Popular Posts

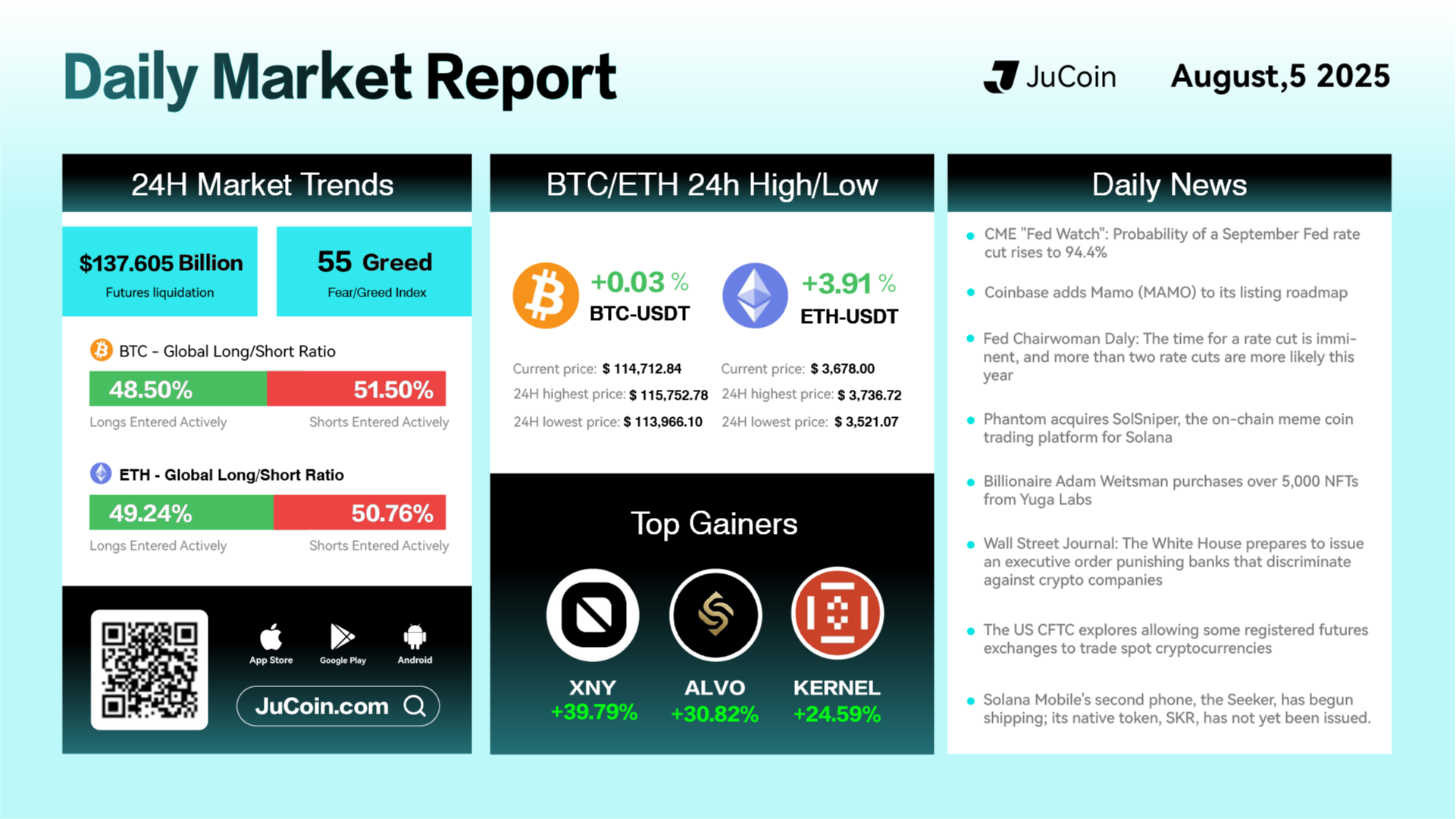

Trading Time: August 5, 2025, 15:00 (UTC)

🪧More:https://bit.ly/40PNbO4

JuCoin Community

2025-08-05 09:12

JuCoin to List TOWNS/USDT Trading Pair on August 5

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📅 August 5 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-05 04:32

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔹Deposit/Withdrawal Time: August 10, 2025, 01:50 (UTC)

🔹Trading Time: August 11, 2025, 01:50 (UTC)

🪧More:https://bit.ly/3UeEBF0

JuCoin Community

2025-08-05 02:44

JuCoin to List D3XAI/USDT Trading Pair on August 11, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔹Deposit/Withdrawal Time: August 10, 2025, 01:50 (UTC)

🔹Trading Time: August 11, 2025, 01:50 (UTC)

🪧More:https://bit.ly/4m6LTqG

JuCoin Community

2025-08-05 02:41

JuCoin to List D3X/USDT Trading Pair on August 11, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👌JuCoin will list the CMEW/USDT trading pair on August 7, 2025

🔹 Deposit: August 6, 2025 at 04:00 (UTC)

🔹 Trading: August 7, 2025 at 09:00 (UTC)

🔹 Withdrawal: August 8, 2025 at 09:00 (UTC)

🪧More:https://bit.ly/458FkfG

JuCoin Community

2025-08-04 07:45

📢 New Listing|CMEW (CelestialMew) 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The DeFi sector is experiencing a remarkable resurgence in 2025, transforming from speculative arena to robust financial infrastructure. Here's what's driving this explosive growth:

💰 Key Growth Drivers:

-

Layer 2 solutions (Optimism, Arbitrum, zk-Rollups) slashing costs & boosting speeds by 20%

$153 billion TVL reached in July 2025 - a three-year high!

Major institutional investment with $1.69B+ Ethereum holdings from leading firms

Enhanced regulatory clarity through EU's MiCA framework

🎯 What's Powering the Momentum:

1️⃣ Cross-Chain Revolution: Seamless asset transfers across Ethereum, Solana, Avalanche ecosystems 2️⃣ Yield Farming Evolution: Advanced protocols offering up to 25% returns on stablecoin strategies 3️⃣ Solana DEX Dominance: 81% of all DEX transactions, $890B trading volume in 5 months 4️⃣ Real-World Asset Tokenization: Converting real estate, commodities into tradeable blockchain tokens

🏆 Innovation Highlights:

-

Jupiter Perps averaging $1B daily perpetual trading volume

AI-powered security with real-time risk alerts and scam detection

Decentralized stablecoins driving cross-chain liquidity

Enhanced composability creating "money legos" for complex financial products

💡 Market Impact:

-

Ethereum maintains 60% DeFi TVL dominance with Lido & Aave leading

Solana surpassing Ethereum in transaction volumes and daily active users

Liquid restaking protocols attracting massive institutional inflows

Multi-signature wallets & advanced auditing boosting security confidence

🔮 Future Outlook: The shift from speculation to utility-focused infrastructure signals DeFi's maturation. With improved security, regulatory clarity, and institutional adoption, the sector is positioned for mainstream financial integration.

Read the complete analysis with detailed insights and market projections: 👇

https://blog.jucoin.com/explore-the-catalysts-behind-defis-recent-surge/?utm_source=blog

#DeFi #Layer2 #Ethereum #Solana #YieldFarming #Crypto #Blockchain #TVL #Institutions #RWA #CrossChain #JuCoin #Web3 #TradFi #Stablecoins #DEX #AI #Security

JU Blog

2025-08-01 08:54

🚀 DeFi Hits $153B TVL - Exploring the Key Catalysts Behind 2025's Massive Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

