Grayscale launched the Story Trust on July 31, 2025, providing qualified investors daily access to Story protocol's native token $IP. Story aims to build an $80 trillion global IP economy infrastructure by minting music, media, and real-world data into programmable, traceable on-chain assets.

💰 What's New:

-

Daily subscription windows for Rule 501(a) accredited investors

2% annual management fee, no redemption fees

Closed-end trust structure with 1:1 share-to-asset backing

Over 1.7M IP transactions and 200K+ monthly active users on Story blockchain

🎯 Trust Structure: 1️⃣ Single-asset trust dedicated to $IP holdings 2️⃣ NAV-based share pricing for fair issuance 3️⃣ No private key custody required for investors 4️⃣ Regulated under U.S. securities laws for compliance

🏆 Key Features:

-

Accredited Investors Only: HNW individuals, licensed professionals, and $5M+ entities

Management Fee: 2% annually covering operations, auditing, and compliance

Liquidity: No redemption service - long-term holding expected

Secondary Markets: Pursuing OTC listing and SEC approval

⚠️ Risk Considerations:

-

Premium/discount volatility without redemption options

Potential illiquidity until secondary market approval

Story protocol execution risks as early-stage project

No guaranteed secondary market listing

🔮 Future Outlook: Story protocol expanding into art, media rights, AI data licensing, and digital likeness management. As ecosystem grows with increased transaction volume and innovation, underlying $IP value may appreciate, providing stable long-term exposure for institutional portfolios.

💡 Quick FAQ:

-

Who can invest? Rule 501(a) accredited investors only

When can shares trade? Awaiting OTC listing and SEC approval

Use cases? Music/media rights, AI training data, digital assets management

Fee structure? 2% annual management fee, competitive vs OTC alternatives

Institutional investors are already planning to add $IP exposure to their digital asset portfolios through this compliant trust structure!

Read the complete in-depth analysis with risk mitigation strategies: 👇

https://blog.jucoin.com/grayscale-story-trust-analysis/?utm_source=blog

#Grayscale #StoryTrust #IP #IntellectualProperty #AccreditedInvestors #DigitalAssets #Blockchain #Compliance #InstitutionalCrypto #JuCoin #NAV #SEC #OTC #Web3 #TokenTrust

JU Blog

2025-08-01 08:47

🚀 Grayscale Story Trust is LIVE - Daily $IP Subscriptions Now Open!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

GAIA has launched its decentralized AI infrastructure that lets anyone create, deploy, and monetize personalized AI Agents through globally distributed nodes. Here's your complete overview:

💡 What is GAIA:

-

Decentralized compute infrastructure for AI Agent deployment

OpenAI-compatible APIs with custom LLM integration

Distributed node network with on-chain governance

WasmEdge runtime for high-performance local inference

🛠️ Core Technologies:

-

WasmEdge Runtime: Lightweight, secure inference on CPU/GPU/AI accelerators

Open-Source LLM Integration: Support for Llama 3, DeepSeek, and custom knowledge bases

Distributed Node Network: Stake-to-earn model with SLA monitoring

OpenAI API Compatibility: Drop-in replacement for existing applications

💰 Tokenomics (1B Total Supply, 170M Circulating):

-

Node Staking & Service Reservation (50%): Stake GAIA for inference rights and rewards

API Call Payments (30%): Pay-per-inference model

Ecosystem Fund (15%): Community development and partnerships

DAO Governance (5%): Protocol governance and voting rights

🚀 Major Milestones:

-

✅ Mainnet officially launched

✅ Mira Trust Layer integration for verifiable AI inference

✅ Partnership with Chainlink and The Graph

✅ Open-source SDK and documentation available

✅ 20+ countries in developer community

🎯 2025 Roadmap:

-

Domain-as-node scheme (tradable subdomains for each Agent)

Cross-chain bridges for Ethereum, Polygon, Avalanche

Zero-knowledge proofs for sensitive data protection

1,000-node network deployment by end-2025

📈 Getting Started: 1️⃣ Download WasmEdge node image 2️⃣ Configure your LLM model and knowledge base 3️⃣ Stake GAIA tokens to register as node operator 4️⃣ Start earning rewards from AI inference services

💎 Where to Buy:

-

PancakeSwap V3 (BSC)

Uniswap V3 (Ethereum)

Initial airdrops available

With the mainnet live and strategic partnerships in place, GAIA is positioning itself as the backbone infrastructure for Web3 AI applications.

Read the complete technical analysis: 👇

https://blog.jucoin.com/gaia-decentralized-ai-inference/

#GAIA #DecentralizedAI #Web3 #AIAgents #Blockchain #LLM #WasmEdge #DeFi #Staking #OpenAI #JuCoin #Mainnet #CrossChain #ZeroKnowledge #NodeOperator

JU Blog

2025-07-31 13:24

🤖 GAIA: The Web3 AI Agent Operating System is LIVE!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

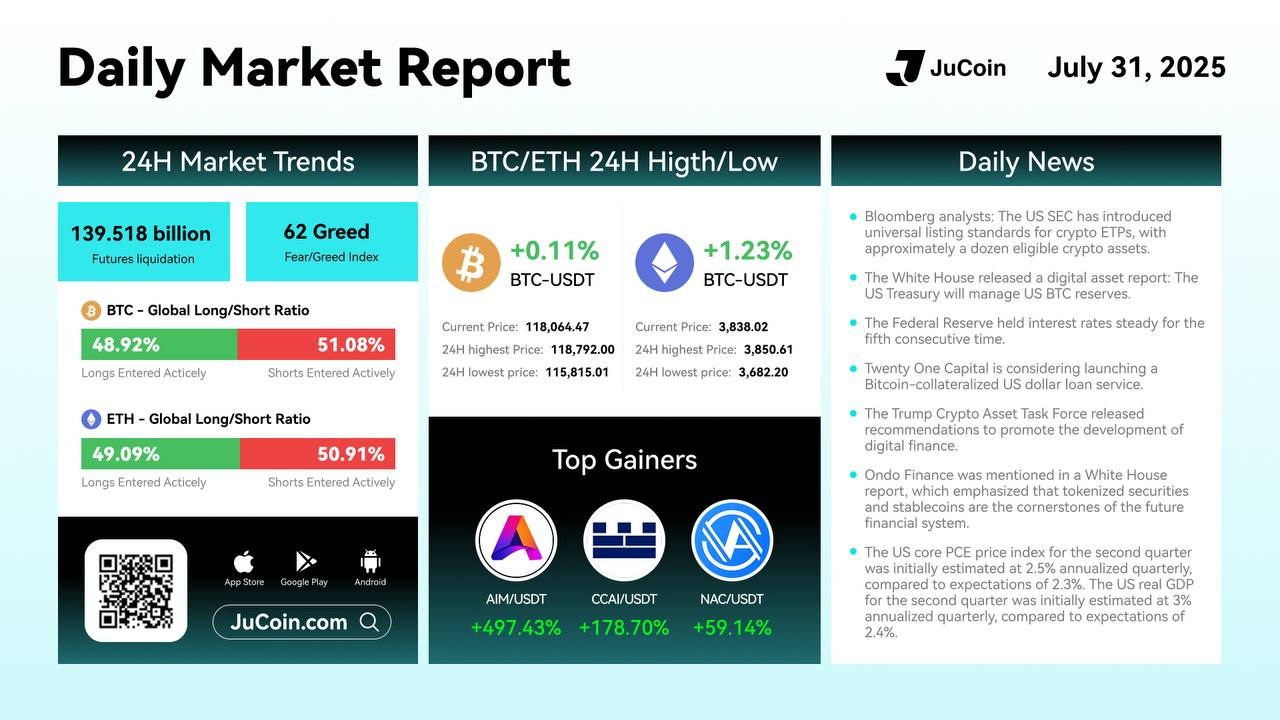

📅 July 31 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-07-31 06:30

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👉 Trade Now: https://bit.ly/4eDheON

