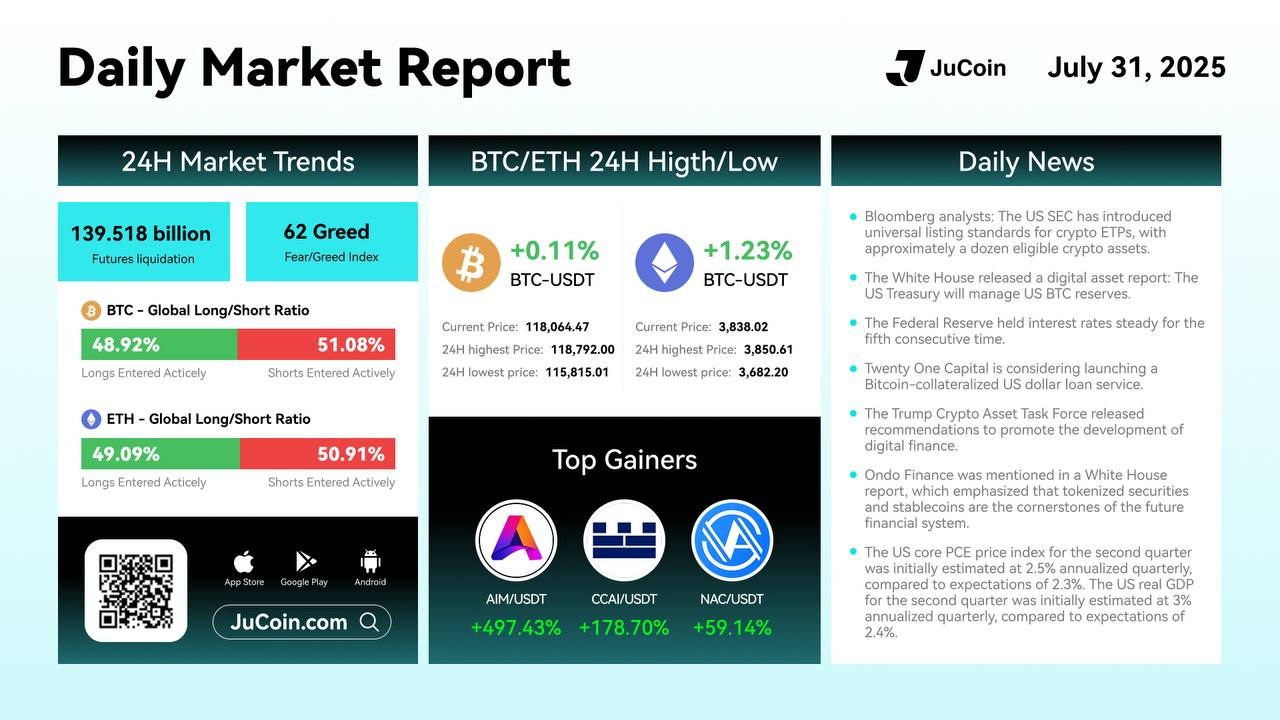

📅 July 31 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-07-31 06:30

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👉 Trade Now: https://bit.ly/4eDheON

JuCoin Community

2025-07-31 06:28

$JU successfully reached 12 USDT, setting a new record high! The price rose 120x since its listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Do Credit Spreads Compare to Other Investment Strategies?

Understanding the role of credit spreads in investment decision-making is essential for investors seeking to optimize their portfolios. While credit spreads are a key indicator within fixed-income markets, they are often compared with other strategies such as equity investing, diversification techniques, and alternative assets. This article explores how credit spread-based strategies stack up against other approaches, providing clarity on their advantages and limitations.

What Are Credit Spread Strategies?

Credit spread strategies involve analyzing the difference in yields between bonds of similar credit quality but different maturities or risk profiles. Investors leverage this information to identify opportunities for higher returns or risk mitigation. For example, buying high-yield bonds when spreads are wide can offer attractive income potential if market conditions improve. Conversely, narrowing spreads might signal a safer environment suitable for more conservative investments.

These strategies are rooted in market sentiment and economic outlooks; widening spreads often indicate increased default risk or economic downturns, while narrowing spreads suggest confidence and stability. As such, credit spread analysis provides real-time insights into market health that can inform tactical investment decisions.

Comparing Credit Spreads with Equity Investment Strategies

Equity investing focuses on purchasing shares of companies with growth potential or dividend income. Unlike fixed-income securities where returns depend largely on interest rates and credit risk perceptions (reflected through credit spreads), equities are driven by company performance, earnings growth, and broader economic factors.

While both approaches aim for capital appreciation or income generation:

- Risk Profile: Equities tend to be more volatile than bonds; however, they also offer higher return potential over the long term.

- Market Sensitivity: Equity prices react sharply to corporate news and macroeconomic shifts; bond markets respond primarily through changes in interest rates and credit conditions.

- Diversification Benefits: Combining equities with fixed-income instruments like bonds can reduce overall portfolio volatility—credit spreads help gauge when bond markets may be more attractive relative to stocks.

In essence, while equity strategies focus on company fundamentals and growth prospects, credit spread-based bond strategies provide insight into macroeconomic risks that influence debt markets.

How Do Credit Spread Strategies Compare With Diversification Techniques?

Diversification is a fundamental principle across all investment styles—spreading investments across asset classes reduces exposure to any single source of risk. Using credit spreads as part of a diversification strategy involves adjusting bond holdings based on perceived risks indicated by spread movements.

For example:

- When credit spreads widen significantly due to economic uncertainty or rising default fears, an investor might reduce exposure to high-yield bonds.