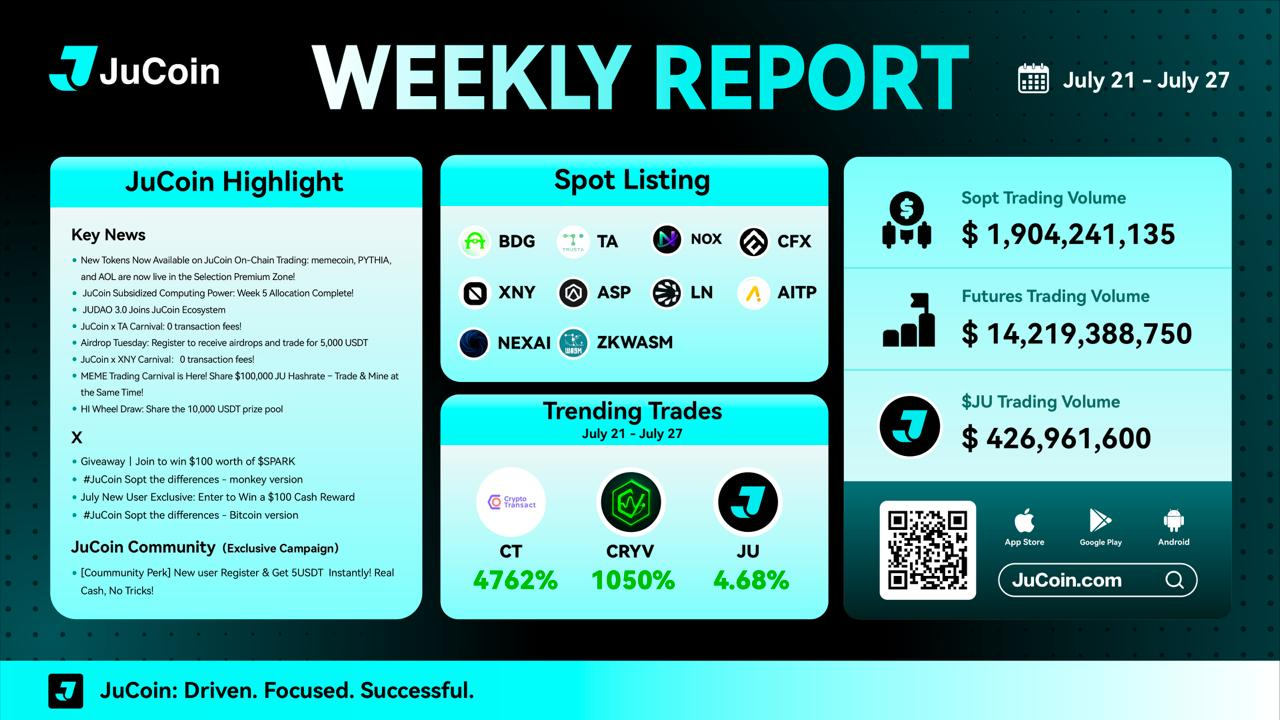

💚10 new spot listings added

💚9 campaigns launched this week

💚Platform token $JU surged over 4.68%

Stay connected with JuCoin and never miss an update!

👉 Register Now:https://www.jucoin.online/en/accounts/register?ref=MR6KTR

JuCoin Community

2025-07-31 06:26

JuCoin Weekly Report | July 21 – July 27 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

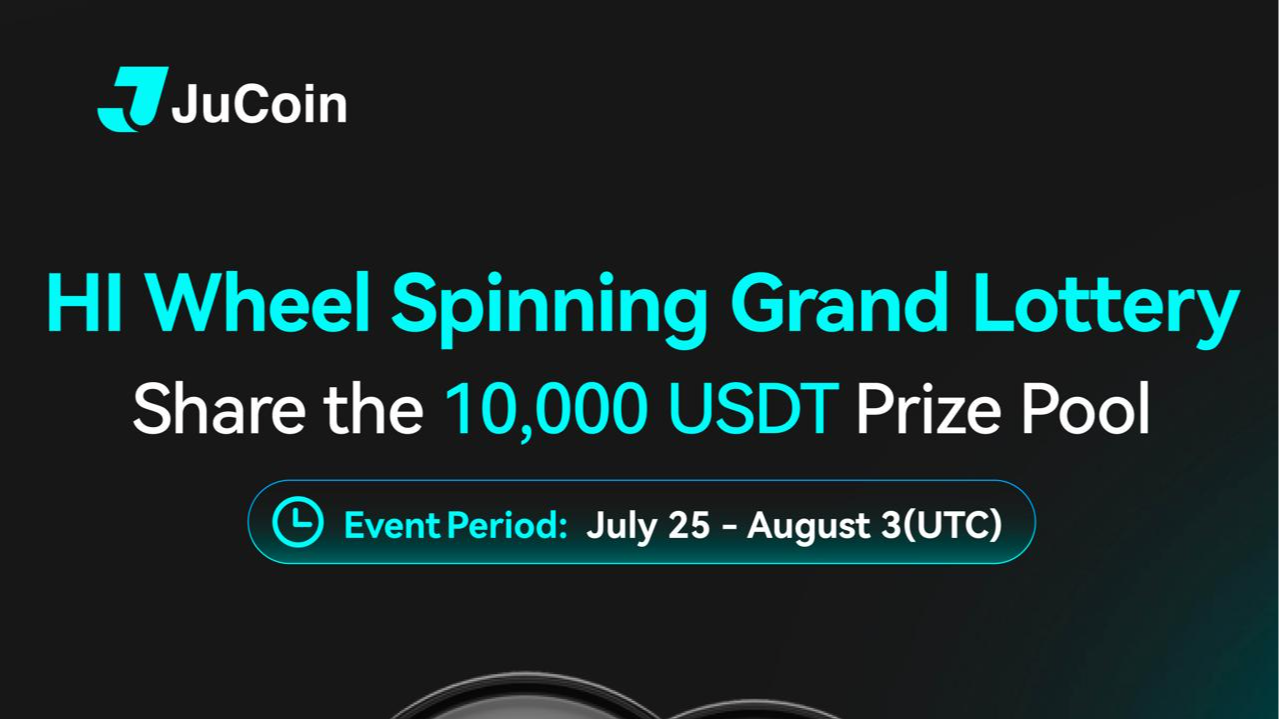

Time: 2025/7/25 13:00 - 2025/8/3 15:59 (UTC)

🔷Completing regular tasks, daily tasks, and step-by-step tasks can earn you a chance to win a USDT airdrop and share a prize pool of 10,000 USDT.

JuCoin Community

2025-07-31 06:22

HI Wheel Draw: Share the 10,000 USDT prize pool!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding Credit Spreads and Their Risks

Credit spreads are a fundamental concept in bond markets, representing the difference in yield between two bonds with similar credit ratings but different maturities. They serve as a vital indicator of market sentiment and perceived risk, helping investors gauge the likelihood of default and overall financial stability. By analyzing credit spreads, investors can make more informed decisions about which bonds to include in their portfolios.

What Are Credit Spreads?

At its core, a credit spread measures the additional yield an investor earns for taking on higher risk compared to a benchmark government bond or other low-risk securities. For example, if a corporate bond offers 5% yield while comparable U.S. Treasury bonds offer 2%, the 3% difference is the credit spread. This spread reflects how much extra compensation investors require for bearing increased default risk associated with corporate debt.

In practice, narrower spreads suggest that investors perceive lower risk—perhaps due to stable economic conditions—while wider spreads indicate heightened concern over potential defaults or economic downturns. These fluctuations provide insights into market confidence and can signal shifts in economic outlooks.

Factors Influencing Credit Spreads

Several key factors impact how credit spreads behave:

Economic Conditions: During periods of economic growth and stability, credit spreads tend to narrow as default risks decrease. Conversely, during recessions or financial crises, spreads widen as concerns over borrower solvency increase.

Interest Rates: Rising interest rates often lead to wider credit spreads because borrowing becomes more expensive for companies, increasing their default likelihood. Lower interest rates generally have the opposite effect.

Market Sentiment: Investor confidence plays a crucial role; positive sentiment leads to narrowing spreads as demand for risky assets increases. Negative news or geopolitical uncertainties tend to widen these gaps.

Understanding these influences helps investors anticipate potential changes in market dynamics that could affect their fixed-income investments.

Recent Trends in Credit Spreads (2025 Context)

As of mid-2025, despite volatility across government bond markets—especially around U.S. Treasuries—credit spreads on high-yield US corporate bonds have remained relatively stable[1]. This stability suggests that while broader markets experience fluctuations driven by macroeconomic factors like trade policies and fiscal uncertainties[2], certain segments maintain resilience temporarily.

However, persistent uncertainty surrounding U.S. fiscal policy and trade relations continues to pose risks for specific bond funds[2]. Tightening credit conditions could lead to widening spreads if investor confidence diminishes further or if economic indicators worsen unexpectedly.

Risks Associated with Widening Credit Spreads

Widening credit spreads are often viewed as warning signs of deteriorating market conditions or increasing default risks within specific sectors or issuers. For investors holding bonds with wide margins:

Higher Default Risk: As spread widening indicates perceived higher chances of issuer failure, there’s an increased probability that some borrowers may fail to meet payment obligations.

Potential Capital Losses: Bonds trading at wider yields may decline in value if market perceptions shift further negative before maturity.

Liquidity Concerns: During times of stress when spreads widen rapidly, liquidity can dry up — making it difficult for investors to sell holdings without incurring losses.

For fund managers managing diversified portfolios containing high-yield assets like CLO ETFs (Collateralized Loan Obligations), monitoring these movements is critical since tightening or widening trends directly impact future performance prospects[3].

Risks Linked With Narrowing Credit Spreads

While narrower credits might seem safer due to reduced perceived risk levels:

Complacency Risk: Investors might underestimate underlying vulnerabilities within seemingly stable sectors leading up to sudden shocks.

Market Overconfidence: Excessively tight spreads could reflect overly optimistic sentiment disconnected from actual fundamentals—a setup prone for abrupt corrections during unforeseen events.