JuCoin Community

2025-07-31 06:28

$JU successfully reached 12 USDT, setting a new record high! The price rose 120x since its listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

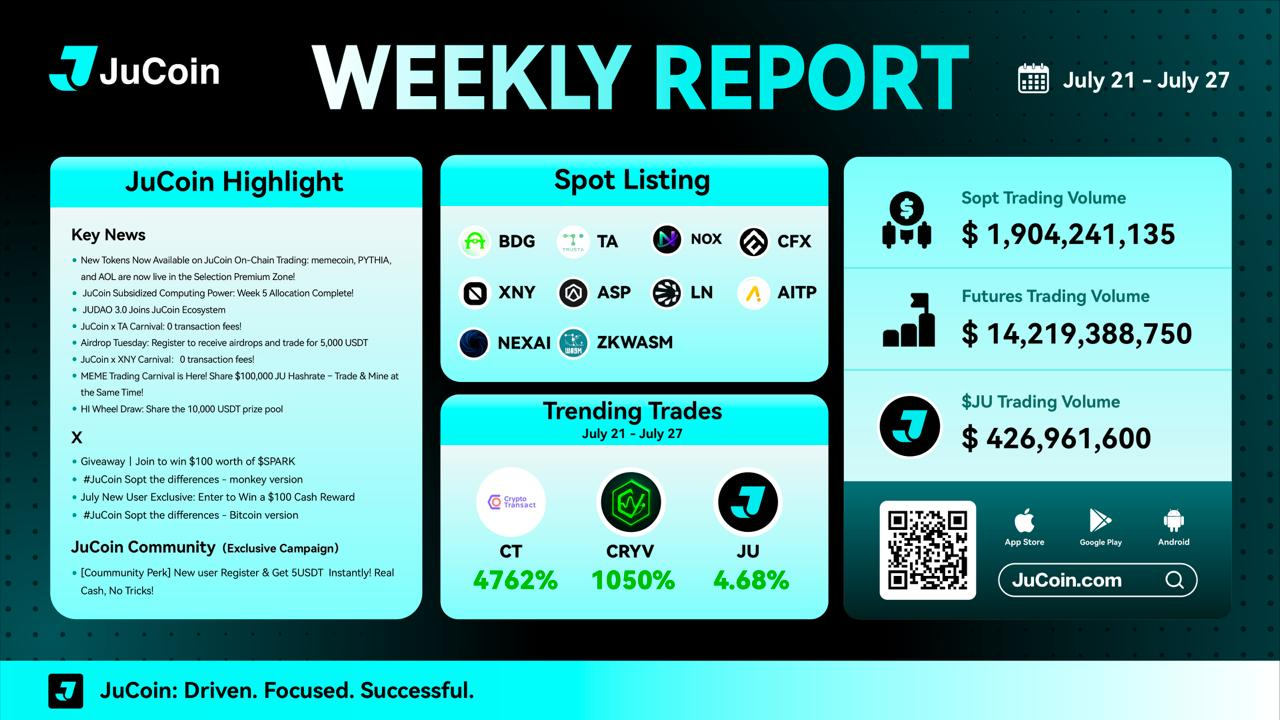

💚10 new spot listings added

💚9 campaigns launched this week

💚Platform token $JU surged over 4.68%

Stay connected with JuCoin and never miss an update!

👉 Register Now:https://www.jucoin.online/en/accounts/register?ref=MR6KTR

JuCoin Community

2025-07-31 06:26

JuCoin Weekly Report | July 21 – July 27 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

We're thrilled to announce that JUDAO 3.0, a decentralized autonomous protocol built on Polygon & AI tech, is now officially part of the JuCoin ecosystem! This collaboration initiated by NordCore Labs will focus on DAO node operations and on-chain incentive mechanisms.

🔗 JUDAO 3.0 has completed JU computing power procurement

⚙️ Will participate in JuChain ecosystem node operations

🤝 Gradually integrating into on-chain governance

JuCoin will continue providing technical support to co-build an open Web3 ecosystem! Stay tuned for on-chain updates.

JuCoin Community

2025-07-31 06:25

🚀 JUDAO 3.0 Joins JuCoin Ecosystem!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔹 Distribution Rules Recap:

▪️ Weekly contract net loss ≥ 500 USDT➡️ receive 1:1 JU computing power allocation

▪️ Computing power is permanent and generates daily JU rewards

▪️ On-chain verifiable earnings, transparent & trustworthy

⏳ Week 6 reference period: 21 July 2025 00:00 - 27 July 2025 23:59

🔸 797 users covered this round.

👉 More Details:https://support.jucoin.blog/hc/zh-cn/articles/49209048884505?utm_campaign=ann_power_0725&utm_source=telegram&utm_medium=post

JuCoin Community

2025-07-31 06:24

JuCoin Subsidized Computing Power: Week 5 Allocation Complete! 🎉

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

This is my first JuSqaure Post!

#cryptocurrency

JCUSER-Rj4NMyiW

2025-07-31 03:52

My First Post

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Security Measures Are in Place for OKX Pay?

Overview of OKX Pay Security Protocols

OKX Pay, developed by the well-established cryptocurrency exchange OKX, aims to provide a secure and user-friendly payment platform. As digital payments become increasingly prevalent, ensuring robust security measures is vital to protect users’ funds and personal data. The platform employs multiple layers of security protocols aligned with industry best practices, including encryption, cold storage solutions, and regulatory compliance.

One of the core features is Two-Factor Authentication (2FA). This adds an extra verification step during login or high-risk transactions, significantly reducing the risk of unauthorized access even if passwords are compromised. Encryption also plays a crucial role; all transactions on OKX Pay are secured using advanced cryptographic techniques that safeguard data from interception or tampering during transmission.

Funds deposited into OKX Pay are stored primarily in cold storage wallets—offline wallets that are disconnected from the internet. Cold storage minimizes exposure to hacking attempts since most cyberattacks target online wallets connected directly to networks. Additionally, the platform adheres strictly to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations worldwide. These compliance measures involve verifying user identities through rigorous processes before allowing access to certain features or higher transaction limits.