- Conversely, narrowing spreads could signal an opportunity to increase allocations toward corporate debt for better yield prospects without taking excessive additional risk.

Compared with broad diversification across stocks and commodities alone,

- Credit Spread Analysis Offers Tactical Edge: It allows investors to fine-tune their fixed-income allocations based on current market signals.

- Limitations: Relying solely on spread movements without considering other factors like macroeconomic data may lead to misjudgments during volatile periods when signals become noisy.

Thus, integrating credit spread analysis enhances traditional diversification by adding a layer of tactical insight specific to bond markets' dynamics.

Comparing Credit Spreads With Alternative Asset Classes

Alternative investments include real estate (REITs), commodities (gold), hedge funds, private equity—and increasingly cryptocurrencies. These assets often serve as hedges against inflation or sources of uncorrelated returns but come with distinct risks compared to traditional bonds influenced by credit spreads.

For instance:

- Cryptocurrencies have shown high volatility unrelated directly to traditional financial indicators like interest rates or default risks reflected in bond yields.

- Real estate investments tend not directly tied but can be affected indirectly through broader economic conditions impacting borrowing costs signaled via widening or narrowing credits spreds.

Investors comparing these options should consider:

- The liquidity profile

- Risk-return characteristics

- Correlation patterns during different economic cycles

While alternative assets diversify away from fixed-income risks indicated by changing credits spreds—they do not replace the predictive power that analyzing these spreds offers regarding macroeconomic health.

Strengths & Limitations of Using Credit Spreads Compared To Other Strategies

Credit-spread-based investing provides valuable insights into market sentiment about default risk which is crucial during periods of economic stress—such as recessions—or rapid rate hikes by central banks[1]. Its strength lies in its abilityto act as an early warning system for deteriorating financial conditions before they fully materialize in stock prices or GDP figures[2].

However,

Strengths:

– Provides timely signals about systemic risks– Enhances tactical asset allocation decisions– Helps identify undervalued debt securities during turbulent times

Limitations:

– Can be misleading if used without considering macroeconomic context– Sensitive to liquidity shocks affecting bond markets disproportionately– Not always predictive during unprecedented events like pandemics

Compared with passive buy-and-hold equity approaches—which rely heavily on long-term fundamentals—credit-spread trading demands active management skills but offers potentially higher short-term gains if executed correctly.

Integrating Multiple Approaches for Better Portfolio Management

The most effective investment portfolios typically combine multiple strategies tailored accordingto individual goalsandrisk tolerance.[3] Incorporating insights fromcreditspread analysis alongside equity valuation modelsand diversifications techniques creates a balanced approach capableof navigating varyingmarket environments effectively.[4]

For example,

- Usecreditspread trendsas partof your macroeconomic outlook assessment,

- Combine thiswith fundamental analysisof individual stocks,

- Maintain diversified holdingsacross asset classes including equities,reits,and commodities,

- Adjust allocations dynamically basedon evolving signalsfrom all sources,

This integrated approach leverages each strategy's strengths while mitigating weaknesses inherentin any single method.

Final Thoughts: Choosing Between Different Investment Approaches

When evaluating whether tousecredit-spread-basedstrategies versus others,it’s importantto consider yourinvestment horizon,timeframe,andrisk appetite.[5] Fixed-income tactics centered around monitoringcreditspreds excel at capturing short-to-medium-term shiftsin market sentimentanddefault expectations,but may underperformduring prolonged bull runsor whenmacro indicators diverge frombond-market signals.[6]

Meanwhile,equity-focusedinvestmentsoffergrowthpotentialbutcomewithhighervolatilityand longer recovery periodsafter downturns.[7] Diversification remains key—blending multiple methods ensures resilienceagainst unpredictablemarket shockswhile aligningwith personalfinancial goals.[8]

By understanding how each approach compares—and recognizingthe unique advantagesofferedbycredit-spread analysis—youcan crafta well-informedstrategy suitedtothe currentmarket landscape.

References

[1] Smith J., "The Role Of Credit Spreads In Economic Forecasting," Journal Of Financial Markets 2022

[2] Lee A., "Market Sentiment Indicators And Their Predictive Power," Financial Analysts Journal 2023

[3] Brown P., "Portfolio Diversification Techniques," Investopedia 2020

[4] Johnson M., "Combining Asset Allocation Models," CFA Institute Publications 2021

[5] Davis R., "Investment Time Horizons And Strategy Selection," Harvard Business Review 2019

[6] Patel S., "Risks Of Fixed Income Investing During Economic Cycles," Bloomberg Markets 2020

[7] Nguyen T., "Equity vs Bond Investing During Market Volatility," Wall Street Journal 2021

[8] Carter L., "Building Resilient Portfolios Through Multi-Asset Strategies," Financial Times 2022

Lo

2025-06-09 22:25

How do credit spreads compare to other investment strategies?

How Do Credit Spreads Compare to Other Investment Strategies?

Understanding the role of credit spreads in investment decision-making is essential for investors seeking to optimize their portfolios. While credit spreads are a key indicator within fixed-income markets, they are often compared with other strategies such as equity investing, diversification techniques, and alternative assets. This article explores how credit spread-based strategies stack up against other approaches, providing clarity on their advantages and limitations.

What Are Credit Spread Strategies?

Credit spread strategies involve analyzing the difference in yields between bonds of similar credit quality but different maturities or risk profiles. Investors leverage this information to identify opportunities for higher returns or risk mitigation. For example, buying high-yield bonds when spreads are wide can offer attractive income potential if market conditions improve. Conversely, narrowing spreads might signal a safer environment suitable for more conservative investments.