This environment underscores why vigilance remains essential even when markets appear calm; complacency can be dangerous when assessing long-term investment strategies.

Managing Risks Through Diversification & Due Diligence

Given these complexities:

Diversify across sectors and asset classes: A well-balanced portfolio mitigates exposure from any single sector experiencing widening or tightening trends.

Conduct thorough research: Regularly review issuer fundamentals alongside macroeconomic indicators influencing spread movements.

Use hedging strategies: Options and other derivatives can help protect against adverse shifts caused by unexpected changes in credit premiums.

By implementing disciplined risk management practices aligned with current market signals—such as monitoring recent developments like volatile rate environments—investors enhance resilience against potential fallout from changing credit spread dynamics[4].

How Market Volatility Affects Investment Strategies

Volatility introduces additional layers of complexity into fixed-income investing because rapid swings in interest rates or geopolitical tensions directly influence credit spread behavior.[1][2] During turbulent periods—as seen recently—the challenge lies not only in predicting direction but also managing timing effectively so portfolios remain resilient amid unpredictable shifts.[4]

Investors should stay informed through credible sources about ongoing macroeconomic developments impacting both government securities and corporate debt instruments alike.[3] Maintaining flexibility allows adjustments aligned with evolving conditions rather than static assumptions based solely on historical data patterns.

Final Thoughts: Navigating Risks Involving Credit Spreads

Understanding what drives changes in credit premiums equips investors with better tools for navigating complex financial landscapes today’s uncertain environment presents unique challenges—and opportunities—for those who approach fixed income investing thoughtfully.[1][2] Recognizing signs such as widening versus narrowing trends enables proactive decision-making aimed at safeguarding capital while capturing attractive yields where appropriate.[4]

In essence:

- Keep abreast of macroeconomic signals

- Diversify holdings prudently

- Monitor issuer-specific fundamentals regularly

- Be prepared for sudden shifts driven by global events

By doing so—and maintaining disciplined oversight—you position yourself better against inherent risks tied closely linked with fluctuations in credit spreds across various asset classes.

References

1. Market Update June 2025 – High-Yield US Corporate Bonds Stability Despite Volatility

2. Policy Uncertainty & Bond Fund Risks – June 2025 Report

3. CLO ETF Performance & Monitoring – June 2025 Analysis

4. Fixed Income Market Volatility – Strategic Implications

kai

2025-06-09 22:04

What risks are involved with credit spreads?

Understanding Credit Spreads and Their Risks

Credit spreads are a fundamental concept in bond markets, representing the difference in yield between two bonds with similar credit ratings but different maturities. They serve as a vital indicator of market sentiment and perceived risk, helping investors gauge the likelihood of default and overall financial stability. By analyzing credit spreads, investors can make more informed decisions about which bonds to include in their portfolios.

What Are Credit Spreads?

At its core, a credit spread measures the additional yield an investor earns for taking on higher risk compared to a benchmark government bond or other low-risk securities. For example, if a corporate bond offers 5% yield while comparable U.S. Treasury bonds offer 2%, the 3% difference is the credit spread. This spread reflects how much extra compensation investors require for bearing increased default risk associated with corporate debt.

In practice, narrower spreads suggest that investors perceive lower risk—perhaps due to stable economic conditions—while wider spreads indicate heightened concern over potential defaults or economic downturns. These fluctuations provide insights into market confidence and can signal shifts in economic outlooks.

Factors Influencing Credit Spreads

Several key factors impact how credit spreads behave:

Economic Conditions: During periods of economic growth and stability, credit spreads tend to narrow as default risks decrease. Conversely, during recessions or financial crises, spreads widen as concerns over borrower solvency increase.

Interest Rates: Rising interest rates often lead to wider credit spreads because borrowing becomes more expensive for companies, increasing their default likelihood. Lower interest rates generally have the opposite effect.

Market Sentiment: Investor confidence plays a crucial role; positive sentiment leads to narrowing spreads as demand for risky assets increases. Negative news or geopolitical uncertainties tend to widen these gaps.

Understanding these influences helps investors anticipate potential changes in market dynamics that could affect their fixed-income investments.

Recent Trends in Credit Spreads (2025 Context)

As of mid-2025, despite volatility across government bond markets—especially around U.S. Treasuries—credit spreads on high-yield US corporate bonds have remained relatively stable[1]. This stability suggests that while broader markets experience fluctuations driven by macroeconomic factors like trade policies and fiscal uncertainties[2], certain segments maintain resilience temporarily.

However, persistent uncertainty surrounding U.S. fiscal policy and trade relations continues to pose risks for specific bond funds[2]. Tightening credit conditions could lead to widening spreads if investor confidence diminishes further or if economic indicators worsen unexpectedly.

Risks Associated with Widening Credit Spreads

Widening credit spreads are often viewed as warning signs of deteriorating market conditions or increasing default risks within specific sectors or issuers. For investors holding bonds with wide margins:

Higher Default Risk: As spread widening indicates perceived higher chances of issuer failure, there’s an increased probability that some borrowers may fail to meet payment obligations.

Potential Capital Losses: Bonds trading at wider yields may decline in value if market perceptions shift further negative before maturity.

Liquidity Concerns: During times of stress when spreads widen rapidly, liquidity can dry up — making it difficult for investors to sell holdings without incurring losses.

For fund managers managing diversified portfolios containing high-yield assets like CLO ETFs (Collateralized Loan Obligations), monitoring these movements is critical since tightening or widening trends directly impact future performance prospects[3].

Risks Linked With Narrowing Credit Spreads

While narrower credits might seem safer due to reduced perceived risk levels:

Complacency Risk: Investors might underestimate underlying vulnerabilities within seemingly stable sectors leading up to sudden shocks.

Market Overconfidence: Excessively tight spreads could reflect overly optimistic sentiment disconnected from actual fundamentals—a setup prone for abrupt corrections during unforeseen events.

This environment underscores why vigilance remains essential even when markets appear calm; complacency can be dangerous when assessing long-term investment strategies.

Managing Risks Through Diversification & Due Diligence

Given these complexities:

Diversify across sectors and asset classes: A well-balanced portfolio mitigates exposure from any single sector experiencing widening or tightening trends.

Conduct thorough research: Regularly review issuer fundamentals alongside macroeconomic indicators influencing spread movements.

Use hedging strategies: Options and other derivatives can help protect against adverse shifts caused by unexpected changes in credit premiums.

By implementing disciplined risk management practices aligned with current market signals—such as monitoring recent developments like volatile rate environments—investors enhance resilience against potential fallout from changing credit spread dynamics[4].

How Market Volatility Affects Investment Strategies

Volatility introduces additional layers of complexity into fixed-income investing because rapid swings in interest rates or geopolitical tensions directly influence credit spread behavior.[1][2] During turbulent periods—as seen recently—the challenge lies not only in predicting direction but also managing timing effectively so portfolios remain resilient amid unpredictable shifts.[4]

Investors should stay informed through credible sources about ongoing macroeconomic developments impacting both government securities and corporate debt instruments alike.[3] Maintaining flexibility allows adjustments aligned with evolving conditions rather than static assumptions based solely on historical data patterns.

Final Thoughts: Navigating Risks Involving Credit Spreads

Understanding what drives changes in credit premiums equips investors with better tools for navigating complex financial landscapes today’s uncertain environment presents unique challenges—and opportunities—for those who approach fixed income investing thoughtfully.[1][2] Recognizing signs such as widening versus narrowing trends enables proactive decision-making aimed at safeguarding capital while capturing attractive yields where appropriate.[4]

In essence:

- Keep abreast of macroeconomic signals

- Diversify holdings prudently

- Monitor issuer-specific fundamentals regularly

- Be prepared for sudden shifts driven by global events

By doing so—and maintaining disciplined oversight—you position yourself better against inherent risks tied closely linked with fluctuations in credit spreds across various asset classes.

References

1. Market Update June 2025 – High-Yield US Corporate Bonds Stability Despite Volatility

2. Policy Uncertainty & Bond Fund Risks – June 2025 Report

3. CLO ETF Performance & Monitoring – June 2025 Analysis

4. Fixed Income Market Volatility – Strategic Implications

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Earn CYBER Tokens: A Complete Guide

Understanding how to earn CYBER tokens is essential for users interested in participating actively within the CyberConnect ecosystem. As a decentralized social platform leveraging blockchain technology, CyberConnect offers multiple avenues for users to earn and utilize CYBER tokens. This guide provides a clear overview of the steps involved, ensuring you can maximize your engagement and potential rewards.

What Are CYBER Tokens and Why Are They Valuable?

CYBER tokens are the native cryptocurrency of the CyberConnect platform, serving as a fundamental component of its decentralized social network. These tokens facilitate various activities such as paying transaction fees, staking for governance participation, and unlocking exclusive features. Their value is driven by their utility within the ecosystem and broader market dynamics influenced by DeFi trends.