Regular security audits form another pillar of OKX’s approach. The company collaborates with reputable cybersecurity firms for periodic assessments aimed at identifying vulnerabilities and implementing necessary patches promptly. Furthermore, insurance coverage is provided for user funds held on the platform—adding an extra layer of reassurance against potential losses due to breaches or hacking incidents.

Recent Enhancements in Security Features

In recent months, OKX has taken steps toward strengthening its security infrastructure further by introducing biometric authentication options for high-value transactions. This biometric layer—using fingerprint scans or facial recognition—serves as an additional verification step that enhances account protection without compromising convenience.

The exchange has also formed strategic partnerships with leading cybersecurity firms dedicated to conducting comprehensive security assessments and adopting industry-leading practices in cybersecurity management. These collaborations help ensure that any emerging threats are swiftly identified and mitigated before they can impact users.

Furthermore, aligning with evolving regulatory standards across different jurisdictions demonstrates OKX’s commitment toward transparency and legal compliance—a critical aspect contributing positively to overall trustworthiness within the crypto community.

User Education & Awareness Initiatives

Security isn’t solely about technological safeguards; informed users play a vital role in maintaining safety standards as well. Recognizing this fact, OKX has launched educational campaigns aimed at raising awareness about common threats like phishing scams and social engineering tactics targeting cryptocurrency holders.

These initiatives include tips on creating strong passwords, avoiding suspicious links or emails claiming account issues unexpectedly—and recognizing signs of potential scams designed to steal login credentials or seed phrases. Educating users helps foster a culture where individuals actively participate in safeguarding their accounts alongside technical protections implemented by the platform itself.

Potential Risks Despite Robust Security Measures

While OKX invests heavily in securing its payment system through layered defenses—including encryption protocols, cold storage solutions—and ongoing audits no system can be entirely immune from threats. Cybercriminals continuously evolve their tactics; phishing remains one of the most common attack vectors targeting unsuspecting users who may inadvertently disclose sensitive information via malicious links or fake websites posing as legitimate platforms like OKX Pay.

Regulatory changes also pose challenges: new laws could require modifications in how user data is handled or introduce additional compliance obligations that might temporarily affect service operations until fully integrated into existing systems.

Moreover, any significant breach involving user data could undermine trust—not only affecting individual accounts but potentially damaging overall reputation among current and prospective customers alike—a crucial consideration given fierce competition within crypto payment services market segments where perceived security often influences choice heavily.

Staying Ahead: Continuous Improvements & Vigilance

To maintain its competitive edge while safeguarding assets effectively:

- Regular updates: Implementing timely patches based on vulnerability assessments.

- Enhanced authentication methods: Expanding biometric options.

- Partnerships with cybersecurity experts: Conducting thorough penetration testing.

- User education programs: Promoting best practices among clients.

This proactive approach ensures that despite evolving cyber threats and regulatory landscapes worldwide — which require constant adaptation —OKX remains committed towards providing a secure environment for digital payments.

How Does User Trust Influence Payment System Security?

Trust forms a cornerstone when it comes to financial platforms like OKX Pay because users need confidence that their assets are protected against theft or misuse. Transparent communication about ongoing security efforts—including regular audits—and visible insurance coverage reassure customers about safety levels offered by such platforms.

Additionally, fostering an educated user base capable of recognizing potential scams reduces human error-related vulnerabilities significantly—a key factor considering many breaches originate from social engineering rather than technical flaws alone.

Final Thoughts

OKX Pay's layered approach combines technological safeguards such as encryption technology—with physical measures like cold storage—and procedural elements including KYC/AML compliance—to create a comprehensive defense system against cyber threats while promoting transparency through regular audits and partnerships with top-tier cybersecurity firms.. While no system guarantees absolute immunity from attacks given ever-changing threat landscapes—the continuous investment into enhanced features coupled with active user education positions it favorably within competitive crypto payment ecosystems aiming for long-term trustworthiness

Lo

2025-06-11 16:27

What security measures are in place for OKX Pay?

What Security Measures Are in Place for OKX Pay?

Overview of OKX Pay Security Protocols

OKX Pay, developed by the well-established cryptocurrency exchange OKX, aims to provide a secure and user-friendly payment platform. As digital payments become increasingly prevalent, ensuring robust security measures is vital to protect users’ funds and personal data. The platform employs multiple layers of security protocols aligned with industry best practices, including encryption, cold storage solutions, and regulatory compliance.

One of the core features is Two-Factor Authentication (2FA). This adds an extra verification step during login or high-risk transactions, significantly reducing the risk of unauthorized access even if passwords are compromised. Encryption also plays a crucial role; all transactions on OKX Pay are secured using advanced cryptographic techniques that safeguard data from interception or tampering during transmission.

Funds deposited into OKX Pay are stored primarily in cold storage wallets—offline wallets that are disconnected from the internet. Cold storage minimizes exposure to hacking attempts since most cyberattacks target online wallets connected directly to networks. Additionally, the platform adheres strictly to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations worldwide. These compliance measures involve verifying user identities through rigorous processes before allowing access to certain features or higher transaction limits.

Regular security audits form another pillar of OKX’s approach. The company collaborates with reputable cybersecurity firms for periodic assessments aimed at identifying vulnerabilities and implementing necessary patches promptly. Furthermore, insurance coverage is provided for user funds held on the platform—adding an extra layer of reassurance against potential losses due to breaches or hacking incidents.

Recent Enhancements in Security Features

In recent months, OKX has taken steps toward strengthening its security infrastructure further by introducing biometric authentication options for high-value transactions. This biometric layer—using fingerprint scans or facial recognition—serves as an additional verification step that enhances account protection without compromising convenience.

The exchange has also formed strategic partnerships with leading cybersecurity firms dedicated to conducting comprehensive security assessments and adopting industry-leading practices in cybersecurity management. These collaborations help ensure that any emerging threats are swiftly identified and mitigated before they can impact users.

Furthermore, aligning with evolving regulatory standards across different jurisdictions demonstrates OKX’s commitment toward transparency and legal compliance—a critical aspect contributing positively to overall trustworthiness within the crypto community.

User Education & Awareness Initiatives

Security isn’t solely about technological safeguards; informed users play a vital role in maintaining safety standards as well. Recognizing this fact, OKX has launched educational campaigns aimed at raising awareness about common threats like phishing scams and social engineering tactics targeting cryptocurrency holders.

These initiatives include tips on creating strong passwords, avoiding suspicious links or emails claiming account issues unexpectedly—and recognizing signs of potential scams designed to steal login credentials or seed phrases. Educating users helps foster a culture where individuals actively participate in safeguarding their accounts alongside technical protections implemented by the platform itself.

Potential Risks Despite Robust Security Measures

While OKX invests heavily in securing its payment system through layered defenses—including encryption protocols, cold storage solutions—and ongoing audits no system can be entirely immune from threats. Cybercriminals continuously evolve their tactics; phishing remains one of the most common attack vectors targeting unsuspecting users who may inadvertently disclose sensitive information via malicious links or fake websites posing as legitimate platforms like OKX Pay.

