Bitcoin Price Predictions 2025: Navigating the Bull Market

🚀 Latest Bitcoin Price Predictions: Bull Run to Continue in 2025!

With Bitcoin currently trading around $113,762, experts are overwhelmingly bullish on BTC's future prospects. Here's what the latest analysis reveals about Bitcoin's price trajectory:

💰 2025 Price Targets:

-

Conservative estimates: $120,000 - $135,000

Bullish predictions: $150,000 - $175,000

Ultra-bullish: Up to $230,000 (Digital Coin Price)

Cathie Wood (Ark Invest): Path to $1 million within 5 years

📈 Key Price Predictions by Year:

-

2025: Average $125,027 (range: $84,643 - $181,064)

2026: Average $111,187 (range: $95,241 - $150,000)

2030: Average $266,129 (range: $198,574 - $500,000)

Long-term: Some analysts predict $900K+ by 2030

🎯 What's Driving the Bullish Outlook:

-

Post-halving momentum (April 2024 halving reducing supply)

Massive institutional adoption via Bitcoin ETFs

Growing acceptance as digital gold and inflation hedge

Potential Federal Reserve rate cuts boosting risk assets

Strong political support and clearer regulations

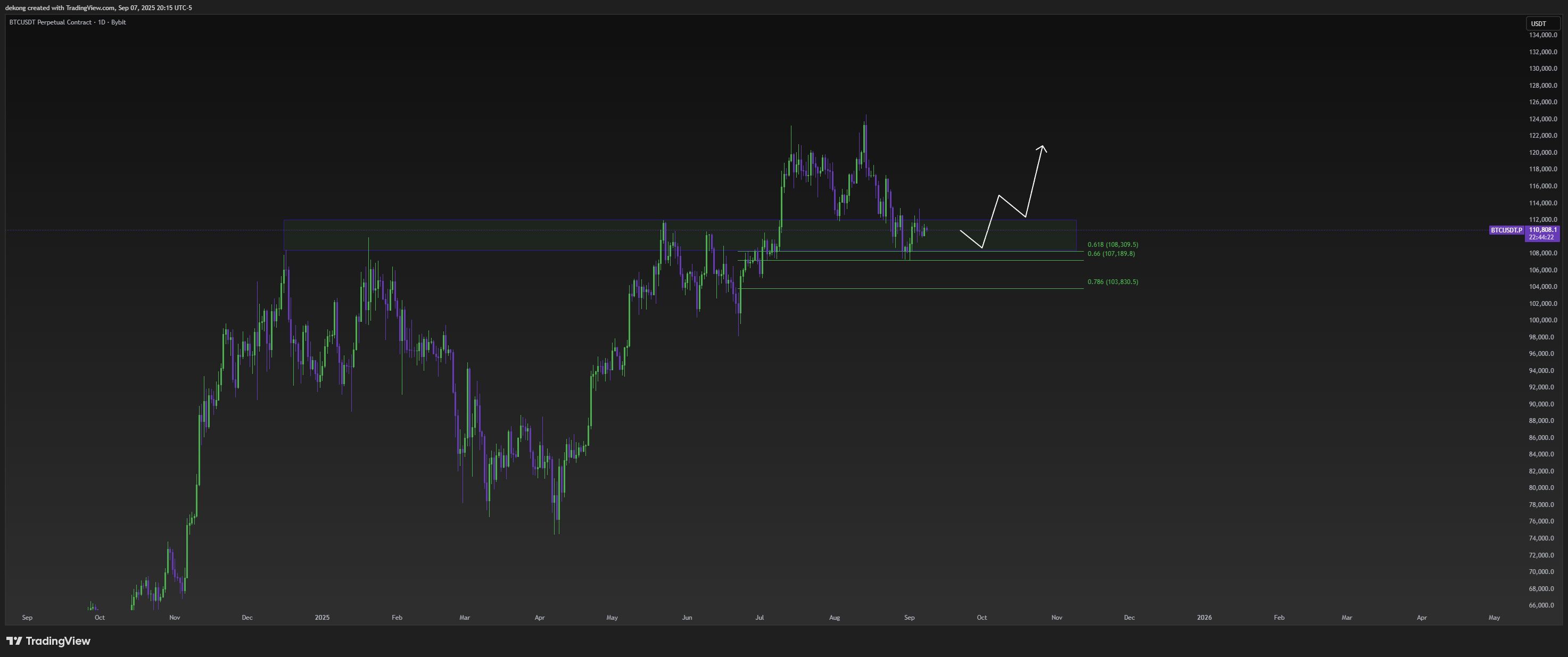

📊 Technical Analysis Insights:

-

200-day moving average trending upward since January 2025

Current RSI in neutral zone (30-70), indicating room for growth

Fear & Greed Index at 50 (neutral), historically preceding rebounds

14/30 green days in the last month showing resilience

⚡ Key Catalysts to Watch:

-

Bitcoin ETF approvals at major wirehouses (Q3-Q4 2025)

Institutional "basis trade" adoption accelerating

Potential shift from retail to institutional investor flows

Macroeconomic stability supporting risk-on sentiment

🔮 Expert Highlights:

-

Bernstein: Revised target from $150K to $200K by end-2025

PlanB: Stock-to-flow model suggests $1M possible by 2025

Bloomberg: Conservative $100K target based on historical cycles

Chamath Palihapitiya: $500K by October 2025

⚠️ Risk Factors:

-

High volatility remains (1.78% daily price swings)

Regulatory uncertainties in various jurisdictions

Competition from other cryptocurrencies

Macroeconomic headwinds and geopolitical tensions

Bottom Line: Despite short-term volatility, the consensus among analysts points to continued Bitcoin appreciation driven by institutional adoption, post-halving dynamics, and its growing role as a digital store of value. The next 12-18 months could be pivotal for BTC reaching new all-time highs.

Current market conditions suggest this could be an opportune time for long-term investors, though as always, conduct your own research and invest responsibly.

Read more detailed analysis and expert insights: 👇 https://blog.jucoin.com/what-are-the-latest-bitcoin-price-predictions/?utm_source=blog

#Bitcoin #BTC

JU Blog

2025-08-22 11:03

Bitcoin Price Predictions 2025: Navigating the Bull Market

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.