Holding CYBER tokens not only grants access to special features but also empowers users to participate in decision-making processes through governance voting. This dual role enhances user engagement while aligning incentives across the community.

How Can You Earn CYBER Tokens Through Staking?

Staking is one of the most straightforward methods to earn additional CYBER tokens. It involves locking up a certain amount of your existing tokens in designated smart contracts on the platform for a specified period—ranging from days to months. In return, stakers receive rewards proportional to their staked amount.

To get started with staking:

- Acquire CYBER Tokens: First, purchase or transfer existing CYBER tokens into your compatible wallet.

- Choose a Staking Pool: Navigate through available staking pools on official platforms or partner sites that support CyberConnect.

- Lock Your Tokens: Follow instructions provided by these pools or platforms to lock your tokens securely.

- Earn Rewards: Over time, you'll accrue rewards based on your stake size and duration; these can often be compounded or reinvested.

Staking not only generates passive income but also contributes toward network security and decentralization efforts.

Participating in Governance for Additional Rewards

Another way to earn CYBER involves active participation in governance decisions within CyberConnect. Token holders typically have voting rights that influence proposals related to platform upgrades, feature development, or policy changes.

Engaging in governance usually requires:

- Holding Sufficient Tokens: Ensure you possess enough CYBER tokens required for voting eligibility.

- Reviewing Proposals: Stay informed about ongoing discussions or proposals posted on official channels.

- Casting Votes: Use your holdings during voting periods via supported interfaces—often integrated into wallets or dedicated dashboards.

Active voters may sometimes receive incentives such as bonus tokens or recognition within the community—adding an extra layer of earning potential beyond mere token appreciation.

Creating Content and Engaging with Community Activities

CyberConnect emphasizes community-driven content creation as part of its social ecosystem. Users who produce high-quality posts, comments, videos, or other forms of content may be rewarded with CYBER tokens either directly from platform incentives or through engagement metrics like likes and shares.

To leverage this:

- Develop engaging content aligned with community interests.

- Participate regularly by commenting on others’ posts.

- Share valuable insights that foster discussion.

- Keep an eye out for specific campaigns offering token rewards for particular activities (e.g., contests).

This approach not only helps grow your presence but can also lead directly—or indirectly—to earning more cybertokens over time due to increased activity levels recognized by reward mechanisms.

Utilizing Referral Programs

Referral programs are common across blockchain projects aiming at expanding their user base organically. By inviting friends or colleagues into CyberConnect using unique referral links:

- You can earn small amounts of CYBER when new users sign up using your link.

- Some programs offer tiered rewards based on referral activity levels.

Ensure you understand each program’s terms before participating; effective referrals require genuine engagement rather than spammy tactics which could violate policies leading to penalties.

Tips To Maximize Your Earnings

While engaging with these methods individually is beneficial, combining them strategically will optimize earnings:

- Regularly stake available funds during high-reward periods

- Stay updated about governance proposals requiring votes

- Consistently create quality content that resonates with communities

- Promote platform growth via referrals responsibly

Additionally,

Stay Informed: Follow official channels like blogs, social media accounts (Twitter/Discord), and newsletters related to CyberConnect for updates about new earning opportunities or changes in protocols affecting reward structures.

Security First: Always use secure wallets supported by reputable providers when handling cryptocurrencies; avoid sharing private keys under any circumstances.

Final Thoughts

Earning CYBER tokens involves active participation across multiple facets—staking assets securely online; engaging thoughtfully in governance decisions; contributing valuable content; leveraging referral programs—all aligned towards fostering growth within this decentralized social ecosystem. By understanding each pathway thoroughly—and staying vigilant regarding security practices—you position yourself well both as an active contributor and potential beneficiary within this innovative blockchain-based community space.

Additional Resources:

- Official CyberConnect Documentation – [Link]

- Community Forums & Social Media – [Links]

- Guides on Cryptocurrency Security Best Practices – [Links]

By following these steps diligently while keeping abreast of industry developments—including regulatory shifts—you can effectively navigate earning opportunities around CYBER coins today—and prepare yourself better amid future innovations emerging from DeFi ecosystems worldwide

Lo

2025-06-09 21:45

What steps do I need to take to earn CYBER tokens?

How to Earn CYBER Tokens: A Complete Guide

Understanding how to earn CYBER tokens is essential for users interested in participating actively within the CyberConnect ecosystem. As a decentralized social platform leveraging blockchain technology, CyberConnect offers multiple avenues for users to earn and utilize CYBER tokens. This guide provides a clear overview of the steps involved, ensuring you can maximize your engagement and potential rewards.

What Are CYBER Tokens and Why Are They Valuable?

CYBER tokens are the native cryptocurrency of the CyberConnect platform, serving as a fundamental component of its decentralized social network. These tokens facilitate various activities such as paying transaction fees, staking for governance participation, and unlocking exclusive features. Their value is driven by their utility within the ecosystem and broader market dynamics influenced by DeFi trends.

Holding CYBER tokens not only grants access to special features but also empowers users to participate in decision-making processes through governance voting. This dual role enhances user engagement while aligning incentives across the community.

How Can You Earn CYBER Tokens Through Staking?

Staking is one of the most straightforward methods to earn additional CYBER tokens. It involves locking up a certain amount of your existing tokens in designated smart contracts on the platform for a specified period—ranging from days to months. In return, stakers receive rewards proportional to their staked amount.

To get started with staking:

- Acquire CYBER Tokens: First, purchase or transfer existing CYBER tokens into your compatible wallet.

- Choose a Staking Pool: Navigate through available staking pools on official platforms or partner sites that support CyberConnect.

- Lock Your Tokens: Follow instructions provided by these pools or platforms to lock your tokens securely.

- Earn Rewards: Over time, you'll accrue rewards based on your stake size and duration; these can often be compounded or reinvested.

Staking not only generates passive income but also contributes toward network security and decentralization efforts.

Participating in Governance for Additional Rewards

Another way to earn CYBER involves active participation in governance decisions within CyberConnect. Token holders typically have voting rights that influence proposals related to platform upgrades, feature development, or policy changes.

Engaging in governance usually requires:

- Holding Sufficient Tokens: Ensure you possess enough CYBER tokens required for voting eligibility.

- Reviewing Proposals: Stay informed about ongoing discussions or proposals posted on official channels.

- Casting Votes: Use your holdings during voting periods via supported interfaces—often integrated into wallets or dedicated dashboards.

Active voters may sometimes receive incentives such as bonus tokens or recognition within the community—adding an extra layer of earning potential beyond mere token appreciation.

Creating Content and Engaging with Community Activities

CyberConnect emphasizes community-driven content creation as part of its social ecosystem. Users who produce high-quality posts, comments, videos, or other forms of content may be rewarded with CYBER tokens either directly from platform incentives or through engagement metrics like likes and shares.

To leverage this:

- Develop engaging content aligned with community interests.

- Participate regularly by commenting on others’ posts.

- Share valuable insights that foster discussion.

- Keep an eye out for specific campaigns offering token rewards for particular activities (e.g., contests).

This approach not only helps grow your presence but can also lead directly—or indirectly—to earning more cybertokens over time due to increased activity levels recognized by reward mechanisms.

Utilizing Referral Programs

Referral programs are common across blockchain projects aiming at expanding their user base organically. By inviting friends or colleagues into CyberConnect using unique referral links:

- You can earn small amounts of CYBER when new users sign up using your link.

- Some programs offer tiered rewards based on referral activity levels.

Ensure you understand each program’s terms before participating; effective referrals require genuine engagement rather than spammy tactics which could violate policies leading to penalties.

Tips To Maximize Your Earnings

While engaging with these methods individually is beneficial, combining them strategically will optimize earnings:

- Regularly stake available funds during high-reward periods

- Stay updated about governance proposals requiring votes

- Consistently create quality content that resonates with communities

- Promote platform growth via referrals responsibly

Additionally,

Stay Informed: Follow official channels like blogs, social media accounts (Twitter/Discord), and newsletters related to CyberConnect for updates about new earning opportunities or changes in protocols affecting reward structures.

Security First: Always use secure wallets supported by reputable providers when handling cryptocurrencies; avoid sharing private keys under any circumstances.

Final Thoughts

Earning CYBER tokens involves active participation across multiple facets—staking assets securely online; engaging thoughtfully in governance decisions; contributing valuable content; leveraging referral programs—all aligned towards fostering growth within this decentralized social ecosystem. By understanding each pathway thoroughly—and staying vigilant regarding security practices—you position yourself well both as an active contributor and potential beneficiary within this innovative blockchain-based community space.