Regulatory changes also pose challenges: new laws could require modifications in how user data is handled or introduce additional compliance obligations that might temporarily affect service operations until fully integrated into existing systems.

Moreover, any significant breach involving user data could undermine trust—not only affecting individual accounts but potentially damaging overall reputation among current and prospective customers alike—a crucial consideration given fierce competition within crypto payment services market segments where perceived security often influences choice heavily.

Staying Ahead: Continuous Improvements & Vigilance

To maintain its competitive edge while safeguarding assets effectively:

- Regular updates: Implementing timely patches based on vulnerability assessments.

- Enhanced authentication methods: Expanding biometric options.

- Partnerships with cybersecurity experts: Conducting thorough penetration testing.

- User education programs: Promoting best practices among clients.

This proactive approach ensures that despite evolving cyber threats and regulatory landscapes worldwide — which require constant adaptation —OKX remains committed towards providing a secure environment for digital payments.

How Does User Trust Influence Payment System Security?

Trust forms a cornerstone when it comes to financial platforms like OKX Pay because users need confidence that their assets are protected against theft or misuse. Transparent communication about ongoing security efforts—including regular audits—and visible insurance coverage reassure customers about safety levels offered by such platforms.

Additionally, fostering an educated user base capable of recognizing potential scams reduces human error-related vulnerabilities significantly—a key factor considering many breaches originate from social engineering rather than technical flaws alone.

Final Thoughts

OKX Pay's layered approach combines technological safeguards such as encryption technology—with physical measures like cold storage—and procedural elements including KYC/AML compliance—to create a comprehensive defense system against cyber threats while promoting transparency through regular audits and partnerships with top-tier cybersecurity firms.. While no system guarantees absolute immunity from attacks given ever-changing threat landscapes—the continuous investment into enhanced features coupled with active user education positions it favorably within competitive crypto payment ecosystems aiming for long-term trustworthiness

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding the CARV Token and Its Ecosystem

The CARV token is a digital asset associated with the CARV ecosystem, which aims to provide innovative solutions within the blockchain space. While specific details about its core functions may vary, tokens like CARV are typically used to facilitate transactions, governance, or access within their respective platforms. The ecosystem could encompass decentralized finance (DeFi) applications, non-fungible tokens (NFTs), or other blockchain-based services designed to enhance user engagement and utility.

Investors and enthusiasts interested in cryptocurrencies should understand that the value of such tokens often depends on factors like ecosystem development, community support, partnerships, and overall market conditions. As with many emerging projects in crypto markets, staying informed about recent updates and strategic moves by project developers is crucial for making educated investment decisions.

How to Participate in Sharing 5819 CARV Tokens

The article emphasizes an opportunity for readers to share a total of 5819 CARV tokens as part of a promotional campaign or community engagement initiative. Typically, such sharing programs involve steps like:

- Registering on official platforms or participating in specific campaigns.

- Completing certain tasks such as social media sharing or inviting friends.

- Following guidelines provided by the project team to ensure eligibility.

Participation methods can vary depending on ongoing promotions but generally aim to increase awareness and adoption of the token while rewarding active community members. It’s essential for participants to verify official sources before engaging in any sharing activities to avoid scams.

Key Uses and Benefits of Holding CARV Tokens

Understanding what you can do with CARV tokens helps clarify their potential value proposition. Common uses include:

- Governance: Token holders may have voting rights on platform upgrades or decision-making processes.

- Staking: Locking up tokens might earn rewards through staking mechanisms that support network security.

- Access: Certain features within the ecosystem could require holding or spending CARV tokens.

- Trading: Like other cryptocurrencies, CARV can be bought or sold on exchanges based on market demand.

Holding these tokens might also offer benefits such as participation incentives during promotional events—like earning additional rewards through sharing campaigns—and potential appreciation if the ecosystem grows successfully over time.

Recent Developments Impacting the CARV Ecosystem

Keeping track of recent updates is vital for assessing future prospects. Notable developments include:

- Market Performance Trends: Analyzing recent price movements reveals volatility levels typical in crypto markets but also indicates investor interest spikes following positive news.

- Partnership Announcements: Collaborations with other blockchain projects or mainstream companies can boost credibility and expand use cases.

- Platform Upgrades: Introduction of new features—such as enhanced security measures, user interface improvements, or additional functionalities—can influence adoption rates positively.

- Regulatory Environment Changes: Evolving legal frameworks around cryptocurrencies globally may impact how easily users can trade or utilize CARV tokens across different jurisdictions.

Staying updated through official channels ensures investors are aware of these developments promptly.

Risks Associated With Investing in Carv Tokens

While opportunities exist within emerging crypto projects like Carv, risks must be carefully considered:

- Market Volatility: Cryptocurrency prices are highly volatile; sudden swings could lead to significant losses.

- Security Concerns: Hacks targeting exchanges or wallets holding Carv could compromise funds if proper security measures aren’t followed.

- Regulatory Risks: Changes in laws governing digital assets might restrict trading options or usage rights for certain jurisdictions.

Additionally,

Community trust plays a critical role; any negative news regarding project management transparency—or technical vulnerabilities—could diminish confidence among investors and users alike.

Strategies for Engaging With Carv Investment Opportunities

For those interested in participating actively with Carv's ecosystem beyond just holding its token:

- Conduct thorough research into project whitepapers and official announcements

- Follow reputable sources discussing market trends related to Carv

- Join community forums where users share insights

- Consider diversification strategies rather than concentrating investments solely into one asset

- Stay cautious about promotional offers promising guaranteed returns without clear backing

By combining due diligence with strategic planning aligned with personal risk tolerance levels — especially considering cryptocurrency’s inherent volatility — investors can better position themselves within this evolving landscape.

This overview provides a comprehensive understanding of what potential investors need when exploring opportunities related to the Carv token—from its purpose within its broader ecosystem through recent developments impacting its value—and highlights key considerations necessary before engaging actively with this digital asset class while emphasizing responsible investing practices rooted in transparency and informed decision-making standards common among reputable financial advice sources today.*

Lo

2025-06-09 21:22

What topics are covered in the 'Learn About CARV to Share 5819 CARV Tokens' article?

Understanding the CARV Token and Its Ecosystem

The CARV token is a digital asset associated with the CARV ecosystem, which aims to provide innovative solutions within the blockchain space. While specific details about its core functions may vary, tokens like CARV are typically used to facilitate transactions, governance, or access within their respective platforms. The ecosystem could encompass decentralized finance (DeFi) applications, non-fungible tokens (NFTs), or other blockchain-based services designed to enhance user engagement and utility.

Investors and enthusiasts interested in cryptocurrencies should understand that the value of such tokens often depends on factors like ecosystem development, community support, partnerships, and overall market conditions. As with many emerging projects in crypto markets, staying informed about recent updates and strategic moves by project developers is crucial for making educated investment decisions.

How to Participate in Sharing 5819 CARV Tokens

The article emphasizes an opportunity for readers to share a total of 5819 CARV tokens as part of a promotional campaign or community engagement initiative. Typically, such sharing programs involve steps like:

- Registering on official platforms or participating in specific campaigns.

- Completing certain tasks such as social media sharing or inviting friends.

- Following guidelines provided by the project team to ensure eligibility.

Participation methods can vary depending on ongoing promotions but generally aim to increase awareness and adoption of the token while rewarding active community members. It’s essential for participants to verify official sources before engaging in any sharing activities to avoid scams.

Key Uses and Benefits of Holding CARV Tokens

Understanding what you can do with CARV tokens helps clarify their potential value proposition. Common uses include:

- Governance: Token holders may have voting rights on platform upgrades or decision-making processes.

- Staking: Locking up tokens might earn rewards through staking mechanisms that support network security.

- Access: Certain features within the ecosystem could require holding or spending CARV tokens.

- Trading: Like other cryptocurrencies, CARV can be bought or sold on exchanges based on market demand.

Holding these tokens might also offer benefits such as participation incentives during promotional events—like earning additional rewards through sharing campaigns—and potential appreciation if the ecosystem grows successfully over time.

Recent Developments Impacting the CARV Ecosystem

Keeping track of recent updates is vital for assessing future prospects. Notable developments include:

- Market Performance Trends: Analyzing recent price movements reveals volatility levels typical in crypto markets but also indicates investor interest spikes following positive news.

- Partnership Announcements: Collaborations with other blockchain projects or mainstream companies can boost credibility and expand use cases.

- Platform Upgrades: Introduction of new features—such as enhanced security measures, user interface improvements, or additional functionalities—can influence adoption rates positively.

- Regulatory Environment Changes: Evolving legal frameworks around cryptocurrencies globally may impact how easily users can trade or utilize CARV tokens across different jurisdictions.

Staying updated through official channels ensures investors are aware of these developments promptly.

Risks Associated With Investing in Carv Tokens

While opportunities exist within emerging crypto projects like Carv, risks must be carefully considered:

- Market Volatility: Cryptocurrency prices are highly volatile; sudden swings could lead to significant losses.

- Security Concerns: Hacks targeting exchanges or wallets holding Carv could compromise funds if proper security measures aren’t followed.

- Regulatory Risks: Changes in laws governing digital assets might restrict trading options or usage rights for certain jurisdictions.

Additionally,

Community trust plays a critical role; any negative news regarding project management transparency—or technical vulnerabilities—could diminish confidence among investors and users alike.

Strategies for Engaging With Carv Investment Opportunities

For those interested in participating actively with Carv's ecosystem beyond just holding its token:

- Conduct thorough research into project whitepapers and official announcements

- Follow reputable sources discussing market trends related to Carv

- Join community forums where users share insights

- Consider diversification strategies rather than concentrating investments solely into one asset

- Stay cautious about promotional offers promising guaranteed returns without clear backing

By combining due diligence with strategic planning aligned with personal risk tolerance levels — especially considering cryptocurrency’s inherent volatility — investors can better position themselves within this evolving landscape.

This overview provides a comprehensive understanding of what potential investors need when exploring opportunities related to the Carv token—from its purpose within its broader ecosystem through recent developments impacting its value—and highlights key considerations necessary before engaging actively with this digital asset class while emphasizing responsible investing practices rooted in transparency and informed decision-making standards common among reputable financial advice sources today.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How the Crypto Fear & Greed Index Helps Traders Make Better Decisions

Understanding market sentiment is crucial for successful trading, especially in the highly volatile world of cryptocurrencies. The Crypto Fear & Greed Index offers traders a valuable tool to gauge investor emotions and anticipate potential market movements. By analyzing this index, traders can enhance their decision-making process, manage risks more effectively, and identify optimal entry and exit points.

What Is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is an algorithmic indicator designed to measure the overall sentiment of cryptocurrency investors. Created by Alternative.me in 2018, it synthesizes various data points—such as price volatility, trading volume, social media activity (like Twitter sentiment), and market capitalization—to produce a single score reflecting current market emotions. This score ranges from 0 to 100: lower values indicate fear or panic selling among investors; higher values suggest greed or overconfidence.

This index mirrors similar tools used in traditional financial markets but tailored specifically for cryptocurrencies' unique dynamics. Its primary purpose is to provide traders with a quick snapshot of whether the market is overly fearful or excessively greedy—conditions that often precede significant price reversals.

How Does the Index Work?

The index operates on a scale from 0 to 100:

- 0-24: Extreme Fear – Investors are panicking; prices may be undervalued.

- 25-49: Fear – Caution prevails; some selling pressure exists.

- 50: Neutral – Market shows balanced sentiment.

- 51-74: Greed – Optimism increases; prices might be overbought.

- 75-100: Extreme Greed – Overconfidence dominates; risk of correction rises.

Traders interpret these signals differently depending on their strategies. For example, extreme fear levels might signal buying opportunities due to potential undervaluation, while extreme greed could warn against entering new long positions or suggest taking profits.

Why Is Sentiment Analysis Important in Cryptocurrency Trading?

Cryptocurrency markets are known for their high volatility driven not only by technical factors but also by emotional reactions among investors. FOMO (Fear Of Missing Out), panic selling during downturns, and exuberance during rallies can all lead to irrational decision-making that deviates from fundamental analysis.

Sentiment analysis tools like the Crypto Fear & Greed Index help traders cut through emotional noise by providing objective data about prevailing investor moods. Recognizing when markets are overly fearful can present contrarian buying opportunities—buy low scenarios—while identifying excessive greed may prompt caution or profit-taking before a correction occurs.

Practical Ways Traders Use the Index

Traders incorporate the Crypto Fear & Greed Index into their strategies through various approaches:

- Contrarian Investing: Buying when fear levels are high (index below 25) with expectations of rebound.

- Profit Taking: Selling or reducing exposure when greed levels reach extremes (above 75).

- Market Timing: Combining index signals with technical analysis for more precise entries/exits.

- Risk Management: Adjusting position sizes based on current sentiment—smaller trades during uncertain times and larger ones when confidence is high.

Additionally, many traders use historical patterns observed via this index as part of broader trend analysis models aimed at predicting future movements based on past behavior under similar sentiment conditions.

Limitations and Risks

While valuable, reliance solely on the Crypto Fear & Greed Index has its pitfalls:

It provides a snapshot rather than comprehensive insight into fundamentals such as project development progress or macroeconomic factors influencing crypto prices.

Market sentiments can remain irrational longer than expected—a phenomenon known as "market timing risk."

Overreacting to short-term swings in sentiment may lead traders astray if they ignore underlying asset fundamentals or broader economic indicators.

Therefore, it's essential for traders to combine this tool with other forms of analysis—including technical charts, news events tracking, macroeconomic data—and maintain disciplined risk management practices.