Additional Resources:

- Official CyberConnect Documentation – [Link]

- Community Forums & Social Media – [Links]

- Guides on Cryptocurrency Security Best Practices – [Links]

By following these steps diligently while keeping abreast of industry developments—including regulatory shifts—you can effectively navigate earning opportunities around CYBER coins today—and prepare yourself better amid future innovations emerging from DeFi ecosystems worldwide

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Risks of Investing in Altcoins: A Complete Guide

Investing in cryptocurrencies has become increasingly popular over the past decade, with many investors exploring options beyond Bitcoin. These alternatives, known as altcoins, offer diverse features and use cases but also come with unique risks that can significantly impact your investment outcomes. Understanding these risks is essential for making informed decisions and managing potential losses effectively.

What Are Altcoins?

Altcoins are any cryptocurrencies other than Bitcoin. They encompass a broad spectrum of digital assets built on different blockchain technologies, each designed to serve specific purposes or improve upon Bitcoin’s features. Examples include Ethereum (ETH), which enables smart contracts; Litecoin (LTC), known for faster transaction times; and privacy-focused coins like Monero (XMR). While some altcoins aim to address limitations of Bitcoin or introduce innovative functionalities, others are created primarily for speculative trading.

Why Is the Altcoin Market Highly Volatile?

One of the defining characteristics of altcoins is their extreme price volatility. Unlike traditional assets such as stocks or bonds, altcoin prices can fluctuate wildly within short periods—sometimes by hundreds of percent in a matter of days or hours. This volatility stems from several factors:

- Market Sentiment: Investor emotions heavily influence prices; hype around new projects or technological breakthroughs can drive rapid price increases.

- Speculative Nature: Many investors buy altcoins purely for quick gains rather than long-term value, amplifying price swings.

- Limited Liquidity: Smaller market capitalization means fewer buyers and sellers, making prices more susceptible to manipulation.

This high volatility presents both opportunities and significant risks—while you might see substantial gains during bullish phases, sharp declines can lead to severe financial losses.

Regulatory Uncertainty Surrounding Altcoins

The regulatory landscape for cryptocurrencies remains uncertain globally. Different countries have varying approaches—from outright bans to comprehensive frameworks—creating an unpredictable environment for investors. For example:

- In 2023, the U.S. Securities and Exchange Commission (SEC) issued rulings classifying certain altcoins as securities subject to federal regulations.

- Some jurisdictions have introduced licensing requirements for exchanges dealing with specific tokens.

This regulatory ambiguity can lead to sudden market disruptions if authorities impose restrictions or enforcement actions against particular projects or exchanges hosting them. Additionally, lack of regulation often results in insufficient oversight regarding security measures—making users vulnerable to scams and hacking incidents.

Technological Risks Impacting Altcoin Investments

Altcoin projects rely on complex blockchain technology that may contain vulnerabilities:

- Technical Bugs: Coding errors can cause network failures or security breaches.

- Scalability Challenges: Many altchains face issues handling increasing transaction volumes efficiently—a problem exemplified by Ethereum's transition towards Ethereum 2.0 aims at improving scalability through layer 2 solutions like sharding.

- 51% Attacks: Some smaller networks are vulnerable if malicious actors gain control over more than half their mining power—a scenario that allows them to manipulate transactions fraudulently.

These technological risks highlight the importance of thorough research into an altcoin’s development team and underlying infrastructure before investing.

Scalability Issues Affect User Experience

Many popular altcoins encounter scalability bottlenecks that hinder widespread adoption:

- Slow transaction processing times

- High fees during peak usage periods

- Network congestion leading to delays

For instance, during periods of high demand on networks like Ethereum or Litecoin, users may experience delayed transactions coupled with increased costs—factors discouraging everyday use and affecting investor confidence.

Security Concerns: Hacks & Phishing Attacks

Security remains a critical concern across all cryptocurrency investments:

Hacking Incidents: Exchanges storing large amounts of crypto assets have been targeted by hackers resulting in significant thefts—for example, multiple exchange hacks over recent years have led to millions lost.

Phishing Scams: Fraudsters often trick users into revealing private keys through fake websites or messages impersonating legitimate platforms—all leading to loss of funds without recourse.

Investors must adopt robust security practices such as using hardware wallets and verifying sources before engaging with any platform involved in trading or storage activities.

Market Manipulation Tactics

The relatively unregulated nature makes the altcoin space prone to manipulation schemes like pump-and-dump operations where coordinated efforts artificially inflate an asset's price before selling off en masse:

- These schemes distort true market value

- Lead inexperienced investors into buying at inflated prices

- Result in abrupt crashes once manipulators exit positions

Being aware of suspicious trading patterns helps mitigate exposure but does not eliminate risk entirely.

Liquidity Challenges & Flash Crashes

Low liquidity is common among lesser-known altcoins due to limited trading volume:

- Difficulty executing large trades without impacting market prices

- Increased risk during sudden sell-offs causing flash crashes—a rapid decline in asset value triggered by minimal sell orders

Such events underscore why understanding liquidity levels is vital when considering investments outside major cryptocurrencies like Ethereum or Ripple (XRP).

Recent Developments Shaping Risk Profiles

Several recent trends influence how these risks manifest today:

Regulatory Changes

In 2023, regulators worldwide intensified scrutiny on certain tokens deemed securities under existing laws—which could lead either toward stricter compliance requirements—or outright bans affecting project viability altogether.

Technological Progress

Advancements such as layer 2 scaling solutions aim at addressing previous network congestion issues—for example:

Ethereum’s move towards Ethereum 2.0 promises higher throughput capacity while reducing energy consumption—a positive step toward stability but still under development with inherent uncertainties about implementation timelines.*

Market Sentiment Fluctuations

The COVID pandemic initially drove many investors toward digital assets seeking safe havens; however,

recent corrections reflect heightened caution amid broader economic uncertainties.*

The Potential Fallout from Investing in Altcoins

Given these multifaceted risks,

Investors face substantial potential losses due solely due volatile markets combined with technological vulnerabilities.

Broader market instability may result from regulatory crackdowns impacting multiple projects simultaneously.

3.Reputation damage within the industry could occur following high-profile hacks or scams—dampening future investor confidence—and slowing mainstream adoption efforts overall.

How To Approach Altcoin Investments Safely?

While investing always involves risk,

consider adopting strategies such as:

- Conduct thorough research into project fundamentals,

- Diversify holdings across different coins,

- Use secure wallets rather than keeping funds on exchanges,

- Stay updated on regulatory developments,

- Avoid falling prey to hype-driven pump schemes,

By understanding these inherent dangers alongside ongoing advancements within blockchain technology—and maintaining cautious optimism—you’ll be better equipped when navigating this dynamic space.

Navigating Risks When Investing in Altcoins

Investing in alternative cryptocurrencies offers exciting opportunities but demands careful risk management due diligence given their volatile nature and evolving landscape.. Staying informed about technological developments ,regulatory shifts ,and security best practices will help safeguard your investments while allowing you participation benefits from this innovative sector responsibly..

Lo

2025-06-09 05:15

What are the risks of investing in altcoins?

Risks of Investing in Altcoins: A Complete Guide

Investing in cryptocurrencies has become increasingly popular over the past decade, with many investors exploring options beyond Bitcoin. These alternatives, known as altcoins, offer diverse features and use cases but also come with unique risks that can significantly impact your investment outcomes. Understanding these risks is essential for making informed decisions and managing potential losses effectively.

What Are Altcoins?

Altcoins are any cryptocurrencies other than Bitcoin. They encompass a broad spectrum of digital assets built on different blockchain technologies, each designed to serve specific purposes or improve upon Bitcoin’s features. Examples include Ethereum (ETH), which enables smart contracts; Litecoin (LTC), known for faster transaction times; and privacy-focused coins like Monero (XMR). While some altcoins aim to address limitations of Bitcoin or introduce innovative functionalities, others are created primarily for speculative trading.

Why Is the Altcoin Market Highly Volatile?

One of the defining characteristics of altcoins is their extreme price volatility. Unlike traditional assets such as stocks or bonds, altcoin prices can fluctuate wildly within short periods—sometimes by hundreds of percent in a matter of days or hours. This volatility stems from several factors:

- Market Sentiment: Investor emotions heavily influence prices; hype around new projects or technological breakthroughs can drive rapid price increases.

- Speculative Nature: Many investors buy altcoins purely for quick gains rather than long-term value, amplifying price swings.

- Limited Liquidity: Smaller market capitalization means fewer buyers and sellers, making prices more susceptible to manipulation.

This high volatility presents both opportunities and significant risks—while you might see substantial gains during bullish phases, sharp declines can lead to severe financial losses.

Regulatory Uncertainty Surrounding Altcoins

The regulatory landscape for cryptocurrencies remains uncertain globally. Different countries have varying approaches—from outright bans to comprehensive frameworks—creating an unpredictable environment for investors. For example:

- In 2023, the U.S. Securities and Exchange Commission (SEC) issued rulings classifying certain altcoins as securities subject to federal regulations.

- Some jurisdictions have introduced licensing requirements for exchanges dealing with specific tokens.

This regulatory ambiguity can lead to sudden market disruptions if authorities impose restrictions or enforcement actions against particular projects or exchanges hosting them. Additionally, lack of regulation often results in insufficient oversight regarding security measures—making users vulnerable to scams and hacking incidents.

Technological Risks Impacting Altcoin Investments

Altcoin projects rely on complex blockchain technology that may contain vulnerabilities:

- Technical Bugs: Coding errors can cause network failures or security breaches.

- Scalability Challenges: Many altchains face issues handling increasing transaction volumes efficiently—a problem exemplified by Ethereum's transition towards Ethereum 2.0 aims at improving scalability through layer 2 solutions like sharding.

- 51% Attacks: Some smaller networks are vulnerable if malicious actors gain control over more than half their mining power—a scenario that allows them to manipulate transactions fraudulently.

These technological risks highlight the importance of thorough research into an altcoin’s development team and underlying infrastructure before investing.

Scalability Issues Affect User Experience

Many popular altcoins encounter scalability bottlenecks that hinder widespread adoption:

- Slow transaction processing times

- High fees during peak usage periods

- Network congestion leading to delays

For instance, during periods of high demand on networks like Ethereum or Litecoin, users may experience delayed transactions coupled with increased costs—factors discouraging everyday use and affecting investor confidence.

Security Concerns: Hacks & Phishing Attacks

Security remains a critical concern across all cryptocurrency investments:

Hacking Incidents: Exchanges storing large amounts of crypto assets have been targeted by hackers resulting in significant thefts—for example, multiple exchange hacks over recent years have led to millions lost.

Phishing Scams: Fraudsters often trick users into revealing private keys through fake websites or messages impersonating legitimate platforms—all leading to loss of funds without recourse.

Investors must adopt robust security practices such as using hardware wallets and verifying sources before engaging with any platform involved in trading or storage activities.

Market Manipulation Tactics

The relatively unregulated nature makes the altcoin space prone to manipulation schemes like pump-and-dump operations where coordinated efforts artificially inflate an asset's price before selling off en masse:

- These schemes distort true market value

- Lead inexperienced investors into buying at inflated prices

- Result in abrupt crashes once manipulators exit positions

Being aware of suspicious trading patterns helps mitigate exposure but does not eliminate risk entirely.

Liquidity Challenges & Flash Crashes

Low liquidity is common among lesser-known altcoins due to limited trading volume:

- Difficulty executing large trades without impacting market prices

- Increased risk during sudden sell-offs causing flash crashes—a rapid decline in asset value triggered by minimal sell orders

Such events underscore why understanding liquidity levels is vital when considering investments outside major cryptocurrencies like Ethereum or Ripple (XRP).

Recent Developments Shaping Risk Profiles

Several recent trends influence how these risks manifest today:

Regulatory Changes

In 2023, regulators worldwide intensified scrutiny on certain tokens deemed securities under existing laws—which could lead either toward stricter compliance requirements—or outright bans affecting project viability altogether.

Technological Progress

Advancements such as layer 2 scaling solutions aim at addressing previous network congestion issues—for example:

Ethereum’s move towards Ethereum 2.0 promises higher throughput capacity while reducing energy consumption—a positive step toward stability but still under development with inherent uncertainties about implementation timelines.*

Market Sentiment Fluctuations

The COVID pandemic initially drove many investors toward digital assets seeking safe havens; however,

recent corrections reflect heightened caution amid broader economic uncertainties.*

The Potential Fallout from Investing in Altcoins

Given these multifaceted risks,

Investors face substantial potential losses due solely due volatile markets combined with technological vulnerabilities.

Broader market instability may result from regulatory crackdowns impacting multiple projects simultaneously.

3.Reputation damage within the industry could occur following high-profile hacks or scams—dampening future investor confidence—and slowing mainstream adoption efforts overall.

How To Approach Altcoin Investments Safely?

While investing always involves risk,

consider adopting strategies such as:

- Conduct thorough research into project fundamentals,

- Diversify holdings across different coins,

- Use secure wallets rather than keeping funds on exchanges,

- Stay updated on regulatory developments,

- Avoid falling prey to hype-driven pump schemes,

By understanding these inherent dangers alongside ongoing advancements within blockchain technology—and maintaining cautious optimism—you’ll be better equipped when navigating this dynamic space.

Navigating Risks When Investing in Altcoins

Investing in alternative cryptocurrencies offers exciting opportunities but demands careful risk management due diligence given their volatile nature and evolving landscape.. Staying informed about technological developments ,regulatory shifts ,and security best practices will help safeguard your investments while allowing you participation benefits from this innovative sector responsibly..

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Top DeFi Projects on the Solana Blockchain

DeFi, or Decentralized Finance, has revolutionized the way individuals access financial services by leveraging blockchain technology. Among various platforms supporting DeFi applications, Solana has emerged as a leading blockchain due to its high throughput, low transaction fees, and scalability. This article explores the top DeFi projects on Solana that are shaping the future of decentralized finance.

Understanding DeFi and Its Significance on Solana

Decentralized Finance (DeFi) encompasses a broad range of financial services such as lending, borrowing, trading, and yield farming—all built on blockchain networks without intermediaries like banks or brokers. Smart contracts automate these processes to ensure transparency and security.

Solana’s unique architecture makes it particularly suitable for DeFi applications that demand rapid transaction speeds and minimal costs. Its Proof of History (PoH) consensus mechanism allows for high throughput—processing thousands of transactions per second—making it an ideal platform for developers aiming to create scalable decentralized apps (dApps). As a result, many innovative DeFi projects have chosen Solana as their foundation.

Leading Decentralized Exchanges (DEXs) on Solana

Decentralized exchanges are core components of any DeFi ecosystem because they facilitate peer-to-peer trading without centralized control. On Solana, several DEXs stand out due to their liquidity pools, user experience, and integration capabilities.

Saber: A Multi-Asset Liquidity Hub

Saber is one of the most prominent DEXs on Solana known for its high liquidity pools across various stablecoins and cryptocurrencies. It supports multiple trading pairs with low slippage rates thanks to its efficient liquidity provisioning mechanisms. Saber’s user-friendly interface makes it accessible even for newcomers in crypto trading.

Recent developments include expanding available trading pairs and deeper integrations with other protocols within the ecosystem. These enhancements aim to improve user experience while attracting more traders seeking fast transactions at minimal costs.

Orca: User-Friendly Trading Platform

Orca emphasizes simplicity combined with efficiency in decentralized trading. It offers an intuitive interface designed specifically for ease-of-use while maintaining competitive fees compared to traditional exchanges or other DEX platforms.

Orca also supports liquidity pools where users can provide assets in exchange for earning yields—a process called yield farming—further incentivizing participation within its ecosystem. The project continues developing features like advanced order types and governance tools aimed at community involvement.

Raydium: Liquidity Provider Powerhouse

Raydium distinguishes itself by acting as both a DEX and an automated market maker (AMM), providing deep liquidity not only within its own platform but also supporting other protocols through integrations like Serum's order book model adapted onto Solana’s infrastructure.

Its recent focus has been expanding available trading pairs alongside improving liquidity provision tools that maximize returns for providers while offering traders better prices through reduced slippage rates—a critical factor in volatile markets.

Cross-Chain Platforms Supporting Multiple Blockchains

While many projects operate solely within the Solana ecosystem, some platforms offer cross-chain functionalities enabling users to transfer assets seamlessly between different blockchains such as Ethereum or Binance Smart Chain (BSC).

Step Finance: Multi-Chain Management Dashboard

Step Finance serves as a comprehensive dashboard allowing users to manage assets across multiple chains from one interface—including lending protocols like Aave or Compound outside of Solana—and execute cross-chain transactions efficiently.

In recent updates during 2024, Step introduced cross-chain lending features that enable borrowing against assets held across different networks—broadening access points for users seeking diversified investment strategies within one unified platform.

Margin Trading & Leverage Protocols on Solana

Leverage-based trading is gaining popularity among experienced traders looking to amplify gains using borrowed funds while managing risks effectively through robust systems integrated into these platforms:

Mango Markets: Advanced Margin Trading System

Mango Markets provides margin trading capabilities with leverage options up to 5x or higher depending upon asset class specifics—all supported by sophisticated risk management algorithms designed specifically for volatile crypto markets.

The platform integrates tightly with other major protocols such as Serum order books ensuring deep liquidity pools necessary when executing large trades without significant price impact.Recent upgrades have included new asset pairs alongside enhanced risk controls aimed at protecting traders from liquidation events during sudden market swings—a vital feature given current market volatility levels seen since 2022 onwards.