Recent Trends Enhancing Its Effectiveness

In recent years, technological advancements have improved how accurately this index reflects real-time market psychology:

The integration of machine learning algorithms allows for better pattern recognition across diverse data sources such as social media trends and trading volumes.

Updates introduced by Alternative.me have expanded data inputs beyond basic metrics—for example incorporating network activity metrics—to refine sentiment assessment further.

These improvements make it easier for traders to interpret current conditions more reliably than ever before while adapting quickly during rapid shifts like those seen during major events such as exchange collapses or regulatory crackdowns.

Furthermore, increased community engagement around behavioral finance concepts has led many retail investors and institutional players alike to pay closer attention not just individually but collectively—as reflected through indices like these—in shaping overall market dynamics.

By understanding how investor emotions influence cryptocurrency prices—and leveraging tools like the Crypto Fear & Greed Index—traders gain an edge in navigating unpredictable markets. While no single indicator guarantees success alone—the key lies in combining multiple analytical methods—they serve as vital components within a comprehensive trading strategy rooted in informed decision-making rather than impulsive reactions driven purely by emotion.

Keywords:

Crypto Market Sentiment | Cryptocurrency Trading Strategies | Investor Emotions | Technical Analysis | Risk Management | Market Psychology

kai

2025-06-09 19:54

How can the Crypto Fear & Greed Index help traders make better decisions?

How the Crypto Fear & Greed Index Helps Traders Make Better Decisions

Understanding market sentiment is crucial for successful trading, especially in the highly volatile world of cryptocurrencies. The Crypto Fear & Greed Index offers traders a valuable tool to gauge investor emotions and anticipate potential market movements. By analyzing this index, traders can enhance their decision-making process, manage risks more effectively, and identify optimal entry and exit points.

What Is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is an algorithmic indicator designed to measure the overall sentiment of cryptocurrency investors. Created by Alternative.me in 2018, it synthesizes various data points—such as price volatility, trading volume, social media activity (like Twitter sentiment), and market capitalization—to produce a single score reflecting current market emotions. This score ranges from 0 to 100: lower values indicate fear or panic selling among investors; higher values suggest greed or overconfidence.

This index mirrors similar tools used in traditional financial markets but tailored specifically for cryptocurrencies' unique dynamics. Its primary purpose is to provide traders with a quick snapshot of whether the market is overly fearful or excessively greedy—conditions that often precede significant price reversals.

How Does the Index Work?

The index operates on a scale from 0 to 100:

- 0-24: Extreme Fear – Investors are panicking; prices may be undervalued.

- 25-49: Fear – Caution prevails; some selling pressure exists.

- 50: Neutral – Market shows balanced sentiment.

- 51-74: Greed – Optimism increases; prices might be overbought.

- 75-100: Extreme Greed – Overconfidence dominates; risk of correction rises.

Traders interpret these signals differently depending on their strategies. For example, extreme fear levels might signal buying opportunities due to potential undervaluation, while extreme greed could warn against entering new long positions or suggest taking profits.

Why Is Sentiment Analysis Important in Cryptocurrency Trading?

Cryptocurrency markets are known for their high volatility driven not only by technical factors but also by emotional reactions among investors. FOMO (Fear Of Missing Out), panic selling during downturns, and exuberance during rallies can all lead to irrational decision-making that deviates from fundamental analysis.

Sentiment analysis tools like the Crypto Fear & Greed Index help traders cut through emotional noise by providing objective data about prevailing investor moods. Recognizing when markets are overly fearful can present contrarian buying opportunities—buy low scenarios—while identifying excessive greed may prompt caution or profit-taking before a correction occurs.

Practical Ways Traders Use the Index

Traders incorporate the Crypto Fear & Greed Index into their strategies through various approaches:

- Contrarian Investing: Buying when fear levels are high (index below 25) with expectations of rebound.

- Profit Taking: Selling or reducing exposure when greed levels reach extremes (above 75).

- Market Timing: Combining index signals with technical analysis for more precise entries/exits.

- Risk Management: Adjusting position sizes based on current sentiment—smaller trades during uncertain times and larger ones when confidence is high.

Additionally, many traders use historical patterns observed via this index as part of broader trend analysis models aimed at predicting future movements based on past behavior under similar sentiment conditions.

Limitations and Risks

While valuable, reliance solely on the Crypto Fear & Greed Index has its pitfalls:

It provides a snapshot rather than comprehensive insight into fundamentals such as project development progress or macroeconomic factors influencing crypto prices.

Market sentiments can remain irrational longer than expected—a phenomenon known as "market timing risk."

Overreacting to short-term swings in sentiment may lead traders astray if they ignore underlying asset fundamentals or broader economic indicators.

Therefore, it's essential for traders to combine this tool with other forms of analysis—including technical charts, news events tracking, macroeconomic data—and maintain disciplined risk management practices.

Recent Trends Enhancing Its Effectiveness

In recent years, technological advancements have improved how accurately this index reflects real-time market psychology:

The integration of machine learning algorithms allows for better pattern recognition across diverse data sources such as social media trends and trading volumes.

Updates introduced by Alternative.me have expanded data inputs beyond basic metrics—for example incorporating network activity metrics—to refine sentiment assessment further.

These improvements make it easier for traders to interpret current conditions more reliably than ever before while adapting quickly during rapid shifts like those seen during major events such as exchange collapses or regulatory crackdowns.

Furthermore, increased community engagement around behavioral finance concepts has led many retail investors and institutional players alike to pay closer attention not just individually but collectively—as reflected through indices like these—in shaping overall market dynamics.

By understanding how investor emotions influence cryptocurrency prices—and leveraging tools like the Crypto Fear & Greed Index—traders gain an edge in navigating unpredictable markets. While no single indicator guarantees success alone—the key lies in combining multiple analytical methods—they serve as vital components within a comprehensive trading strategy rooted in informed decision-making rather than impulsive reactions driven purely by emotion.

Keywords:

Crypto Market Sentiment | Cryptocurrency Trading Strategies | Investor Emotions | Technical Analysis | Risk Management | Market Psychology

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

kai

2025-06-09 07:27

What precedents are being set by countries adopting Bitcoin?

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Factors Influencing the Value of Alternative Cryptocurrencies

Understanding what drives the value of alternative cryptocurrencies, commonly known as altcoins, is essential for investors, developers, and enthusiasts alike. Altcoins operate independently from Bitcoin but are often influenced by similar market forces and technological developments. This article explores the key factors that impact their valuation, providing a comprehensive overview grounded in current industry insights.

Market Sentiment and Adoption Rates

Market sentiment plays a pivotal role in shaping the price movements of altcoins. Positive news such as regulatory approvals, technological breakthroughs, or endorsements from influential figures can boost investor confidence. Conversely, negative headlines—like security breaches or regulatory crackdowns—can trigger sharp declines.