Security Challenges & Regulatory Considerations

Despite impressive growth figures driven by speed advantages inherent in solan-based solutions; security remains paramount given past incidents involving exploits targeting vulnerabilities in smart contracts or network-level attacks affecting some early-stage projects during 2022–2023 period.Regulatory uncertainty also poses risks; governments worldwide are still formulating policies around digital assets which could influence project viability long-term—for example stricter compliance requirements might increase operational costs or limit certain functionalities.Active community engagement plays a crucial role here; communities often rally around transparent development practices which help mitigate some security concerns but ongoing vigilance remains essential.

Future Outlook & Development Trends

The trajectory indicates continued innovation among top-tier projects like Saber, Orca,and Raydium—with new features such as improved yield farming options,multi-chain interoperability,and advanced derivatives being rolled out regularly.Market trends suggest increasing adoption from institutional investors seeking exposure via secure yet flexible platforms supported by robust security measures.Furthermore,the evolution toward regulatory clarity could foster broader mainstream acceptance if frameworks balance innovation with consumer protection standards effectively.

By understanding these key players—their strengths,business models,and ongoing developments—you gain insight into how DeFi is transforming finance through decentralization on one of today’s fastest-growing blockchains —Solana. As this space matures further,it promises more opportunities coupled with challenges requiring continuous attention from developers,institutions,and regulators alike.

Keywords: DeFi Projects on Solano , Top Decentralized Exchanges , Cross-Chain Protocols , Margin Trading Platforms , Blockchain Security Risks

JCUSER-WVMdslBw

2025-06-07 16:48

What are the top DeFi projects on the Solana blockchain?

Top DeFi Projects on the Solana Blockchain

DeFi, or Decentralized Finance, has revolutionized the way individuals access financial services by leveraging blockchain technology. Among various platforms supporting DeFi applications, Solana has emerged as a leading blockchain due to its high throughput, low transaction fees, and scalability. This article explores the top DeFi projects on Solana that are shaping the future of decentralized finance.

Understanding DeFi and Its Significance on Solana

Decentralized Finance (DeFi) encompasses a broad range of financial services such as lending, borrowing, trading, and yield farming—all built on blockchain networks without intermediaries like banks or brokers. Smart contracts automate these processes to ensure transparency and security.

Solana’s unique architecture makes it particularly suitable for DeFi applications that demand rapid transaction speeds and minimal costs. Its Proof of History (PoH) consensus mechanism allows for high throughput—processing thousands of transactions per second—making it an ideal platform for developers aiming to create scalable decentralized apps (dApps). As a result, many innovative DeFi projects have chosen Solana as their foundation.

Leading Decentralized Exchanges (DEXs) on Solana

Decentralized exchanges are core components of any DeFi ecosystem because they facilitate peer-to-peer trading without centralized control. On Solana, several DEXs stand out due to their liquidity pools, user experience, and integration capabilities.

Saber: A Multi-Asset Liquidity Hub

Saber is one of the most prominent DEXs on Solana known for its high liquidity pools across various stablecoins and cryptocurrencies. It supports multiple trading pairs with low slippage rates thanks to its efficient liquidity provisioning mechanisms. Saber’s user-friendly interface makes it accessible even for newcomers in crypto trading.

Recent developments include expanding available trading pairs and deeper integrations with other protocols within the ecosystem. These enhancements aim to improve user experience while attracting more traders seeking fast transactions at minimal costs.

Orca: User-Friendly Trading Platform

Orca emphasizes simplicity combined with efficiency in decentralized trading. It offers an intuitive interface designed specifically for ease-of-use while maintaining competitive fees compared to traditional exchanges or other DEX platforms.

Orca also supports liquidity pools where users can provide assets in exchange for earning yields—a process called yield farming—further incentivizing participation within its ecosystem. The project continues developing features like advanced order types and governance tools aimed at community involvement.

Raydium: Liquidity Provider Powerhouse

Raydium distinguishes itself by acting as both a DEX and an automated market maker (AMM), providing deep liquidity not only within its own platform but also supporting other protocols through integrations like Serum's order book model adapted onto Solana’s infrastructure.

Its recent focus has been expanding available trading pairs alongside improving liquidity provision tools that maximize returns for providers while offering traders better prices through reduced slippage rates—a critical factor in volatile markets.

Cross-Chain Platforms Supporting Multiple Blockchains

While many projects operate solely within the Solana ecosystem, some platforms offer cross-chain functionalities enabling users to transfer assets seamlessly between different blockchains such as Ethereum or Binance Smart Chain (BSC).

Step Finance: Multi-Chain Management Dashboard

Step Finance serves as a comprehensive dashboard allowing users to manage assets across multiple chains from one interface—including lending protocols like Aave or Compound outside of Solana—and execute cross-chain transactions efficiently.

In recent updates during 2024, Step introduced cross-chain lending features that enable borrowing against assets held across different networks—broadening access points for users seeking diversified investment strategies within one unified platform.

Margin Trading & Leverage Protocols on Solana

Leverage-based trading is gaining popularity among experienced traders looking to amplify gains using borrowed funds while managing risks effectively through robust systems integrated into these platforms:

Mango Markets: Advanced Margin Trading System

Mango Markets provides margin trading capabilities with leverage options up to 5x or higher depending upon asset class specifics—all supported by sophisticated risk management algorithms designed specifically for volatile crypto markets.

The platform integrates tightly with other major protocols such as Serum order books ensuring deep liquidity pools necessary when executing large trades without significant price impact.Recent upgrades have included new asset pairs alongside enhanced risk controls aimed at protecting traders from liquidation events during sudden market swings—a vital feature given current market volatility levels seen since 2022 onwards.

Security Challenges & Regulatory Considerations

Despite impressive growth figures driven by speed advantages inherent in solan-based solutions; security remains paramount given past incidents involving exploits targeting vulnerabilities in smart contracts or network-level attacks affecting some early-stage projects during 2022–2023 period.Regulatory uncertainty also poses risks; governments worldwide are still formulating policies around digital assets which could influence project viability long-term—for example stricter compliance requirements might increase operational costs or limit certain functionalities.Active community engagement plays a crucial role here; communities often rally around transparent development practices which help mitigate some security concerns but ongoing vigilance remains essential.

Future Outlook & Development Trends

The trajectory indicates continued innovation among top-tier projects like Saber, Orca,and Raydium—with new features such as improved yield farming options,multi-chain interoperability,and advanced derivatives being rolled out regularly.Market trends suggest increasing adoption from institutional investors seeking exposure via secure yet flexible platforms supported by robust security measures.Furthermore,the evolution toward regulatory clarity could foster broader mainstream acceptance if frameworks balance innovation with consumer protection standards effectively.

By understanding these key players—their strengths,business models,and ongoing developments—you gain insight into how DeFi is transforming finance through decentralization on one of today’s fastest-growing blockchains —Solana. As this space matures further,it promises more opportunities coupled with challenges requiring continuous attention from developers,institutions,and regulators alike.

Keywords: DeFi Projects on Solano , Top Decentralized Exchanges , Cross-Chain Protocols , Margin Trading Platforms , Blockchain Security Risks

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Benefits of Using a Liquidity Pool?

Liquidity pools are transforming the landscape of decentralized finance (DeFi) by offering a new way to facilitate cryptocurrency trading. As DeFi platforms continue to grow in popularity, understanding the advantages of liquidity pools becomes essential for both investors and traders. This article explores the key benefits, backed by current trends and technological insights, providing a comprehensive overview aligned with user intent.

Enhancing Market Efficiency Through Liquidity Pools

One of the primary benefits of liquidity pools is their ability to improve market efficiency. Traditional exchanges rely on order books where buyers and sellers place individual orders, which can lead to wider spreads—the difference between bid and ask prices. In contrast, liquidity pools aggregate assets from multiple users into a single pool that powers decentralized exchanges like Uniswap or SushiSwap.

This pooling mechanism reduces bid-ask spreads significantly because trades are executed against the pooled assets rather than matching individual orders. As a result, traders benefit from more competitive prices and faster execution times. For users seeking quick transactions at fair market rates, this efficiency is crucial—especially in volatile markets where price discrepancies can be costly.

Increasing Trading Volume and Market Stability

Liquidity pools enable higher trading volumes by providing ample capital for executing large trades without causing significant price slippage. When there’s sufficient liquidity within these pools, it becomes easier for traders to buy or sell sizable amounts without impacting asset prices drastically.

This increased capacity supports overall market stability by preventing sudden price swings caused by low liquidity—a common issue on traditional exchanges during high volatility periods. For DeFi platforms aiming for sustainable growth, maintaining robust liquidity is vital; it encourages more participants to trade confidently knowing they can execute transactions smoothly.

Reducing Slippage During Transactions

Slippage occurs when there’s a difference between expected transaction prices and actual execution prices—often due to insufficient liquidity or rapid market movements. High slippage can erode profits or increase costs for traders executing large orders.

Liquidity pools mitigate this problem effectively because they always hold enough assets to accommodate trades promptly. By ensuring continuous availability of funds within these pools, users experience less price deviation during trade execution—even in fast-moving markets—making trading more predictable and less risky.