Adoption rates are equally critical; when more users and businesses start accepting or utilizing an altcoin, demand naturally increases. Higher adoption enhances liquidity—the ease with which assets can be bought or sold without affecting their price—which tends to stabilize prices over time. For example, widespread acceptance of certain stablecoins has contributed to their relatively steady valuations compared to more volatile tokens.

Technological Advancements and Blockchain Capabilities

The underlying technology behind an altcoin significantly influences its perceived value. Advanced blockchain features such as enhanced security protocols or faster transaction speeds attract investor interest because they address common issues like scalability and network vulnerabilities.

Smart contracts and decentralized applications (DApps) further add utility to an altcoin’s ecosystem. Projects that support these functionalities tend to have higher utility value because they enable complex financial operations without intermediaries—making them attractive for DeFi (Decentralized Finance) applications and enterprise solutions alike.

Regulatory Environment Impact

Government policies and regulations directly affect how altcoins are perceived in mainstream finance markets. Clearer regulatory frameworks tend to foster trust among investors by reducing uncertainty about legal compliance risks.

For instance, jurisdictions that implement comprehensive AML (Anti-Money Laundering) and KYC (Know Your Customer) standards facilitate easier listing on major exchanges—thus increasing accessibility for traders worldwide. Conversely, restrictive regulations can limit trading options or even lead to delistings from exchanges if compliance standards aren’t met.

Supply Dynamics: Tokenomics & Liquidity

Tokenomics—the economic model governing supply distribution—is fundamental in determining an altcoin’s market behavior. Factors such as total supply caps (e.g., Bitcoin’s 21 million limit), inflation rates through mining rewards or token releases influence scarcity perceptions among investors.

High liquidity levels also contribute positively; markets with numerous buyers and sellers tend to experience less volatility because large trades won’t drastically sway prices—a vital consideration during periods of heightened market activity or sudden shifts in sentiment.

Security Measures & Network Scalability

Security remains paramount for maintaining trust within any cryptocurrency ecosystem. Networks vulnerable to hacking incidents risk losing user confidence rapidly; notable breaches have historically caused significant drops in token values across various projects.

Scalability addresses whether a network can handle increasing transaction volumes efficiently—a necessity for mass adoption beyond niche communities. Projects capable of scaling effectively often enjoy sustained growth prospects due to their ability to serve larger user bases without compromising performance or security standards.

Competitive Landscape: Positioning Among Altcoins & Bitcoin Influence

The competitive environment within the crypto space shapes individual coin valuations considerably. While Bitcoin dominates market capitalization—and exerts influence over overall sentiment—altcoins must differentiate themselves through unique features like faster transactions (e.g., Litecoin), privacy enhancements (e.g., Monero), or specialized use cases like gaming tokens.

When Bitcoin experiences significant price movements—either upward surges or downturns—it often impacts broader market confidence affecting all cryptocurrencies including altcoins indirectly through investor psychology rather than fundamentals alone.

Recent Trends Shaping Altcoin Valuations

Growth Driven by Decentralized Finance (DeFi)

DeFi has revolutionized how digital assets are used by enabling lending platforms, yield farming strategies, staking pools—and many other financial services—all built on blockchain networks supporting smart contracts like Ethereum's platform. The surge in DeFi projects has led many related tokens’ values skyrocket due to increased demand driven by innovative use cases offering high yields compared with traditional finance options.

Institutional Investment Enhancing Market Stability

As institutional players—including hedge funds and asset managers—increase exposure via regulated channels such as futures contracts or custody solutions they bring greater liquidity into crypto markets overall—including specific promising altcoins with strong fundamentals—which helps reduce volatility spikes historically associated with retail-driven speculation.

Regulatory Clarity Supporting Growth

Governments worldwide are gradually establishing clearer rules around digital assets—for example U.S regulators issuing guidance on securities classification—that help legitimize certain types of tokens while discouraging illicit activities like money laundering via anonymous transactions.

Risks That Could Affect Altcoin Values

Despite positive developments there remain inherent risks impacting valuation stability:

- Market Volatility: Cryptocurrency prices remain highly sensitive; sudden shifts driven by macroeconomic factors—or social media trends—can cause rapid fluctuations.

- Security Vulnerabilities: Flaws within codebases may lead hackers exploiting vulnerabilities resulting in loss of funds.

- Intensified Competition: As new projects emerge offering innovative features—from privacy-focused coins versus scalable layer-two solutions—their ability to capture market share could threaten existing coins’ dominance.

Navigating the Complex World of Altcoin Valuation

Investors seeking exposure should consider multiple factors—from technological robustness through regulatory landscape—to make informed decisions aligned with long-term growth potential rather than short-term speculation tendencies.

Keywords: alternative cryptocurrencies valuation | factors influencing crypto prices | blockchain technology impact | DeFi growth effects | crypto regulation influence | tokenomics principles | cryptocurrency security risks

kai

2025-06-09 05:03

What factors influence the value of alternative cryptocurrencies?

Factors Influencing the Value of Alternative Cryptocurrencies

Understanding what drives the value of alternative cryptocurrencies, commonly known as altcoins, is essential for investors, developers, and enthusiasts alike. Altcoins operate independently from Bitcoin but are often influenced by similar market forces and technological developments. This article explores the key factors that impact their valuation, providing a comprehensive overview grounded in current industry insights.

Market Sentiment and Adoption Rates

Market sentiment plays a pivotal role in shaping the price movements of altcoins. Positive news such as regulatory approvals, technological breakthroughs, or endorsements from influential figures can boost investor confidence. Conversely, negative headlines—like security breaches or regulatory crackdowns—can trigger sharp declines.

Adoption rates are equally critical; when more users and businesses start accepting or utilizing an altcoin, demand naturally increases. Higher adoption enhances liquidity—the ease with which assets can be bought or sold without affecting their price—which tends to stabilize prices over time. For example, widespread acceptance of certain stablecoins has contributed to their relatively steady valuations compared to more volatile tokens.

Technological Advancements and Blockchain Capabilities

The underlying technology behind an altcoin significantly influences its perceived value. Advanced blockchain features such as enhanced security protocols or faster transaction speeds attract investor interest because they address common issues like scalability and network vulnerabilities.

Smart contracts and decentralized applications (DApps) further add utility to an altcoin’s ecosystem. Projects that support these functionalities tend to have higher utility value because they enable complex financial operations without intermediaries—making them attractive for DeFi (Decentralized Finance) applications and enterprise solutions alike.

Regulatory Environment Impact

Government policies and regulations directly affect how altcoins are perceived in mainstream finance markets. Clearer regulatory frameworks tend to foster trust among investors by reducing uncertainty about legal compliance risks.

For instance, jurisdictions that implement comprehensive AML (Anti-Money Laundering) and KYC (Know Your Customer) standards facilitate easier listing on major exchanges—thus increasing accessibility for traders worldwide. Conversely, restrictive regulations can limit trading options or even lead to delistings from exchanges if compliance standards aren’t met.