Opportunities for Liquidity Providers: Earning Fees

Another compelling advantage involves incentives for those who contribute assets to these pools—liquidity providers (LPs). When users deposit tokens into a pool, they earn fees generated from each trade that occurs within that pool. These fees are typically distributed proportionally based on each provider's contribution size.

For many LPs, this creates an attractive passive income stream while supporting platform operations. The potential returns depend on trading activity levels; higher volume generally translates into higher earnings for providers—a win-win scenario fostering ecosystem growth through community participation.

Transparency and Decentralization via Blockchain Technology

The core strength of liquidity pools lies in their foundation on blockchain technology—which guarantees transparency and decentralization. All transactions involving deposits or withdrawals are recorded immutably on public ledgers accessible worldwide.

This openness ensures that no central authority controls fund movements or fee distributions; instead, smart contracts automate processes securely without human intervention once deployed correctly. Such transparency builds trust among participants who want assurance their assets are managed fairly—and aligns with broader principles underpinning blockchain innovation: security through decentralization combined with open access data records.

Diversification Risks Managed Through Asset Pooling

Pooling various cryptocurrencies helps diversify risk—a critical consideration amid volatile markets typical in crypto ecosystems today. Instead of holding one asset susceptible to sharp declines (e.g., Bitcoin drops), LPs benefit from exposure across multiple tokens stored within the same pool.

Diversification reduces vulnerability associated with single-asset holdings while enabling LPs—and even regular traders—to spread potential losses across different digital assets rather than risking everything on one coin's performance alone.

Recent Trends Amplifying Benefits

The rise of DeFi has accelerated adoption rates globally as platforms like Uniswap have demonstrated how effective automated market makers (AMMs) powered by liquidity pools can be compared with traditional centralized exchanges (CEXs). Moreover:

Stablecoins Integration: Incorporating stablecoins such as USDC or USDT into liquidity pools provides stability amid crypto volatility since these tokens maintain relatively constant values.

Platform Competition: The proliferation of DeFi protocols fosters innovation—offering better incentives like higher yields or lower fees—to attract more LPs.

Security Improvements: Developers continually enhance smart contract security measures following past exploits; however, vulnerabilities still pose risks requiring ongoing vigilance.

Challenges That Could Impact Future Growth

Despite numerous advantages, several challenges could hinder long-term sustainability:

Regulatory Environment: Governments worldwide scrutinize DeFi activities increasingly closely; unclear regulations might impose restrictions affecting platform operations.

Smart Contract Risks: Vulnerabilities remain inherent risks due to coding errors or malicious exploits leading potentially to significant financial losses.

Market Volatility: Sudden downturns may devalue pooled assets rapidly—impacting both LP returns and overall platform stability.

User Education Needs: Complex mechanisms require adequate user education; lack thereof could lead newcomers making costly mistakes.

Final Thoughts: Navigating Benefits Amid Challenges

Liquidity pools have revolutionized decentralized trading by offering improved efficiency, increased volume capacity, reduced slippage risks—and opportunities for passive income through fee sharing—all underpinned by transparent blockchain technology facilitating risk diversification across multiple digital assets.

However—as adoption accelerates—the ecosystem must address regulatory uncertainties alongside technical vulnerabilities such as smart contract security issues while educating new users about best practices in DeFi participation.. Doing so will ensure sustained growth rooted in trustworthiness & resilience within this innovative financial frontier.

Keywords: Liquidity Pools Benefits | Decentralized Finance | Crypto Trading Efficiency | Yield Farming | Smart Contract Security | Stablecoins Integration

JCUSER-F1IIaxXA

2025-05-29 07:47

What are the benefits of using a liquidity pool?

What Are the Benefits of Using a Liquidity Pool?

Liquidity pools are transforming the landscape of decentralized finance (DeFi) by offering a new way to facilitate cryptocurrency trading. As DeFi platforms continue to grow in popularity, understanding the advantages of liquidity pools becomes essential for both investors and traders. This article explores the key benefits, backed by current trends and technological insights, providing a comprehensive overview aligned with user intent.

Enhancing Market Efficiency Through Liquidity Pools

One of the primary benefits of liquidity pools is their ability to improve market efficiency. Traditional exchanges rely on order books where buyers and sellers place individual orders, which can lead to wider spreads—the difference between bid and ask prices. In contrast, liquidity pools aggregate assets from multiple users into a single pool that powers decentralized exchanges like Uniswap or SushiSwap.

This pooling mechanism reduces bid-ask spreads significantly because trades are executed against the pooled assets rather than matching individual orders. As a result, traders benefit from more competitive prices and faster execution times. For users seeking quick transactions at fair market rates, this efficiency is crucial—especially in volatile markets where price discrepancies can be costly.

Increasing Trading Volume and Market Stability

Liquidity pools enable higher trading volumes by providing ample capital for executing large trades without causing significant price slippage. When there’s sufficient liquidity within these pools, it becomes easier for traders to buy or sell sizable amounts without impacting asset prices drastically.

This increased capacity supports overall market stability by preventing sudden price swings caused by low liquidity—a common issue on traditional exchanges during high volatility periods. For DeFi platforms aiming for sustainable growth, maintaining robust liquidity is vital; it encourages more participants to trade confidently knowing they can execute transactions smoothly.

Reducing Slippage During Transactions

Slippage occurs when there’s a difference between expected transaction prices and actual execution prices—often due to insufficient liquidity or rapid market movements. High slippage can erode profits or increase costs for traders executing large orders.

Liquidity pools mitigate this problem effectively because they always hold enough assets to accommodate trades promptly. By ensuring continuous availability of funds within these pools, users experience less price deviation during trade execution—even in fast-moving markets—making trading more predictable and less risky.

Opportunities for Liquidity Providers: Earning Fees

Another compelling advantage involves incentives for those who contribute assets to these pools—liquidity providers (LPs). When users deposit tokens into a pool, they earn fees generated from each trade that occurs within that pool. These fees are typically distributed proportionally based on each provider's contribution size.

For many LPs, this creates an attractive passive income stream while supporting platform operations. The potential returns depend on trading activity levels; higher volume generally translates into higher earnings for providers—a win-win scenario fostering ecosystem growth through community participation.

Transparency and Decentralization via Blockchain Technology

The core strength of liquidity pools lies in their foundation on blockchain technology—which guarantees transparency and decentralization. All transactions involving deposits or withdrawals are recorded immutably on public ledgers accessible worldwide.

This openness ensures that no central authority controls fund movements or fee distributions; instead, smart contracts automate processes securely without human intervention once deployed correctly. Such transparency builds trust among participants who want assurance their assets are managed fairly—and aligns with broader principles underpinning blockchain innovation: security through decentralization combined with open access data records.

Diversification Risks Managed Through Asset Pooling

Pooling various cryptocurrencies helps diversify risk—a critical consideration amid volatile markets typical in crypto ecosystems today. Instead of holding one asset susceptible to sharp declines (e.g., Bitcoin drops), LPs benefit from exposure across multiple tokens stored within the same pool.

Diversification reduces vulnerability associated with single-asset holdings while enabling LPs—and even regular traders—to spread potential losses across different digital assets rather than risking everything on one coin's performance alone.

Recent Trends Amplifying Benefits

The rise of DeFi has accelerated adoption rates globally as platforms like Uniswap have demonstrated how effective automated market makers (AMMs) powered by liquidity pools can be compared with traditional centralized exchanges (CEXs). Moreover:

Stablecoins Integration: Incorporating stablecoins such as USDC or USDT into liquidity pools provides stability amid crypto volatility since these tokens maintain relatively constant values.

Platform Competition: The proliferation of DeFi protocols fosters innovation—offering better incentives like higher yields or lower fees—to attract more LPs.

Security Improvements: Developers continually enhance smart contract security measures following past exploits; however, vulnerabilities still pose risks requiring ongoing vigilance.

Challenges That Could Impact Future Growth

Despite numerous advantages, several challenges could hinder long-term sustainability:

Regulatory Environment: Governments worldwide scrutinize DeFi activities increasingly closely; unclear regulations might impose restrictions affecting platform operations.

Smart Contract Risks: Vulnerabilities remain inherent risks due to coding errors or malicious exploits leading potentially to significant financial losses.

Market Volatility: Sudden downturns may devalue pooled assets rapidly—impacting both LP returns and overall platform stability.

User Education Needs: Complex mechanisms require adequate user education; lack thereof could lead newcomers making costly mistakes.

Final Thoughts: Navigating Benefits Amid Challenges

Liquidity pools have revolutionized decentralized trading by offering improved efficiency, increased volume capacity, reduced slippage risks—and opportunities for passive income through fee sharing—all underpinned by transparent blockchain technology facilitating risk diversification across multiple digital assets.