Supply Dynamics: Tokenomics & Liquidity

Tokenomics—the economic model governing supply distribution—is fundamental in determining an altcoin’s market behavior. Factors such as total supply caps (e.g., Bitcoin’s 21 million limit), inflation rates through mining rewards or token releases influence scarcity perceptions among investors.

High liquidity levels also contribute positively; markets with numerous buyers and sellers tend to experience less volatility because large trades won’t drastically sway prices—a vital consideration during periods of heightened market activity or sudden shifts in sentiment.

Security Measures & Network Scalability

Security remains paramount for maintaining trust within any cryptocurrency ecosystem. Networks vulnerable to hacking incidents risk losing user confidence rapidly; notable breaches have historically caused significant drops in token values across various projects.

Scalability addresses whether a network can handle increasing transaction volumes efficiently—a necessity for mass adoption beyond niche communities. Projects capable of scaling effectively often enjoy sustained growth prospects due to their ability to serve larger user bases without compromising performance or security standards.

Competitive Landscape: Positioning Among Altcoins & Bitcoin Influence

The competitive environment within the crypto space shapes individual coin valuations considerably. While Bitcoin dominates market capitalization—and exerts influence over overall sentiment—altcoins must differentiate themselves through unique features like faster transactions (e.g., Litecoin), privacy enhancements (e.g., Monero), or specialized use cases like gaming tokens.

When Bitcoin experiences significant price movements—either upward surges or downturns—it often impacts broader market confidence affecting all cryptocurrencies including altcoins indirectly through investor psychology rather than fundamentals alone.

Recent Trends Shaping Altcoin Valuations

Growth Driven by Decentralized Finance (DeFi)

DeFi has revolutionized how digital assets are used by enabling lending platforms, yield farming strategies, staking pools—and many other financial services—all built on blockchain networks supporting smart contracts like Ethereum's platform. The surge in DeFi projects has led many related tokens’ values skyrocket due to increased demand driven by innovative use cases offering high yields compared with traditional finance options.

Institutional Investment Enhancing Market Stability

As institutional players—including hedge funds and asset managers—increase exposure via regulated channels such as futures contracts or custody solutions they bring greater liquidity into crypto markets overall—including specific promising altcoins with strong fundamentals—which helps reduce volatility spikes historically associated with retail-driven speculation.

Regulatory Clarity Supporting Growth

Governments worldwide are gradually establishing clearer rules around digital assets—for example U.S regulators issuing guidance on securities classification—that help legitimize certain types of tokens while discouraging illicit activities like money laundering via anonymous transactions.

Risks That Could Affect Altcoin Values

Despite positive developments there remain inherent risks impacting valuation stability:

- Market Volatility: Cryptocurrency prices remain highly sensitive; sudden shifts driven by macroeconomic factors—or social media trends—can cause rapid fluctuations.

- Security Vulnerabilities: Flaws within codebases may lead hackers exploiting vulnerabilities resulting in loss of funds.

- Intensified Competition: As new projects emerge offering innovative features—from privacy-focused coins versus scalable layer-two solutions—their ability to capture market share could threaten existing coins’ dominance.

Navigating the Complex World of Altcoin Valuation

Investors seeking exposure should consider multiple factors—from technological robustness through regulatory landscape—to make informed decisions aligned with long-term growth potential rather than short-term speculation tendencies.

Keywords: alternative cryptocurrencies valuation | factors influencing crypto prices | blockchain technology impact | DeFi growth effects | crypto regulation influence | tokenomics principles | cryptocurrency security risks

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Tools Are Available for Trading in the XT Carnival?

Understanding the landscape of trading tools within the XT Carnival is essential for both new and experienced traders looking to navigate this rapidly evolving DeFi ecosystem. The XT Carnival encompasses a variety of platforms that leverage blockchain technology, smart contracts, and artificial intelligence to facilitate diverse trading activities. These tools are designed to enhance efficiency, security, and profitability while also presenting unique risks that users must consider.

Decentralized Exchanges (DEXs)

Decentralized exchanges are at the core of the XT Carnival’s trading environment. Unlike traditional centralized exchanges, DEXs operate without intermediaries by utilizing automated market makers (AMMs). Uniswap stands out as one of the most popular DEXs globally due to its user-friendly interface and liquidity pools that enable seamless token swaps. SushiSwap offers similar functionalities but emphasizes community governance, allowing token holders to influence platform decisions through voting mechanisms.

Curve Finance specializes in stablecoin trading with low slippage and high liquidity pools. Its focus on stablecoins makes it an attractive option for traders seeking minimal price fluctuations during transactions. These platforms collectively provide a robust foundation for peer-to-peer crypto trading while maintaining transparency through blockchain technology.

Lending and Borrowing Platforms

Lending protocols like Aave and Compound have become vital components within the XT Carnival ecosystem. They allow users to lend their cryptocurrencies in exchange for interest payments or borrow assets against collateral—often without needing traditional banking infrastructure. Aave is known for its flexible interest rate models—variable or stable—that cater to different risk appetites.

Similarly, Compound offers high-yield opportunities for lenders while providing borrowers with access to various assets at competitive rates. These platforms not only facilitate liquidity provision but also enable sophisticated strategies such as leveraging positions or earning passive income from idle tokens.

Yield Farming Tools

Yield farming has gained significant popularity as a way to maximize returns on crypto holdings within DeFi protocols like those found in the XT Carnival space. Yearn.finance automates this process by aggregating yields across multiple protocols, dynamically shifting funds between opportunities based on profitability metrics—a practice known as yield optimization.

Saddle Finance focuses on providing targeted yield farming options with an emphasis on liquidity provision in specific pools or pairs—particularly stablecoins—to reduce impermanent loss risks associated with volatile assets. Such tools empower investors seeking higher yields but require careful management due to inherent market risks.

Prediction Markets

Prediction markets serve as innovative tools where traders can speculate on future events using cryptocurrencies like Ether (ETH). Augur is one of the leading decentralized prediction market platforms that enables users to create markets around political outcomes, sports results, or other real-world events—all settled transparently via smart contracts.

Gnosis complements Augur by offering customizable prediction markets along with governance features that allow community participation in decision-making processes related to platform development or event creation. These markets add a layer of speculative opportunity beyond conventional trading methods within the XT ecosystem.

Trading Bots and AI Tools

Automation plays an increasingly important role in modern crypto trading strategies offered by platforms like Gekko—a free open-source bot capable of executing predefined strategies across multiple exchanges—and ZigZag’s AI-driven analysis services which generate real-time signals based on market trend data.

These tools help traders manage complex portfolios more efficiently by reducing emotional biases and enabling rapid response during volatile periods characteristic of cryptocurrency markets today—though they also require technical knowledge for optimal use and risk management practices.

Recent Developments Impacting Trading Tools

Over recent years, regulatory scrutiny has intensified around DeFi projects operating within ecosystems like those comprising the XT Carnival space. Governments worldwide are exploring ways to enforce compliance standards which could lead some platforms toward stricter KYC/AML procedures or even shutdowns if they fail regulatory requirements—a factor investors should monitor closely given potential impacts on asset security and usability.